This blog delves into tax invoice format in the UAE, covering all essentials, answering frequently asked questions, and providing valuable insights to ensure your business stays on the right side of the law.

Tax compliance is a critical part of doing business, especially in the UAE, where Value Added Tax (VAT) regulations are strictly enforced. One of the most crucial elements of compliance is issuing tax invoices correctly.

Introduction

In the UAE, adhering to VAT regulations isn’t just a legal obligation—it’s a sign of professionalism and trustworthiness. A tax invoice is a vital document that businesses must issue when supplying goods or services subject to VAT.

But what exactly does a compliant tax invoice look like? And why is it so important?

This guide breaks it all down in simple terms, helping you understand the format, the components, and best practices for issuing tax invoices in the UAE.

Why Tax Invoice Compliance Matters in the UAE

Tax invoices aren’t just about meeting legal requirements—they’re the foundation of transparent financial dealings. In the UAE, where VAT stands at 5%, issuing a correct tax invoice helps:

- Avoid penalties: Non-compliance can lead to hefty fines.

- Facilitate VAT claims: Businesses can reclaim VAT on valid tax invoices.

- Boost credibility: Accurate invoicing builds trust with customers and partners.

Did You Know?

Failing to issue a proper tax invoice can result in fines of up to AED 5,000 per document.

