Have you ever looked at a balance sheet and wondered what it all means?

Analyzing a balance sheet is crucial for understanding a company’s financial health.

It can help you see how much money the company has, what it owes, and how well it is doing overall.

In this blog, we’ll guide you through 12 simple questions to ask when analyzing a balance sheet.

By the end, you’ll be able to quickly assess a company’s financial situation.

Why Analyze a Balance Sheet?

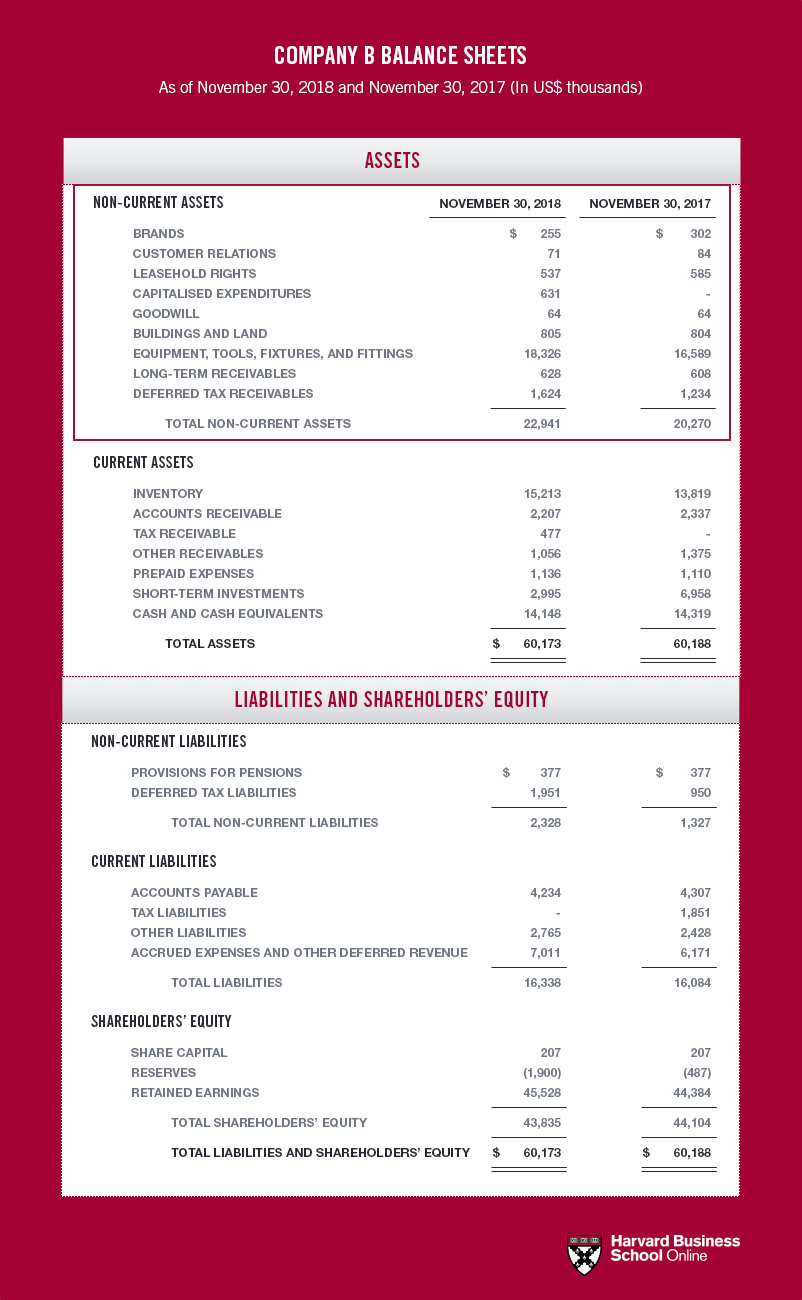

A balance sheet is one of the three main financial statements, along with the income statement and cash flow statement.

It shows:

What the company owns (assets)

What the company owes (liabilities)

The value left for the owners (equity)

Analyzing this information helps you understand if the company is financially strong or if it might face problems.

12 Questions to Analyze a Balance Sheet

How Much Cash Does the Company Have?

Best Possible Answer:

More cash than debt.

Why It Matters:

Having more cash than debt means the company can pay its bills easily. Cash is very important for day-to-day operations.

Example:

If Company A has AED 500,000 in cash and AED 300,000 in debt, it is in a good position to handle unexpected expenses or invest in new projects.

