Introduction

Capital expenditure (CapEx) is the lifeblood of long-term business growth, especially in fast-paced markets like the UAE.

Whether you’re expanding a Dubai-based startup or managing a multinational corporation, understanding CapEx ensures smarter investments and healthier cash flow.

In this guide, we’ll break down CapEx formulas, depreciation, and best practices—plus how to align it with UAE tax regulations like Corporate Tax.

What is Capital Expenditure (CapEx)?

Capital expenditure (CapEx) refers to funds spent acquiring, upgrading, or maintaining long-term physical assets like property, equipment, or technology.

Unlike day-to-day expenses (OpEx), CapEx is capitalized on the balance sheet and depreciated over time.

Example: Amazon invested $63.6 billion in CapEx (2022) for warehouses and tech infrastructure—key to its global dominance.

Why CapEx Matters for UAE Businesses

- Drives Growth: Expands production capacity (e.g., Dubai manufacturing hubs).

- Tax Efficiency: UAE Corporate Tax allows deductions for depreciation of assets.

- Investor Appeal: Consistent CapEx signals stability, crucial for attracting FDI in UAE free zones.

CapEx vs. OpEx: Key Differences

| Factor | CapEx | OpEx |

|---|---|---|

| Duration | Benefits >1 year | Benefits <1 year |

| Financial Impact | Balance Sheet (Asset) | Income Statement (Expense) |

| Tax Treatment | Depreciated over time | Fully deductible immediately |

Confused about tax rules? Book a free consultation with our UAE tax experts.

How to Calculate CapEx

Use two methods:

1. Direct Method

Formula:

Net CapEx = Cost of New Assets - Proceeds from Sold Assets

Example:

If your Dubai logistics company buys AED 500K in vehicles and sells old ones for AED 100K:Net CapEx = 500,000 - 100,000 = AED 400,000

2. Indirect Method

Formula:

Net CapEx = Current PP&E - Previous PP&E + Depreciation

Example:

- PP&E (2023): AED 2M

- PP&E (2022): AED 1.5M

- Depreciation: AED 200K

Net CapEx = 2,000,000 - 1,500,000 + 200,000 = AED 700,000

Need help tracking PP&E? Use our Free Balance Sheet Analysis Guide.

CapEx in Financial Statements

- Cash Flow Statement: Listed under Investing Activities.

- Balance Sheet: Added to Property, Plant & Equipment (PP&E).

- Income Statement: Depreciation expense reduces taxable income.

Pro Tip: UAE businesses must align CapEx with tax invoice requirements for compliance.

CapEx Challenges & Solutions

| Challenge | Solution |

|---|---|

| High Upfront Costs | Use business loans from UAE banks. |

| Unpredictable ROI | Conduct a break-even analysis. |

| Complex Depreciation Rules | Partner with a Dubai accounting firm. |

CapEx Best Practices for UAE Companies

- Plan Strategically: Align investments with UAE market trends (e.g., green energy).

- Use Budgeting Tools: Track expenses with cloud accounting software.

- Optimize Tax Benefits: Leverage Designated Free Zones for tax exemptions.

FAQs About CapEx

Q: Is CapEx deductible under UAE Corporate Tax?

A: Yes, but only through depreciation. Learn more here.

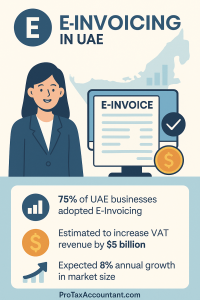

Q: How does CapEx affect VAT in the UAE?

A: VAT applies to asset purchases, but you can reclaim it if VAT-registered.

Q: Can startups delay CapEx?

A: Yes—consider outsourcing accounting to preserve cash flow.

External Resources

- IRS Depreciation Guide (For global context): IRS Publication 946

- Investopedia CapEx Definition: Investopedia CapEx

- Harvard Business Review on CapEx Planning: HBR Article

Final Thoughts

CapEx isn’t just about spending—it’s about investing in your UAE business’s future. From avoiding non-deductible expenses to optimizing free cash flow, strategic CapEx management separates thriving businesses from struggling ones.

Need help? Schedule a call with ProTaxAccountant for personalized CapEx planning and UAE tax compliance!