Introduction

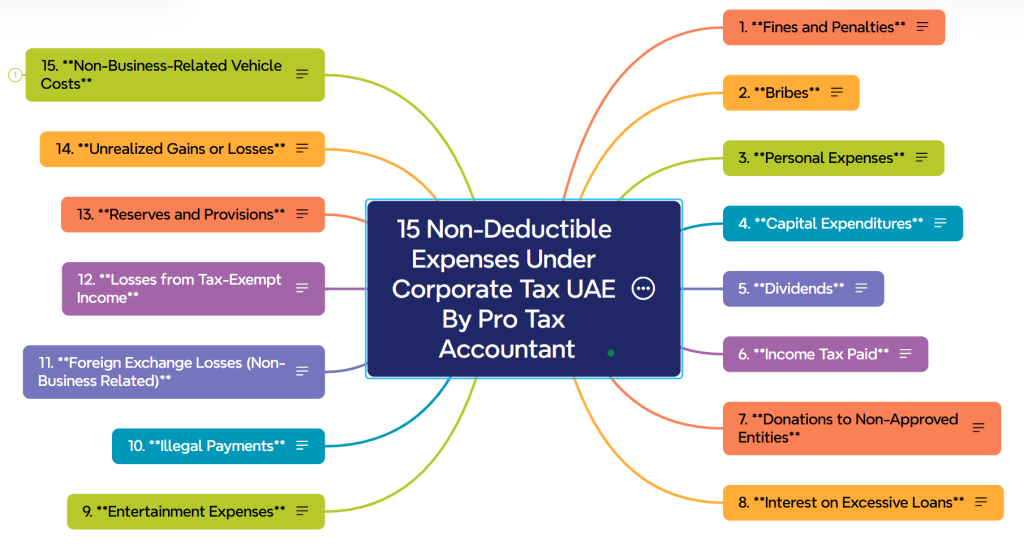

Navigating corporate tax laws can feel like stepping into a maze, especially with new regulations like the UAE corporate tax. Understanding which expenses are non-deductible is critical for avoiding mistakes and ensuring compliance.

But what exactly are these non-deductible expenses?

In this guide, we’ll break down the top 15 non-deductible expenses under corporate tax in the UAE, answer frequently asked questions, and share actionable tips to keep your finances in check. Let’s dive in!

Non-Deductible Expenses: What Does It Mean?

Non-deductible expenses are costs that a business incurs but cannot deduct from its taxable income.

These rules are designed to prevent misuse of tax deductions and ensure fair tax collection.

In the UAE, corporate tax regulations explicitly outline these expenses, so understanding them is vital for your business.

15 Common Non-Deductible Expenses in UAE Corporate Tax

1. Fines and Penalties

Fines for legal violations, such as traffic tickets or late payment penalties, are not deductible. The government sees these as avoidable and unrelated to income generation.

2. Personal Expenses

Costs unrelated to your business, such as personal travel or luxury items, cannot be claimed. For example, that extravagant weekend getaway? Definitely non-deductible.

3. Dividend Payments

Distributing profits to shareholders is not considered a business expense. These payments come from net profit after tax.

4. Provisions for Bad Debts

While writing off bad debts may be allowed, creating a provision for potential bad debts is not deductible under UAE corporate tax law.

5. Non-Business Donations

Charitable donations made to entities not approved by the Ministry of Finance cannot be deducted. Ensure any donation aligns with government-approved causes.

6. Capital Expenditures

Buying assets like vehicles or property? These are capital expenditures, not operating expenses. You might be able to depreciate them over time but can’t deduct them directly.

7. Entertainment Expenses Above Limits

Hosting clients or team celebrations? Only a portion of entertainment expenses may be deductible; excessive spending is non-deductible.

8. Illegal Payments

Bribes or other payments made in contravention of UAE law are non-deductible.

9. Interest on Loans Above Prescribed Limits

Interest payments exceeding the cap set by the UAE government cannot be deducted.

10. Tax Penalties

Penalties for failing to comply with tax regulations, such as late filing fees, cannot be deducted from your taxable income.

11. Reserves and General Provisions

Reserves for unforeseen liabilities or general provisions are non-deductible unless specifically allowed by law.

12. Employee Personal Expenses

Personal expenses paid on behalf of employees, like gym memberships or non-business travel, are non-deductible.

13. Unapproved Sponsorships

Sponsorship costs not linked to business objectives or approved under corporate tax regulations are non-deductible.