“Cash flow is essential for business survival.” – Investopedia

Are There Accounts Receivables? How Much?

Best Possible Answer: None. This means the company is paid in cash.

Why It Matters:

Accounts receivable is money owed to the company by customers who haven’t paid yet.

If there are no receivables, it means customers pay upfront.

Example:

If Company B has AED 0 in accounts receivable, it shows that all sales are made in cash, making cash management simpler.

Is There Inventory? How Much?

Best Possible Answer:

None. This means the company doesn’t have to worry about managing inventory.

Why It Matters:

No inventory means the company doesn’t have to store products or worry about unsold items, which can save money.

Example:

If Company C has AED 0 in inventory, it likely focuses on providing services rather than selling products.

Is There Any Goodwill? How Much?

Best Possible Answer: None. This means the company has grown organically.

Why It Matters:

Goodwill appears when a company buys another for more than its fair value.

A lack of goodwill suggests that growth has been achieved through its own efforts.

Example:

If Company D shows AED 0 in goodwill, it indicates that it has built its brand value without acquiring other companies.

What Are the Company’s Biggest Assets?

Best Possible Answer:

Cash. This means the company has plenty of financial flexibility.

Why It Matters:

Cash as a primary asset allows quick responses to opportunities or challenges without needing loans or additional financing.

Example:

If Company E lists AED 400,000 in cash as its largest asset, it can easily invest in new projects or handle emergencies.

Does the Company Have Debt? How Much? What Kind?

Best Possible Answer:

None. This means the company hasn’t financed itself with debt.

Why It Matters:

No debt indicates financial stability but may also mean missed growth opportunities if not used wisely.

Example:

If Company F has AED 0 in long-term debt, it shows that it has funded its growth through equity rather than borrowing money.

“Debt can be a double-edged sword.” – Forbes

Does the Company Have Deferred Revenue?

Best Possible Answer:

Yes. It’s a sign that the company gets paid before it delivers the product/service.

Why It Matters:

Deferred revenue indicates that customers have paid upfront for services or products yet to be delivered, providing immediate cash flow benefits.

Example:

If Company G has AED 50,000 in deferred revenue, it shows strong customer demand and immediate cash without having delivered services yet.

What Are the Company’s Biggest Liabilities?

Best Possible Answer:

Deferred revenue. See question 7.

Why It Matters:

Understanding liabilities helps assess potential risks related to future obligations and cash flow requirements.

Example:

If Company H’s biggest liability is AED 70,000 in deferred revenue, this indicates future obligations but also reflects strong upfront sales.

How Has the Company Been Funded? Debt? Equity?

Best Possible Answer:

Equity. This means the company is free of debt.

Why It Matters:

Funding through equity rather than debt suggests lower financial risk but may dilute ownership among shareholders.

Example:

If Company I has raised AED 200,000 through equity financing and has no outstanding loans, it shows a conservative approach to funding growth without incurring debt obligations.

Is There Any Preferred Stock?

Best Possible Answer:

No. Preferred stock is a sign that a company has poor economics.

Why It Matters:

Preferred stock often comes with fixed dividends and may indicate that common shareholders are at risk if profits fall short.

Example:

If Company J reports no preferred stock on its balance sheet, it suggests straightforward equity financing without complex obligations to preferred shareholders.

Are Retained Earnings Positive and Growing?

Best Possible Answer:

Yes. This means the company is profitable and retains its profits for growth.

Why It Matters:

Positive retained earnings indicate that profits are being reinvested into the business rather than distributed as dividends, supporting future growth initiatives.

Example:

If Company K shows retained earnings of AED 150,000 that have grown from AED 100,000 last year, it reflects successful reinvestment strategies and profitability over time.

Is There Any Treasury Stock?

Best Possible Answer:

Yes. This means the company is buying back stock.

Why It Matters:

Treasury stock represents shares that have been repurchased by the company itself; this can signal confidence in future performance or an effort to improve shareholder value by reducing outstanding shares.

Example:

If Company L holds AED 30,000 worth of treasury stock, it may be signaling confidence in its future profitability or seeking to enhance earnings per share (EPS).

Conclusion

By asking these twelve questions when analyzing a balance sheet, you can quickly gauge a company’s financial health and operational performance.

Understanding these elements allows you to make informed decisions about investments or business strategies while identifying potential risks and opportunities for improvement.

For further reading on analyzing financial statements effectively, check out these resources:

By mastering these concepts and techniques, you’ll be better equipped to evaluate companies’ performances confidently and effectively!

For personalised review and analysis contact us.