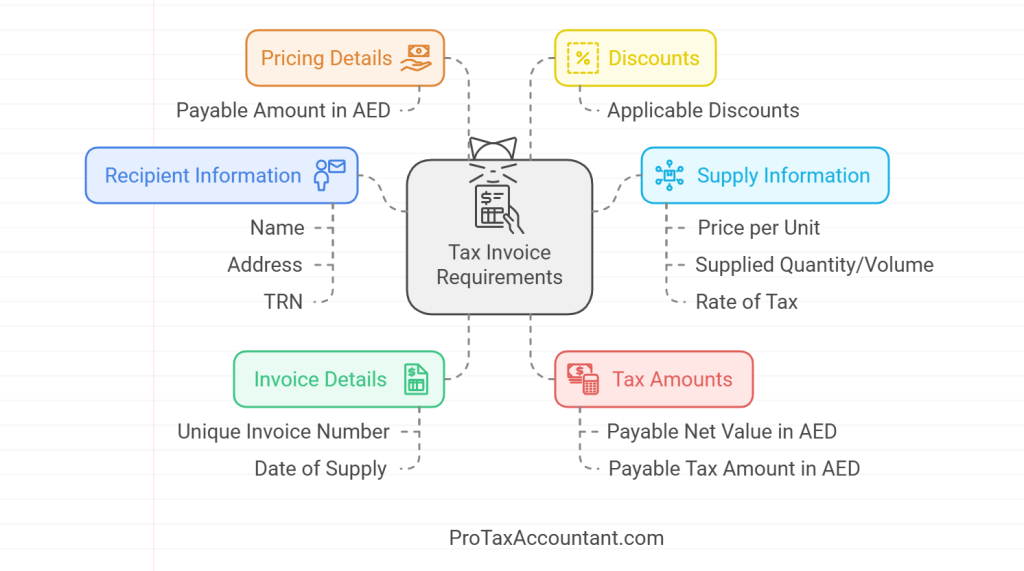

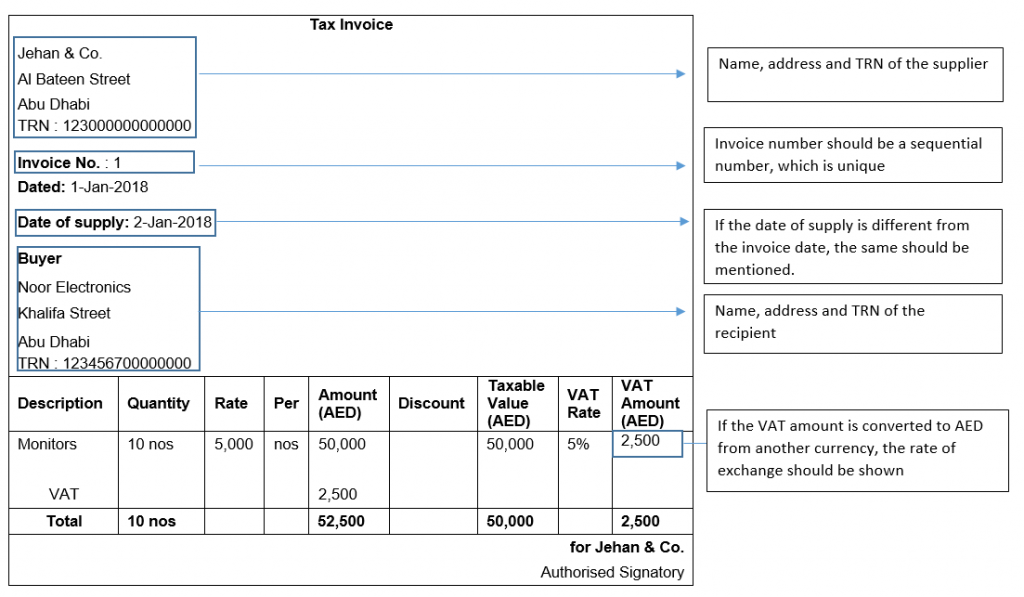

What Should a Tax Invoice in the UAE Include?

A tax invoice in the UAE must meet specific standards set by the Federal Tax Authority (FTA). The details required vary depending on the transaction value.

For Transactions Exceeding AED 10,000

Here’s what a full tax invoice must include:

| Component | Description |

|---|---|

| Title | Clearly labeled as “Tax Invoice.” |

| Supplier’s Details | Name, address, and TRN (Tax Registration Number). |

| Invoice Date | Date of issuance. |

| Invoice Number | Sequential number to ensure uniqueness. |

| Customer Details | Name, address, and, if applicable, TRN. |

| Description of Goods/Services | Clear description of what was supplied. |

| Unit Price | Price per item, exclusive of VAT. |

| Quantity | Number of items or services. |

| VAT Rate | Applicable VAT percentage (usually 5%). |

| VAT Amount | Total VAT charged for the invoice. |

| Gross Amount | Total including VAT. |

For Transactions Below AED 10,000

A simplified tax invoice may be issued, containing:

- The words “Tax Invoice.”

- Supplier’s name, address, and TRN.

- Date of issuance.

- Description of goods or services.

- Total VAT amount.

- Total amount inclusive of VAT.

FAQs About Tax Invoice Format in the UAE

What is the purpose of a Tax Registration Number (TRN) on a tax invoice?

The TRN is a unique identifier issued by the FTA. It ensures that the supplier is VAT-registered and authorized to collect and remit VAT.

Can I issue tax invoices in a language other than English?

Yes, but a certified English translation must be provided upon request by the FTA.

What happens if my invoice format is incorrect?

The FTA can impose fines, and your customers may face difficulties claiming VAT refunds.

Is it mandatory to issue tax invoices for all sales?

Yes, tax invoices must be issued for all taxable supplies, whether standard-rated or zero-rated.

Can I use electronic tax invoices?

Yes, electronic invoices are permissible as long as they meet the FTA’s requirements.

Best Practices for Issuing Tax Invoices

To ensure smooth operations and compliance, follow these best practices:

- Use accounting software: Automate invoicing to avoid errors.

- Double-check details: Verify customer information, TRN, and VAT calculations.

- Stay updated: Regularly review FTA guidelines for changes in VAT laws.

- Provide training: Educate your team on creating and managing tax invoices.

- Keep records: Maintain invoices for at least five years as required by UAE law.

Why Your Business Needs Accurate Tax Invoices

Tax invoices are more than just paperwork—they’re critical for audits, VAT returns, and building trust with stakeholders.

Investing in robust invoicing systems and ensuring compliance can save your business from potential pitfalls.

Conclusion

Understanding and adhering to the tax invoice format in the UAE is essential for businesses of all sizes.

By following the guidelines outlined here, you can ensure compliance, avoid fines, and streamline your financial processes.

Need help managing your VAT obligations? ProTaxAccountant is here to assist you every step of the way.

More for you.

Share this blog with your network to spread the knowledge about tax invoice compliance in the UAE!