14. Non-Business Insurance Premiums

Only insurance policies related to business activities, such as property or liability insurance, are deductible. Personal or unrelated policies are not.

15. Foreign Taxes Paid

Taxes paid to other countries, unless specified under double taxation agreements, are non-deductible under UAE law.

Non-Deductible Expenses Under UAE Corporate Tax – Quick Table

| Expense Type | Description | Example |

|---|---|---|

| Fines and Penalties | Payments for legal violations or delays in compliance. | Traffic fines, late tax filing fees. |

| Personal Expenses | Costs not related to business operations. | Luxury travel, personal shopping. |

| Dividend Payments | Profit distributions to shareholders are non-deductible. | Dividends paid to investors from net profits. |

| Provisions for Bad Debts | Estimated losses for potential bad debts that haven’t materialized. | Setting aside funds for customers’ unpaid invoices. |

| Non-Business Donations | Charitable donations to unapproved organizations. | Contributions to a non-UAE charity. |

| Capital Expenditures | Costs for acquiring or upgrading assets. | Purchasing a building or vehicle. |

| Entertainment Expenses Above Limits | Excessive or lavish client or employee entertainment costs. | Hosting a luxury dinner beyond allowable limits. |

| Illegal Payments | Any payment made in violation of UAE laws. | Bribes or unauthorized kickbacks. |

| Interest on Loans Above Limits | Loan interest exceeding the allowable threshold. | High-interest loans beyond legal caps. |

| Tax Penalties | Charges for non-compliance with tax regulations. | Late payment fines for corporate tax. |

| Reserves and General Provisions | Funds set aside for future uncertainties or risks. | Reserving money for potential legal disputes. |

| Employee Personal Expenses | Non-business-related costs paid on behalf of employees. | Gym memberships, personal travel expenses. |

| Unapproved Sponsorships | Sponsorships not aligned with business goals or unapproved by tax authorities. | Sponsoring a personal event unrelated to business. |

| Non-Business Insurance Premiums | Premiums for policies not directly linked to business operations. | Life insurance for the owner, unrelated policies. |

| Foreign Taxes Paid | Taxes paid to foreign governments, unless covered by agreements. | Overseas income tax without a treaty exemption. |

This table serves as a quick reference to identify and avoid non-deductible expenses while planning your business finances under UAE corporate tax regulations.

FAQs

1. Why are fines non-deductible under UAE corporate tax?

The government considers fines a consequence of legal non-compliance, unrelated to business operations. Allowing deductions would indirectly encourage violations.

2. Are travel expenses deductible?

Business-related travel expenses can be deductible, but personal travel costs or excessive luxury accommodations are not.

3. How can businesses differentiate between deductible and non-deductible expenses?

Maintain detailed financial records. Consult the UAE corporate tax guidelines or hire a tax consultant to ensure accurate classification.

4. Can I deduct donations made to international charities?

Donations are only deductible if made to UAE government-approved entities. Contributions to international organizations are generally non-deductible.

Key Tips to Avoid Non-Deductible Expenses

- Track Expenses Diligently

Use accounting software to classify expenses correctly. This reduces the risk of misclassifying non-deductible costs. - Consult a Tax Expert

A professional can help you navigate the nuances of UAE corporate tax and avoid penalties. - Stay Updated on Regulations

Corporate tax laws in the UAE may evolve. Regularly review updates from the Ministry of Finance to ensure compliance. - Separate Personal and Business Finances

Maintain separate accounts for personal and business transactions to avoid confusion.

Why Understanding Non-Deductible Expenses Matters

Misclassifying expenses can lead to audits, penalties, or higher tax liabilities. By clearly understanding non-deductible costs, businesses can:

- Optimize tax planning: Reduce errors and stay compliant.

- Avoid penalties: Save money by adhering to regulations.

- Improve financial health: Gain better control over business expenses.

Conclusion

Understanding non-deductible expenses under UAE corporate tax is more than just compliance—it’s about empowering your business with the knowledge to make smarter financial decisions.

By staying informed and proactive, you can navigate tax season confidently, avoid penalties, and focus on growing your business.

Need help with corporate tax compliance? At ProTaxAccountant, we’re here to simplify the process. From tax filing to expert advice, we’ve got your back.

Let’s get your business tax-ready today!

Make sure to bookmark this guide and share it with fellow business owners in the UAE who could use these insights. Together, let’s build a community of tax-savvy businesses!