10 CAPEX KPIs for Finance Managers, CFOs & CEOs

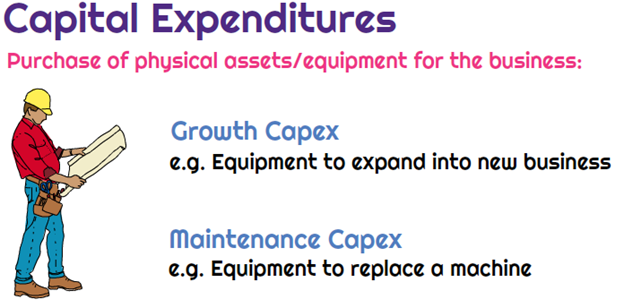

Understanding capital expenditures (CAPEX) and their key performance indicators (KPIs) can seem daunting for small business owners. However, breaking these concepts down into simple terms can help you grasp their significance and how they can benefit your business. In this blog, we’ll explore 10 essential CAPEX KPIs, their meanings, and how they can help you […]

10 CAPEX KPIs for Finance Managers, CFOs & CEOs Read More »