Managing Finances for Dubai Small Businesses?

Let Technology Do the Heavy Lifting

Struggling with spreadsheets, VAT filings, or messy financial records? You’re not alone.

For Dubai’s small businesses, bookkeeping is more than compliance—it’s survival. But manual data entry and hiring costly accountants drain time and profits.

Here’s the good news:

Modern online bookkeeping services automate 90% of financial tasks and cut costs by up to 40% (see how online accounting reduces costs by 60%).

Why Dubai Startups Switched to Online Bookkeeping in 2025

“Outsourcing our books saved us 15 hours/week and AED 12,000/year in penalties.”

– Ahmed, E-commerce Founder (Dubai Silicon Oasis)

Top Benefits for UAE Businesses:

-

VAT & Corporate Tax Compliance

-

Auto-filing for UAE VAT (step-by-step VAT payment guide) and corporate tax (2024 corporate tax registration guide).

-

-

Real-Time Financial Insights

-

Track cash flow, profits, and expenses 24/7 via apps like QuickBooks or Xero. Learn to analyze a balance sheet in under 2 minutes.

-

-

Scalability

-

From 10 transactions/month to enterprise-level reporting. Explore choosing the right business structure in Dubai.

-

Online Bookkeeping Services: Dubai Price Guide (2025)

| Business Size | Monthly Cost (AED) | Key Features |

|---|---|---|

| Startups (<50 transactions) | 499–799 | Basic bookkeeping, VAT filing, bank reconciliation |

❗ Hidden Cost Alert:

Avoid firms charging extra for VAT return revisions. Learn about non-deductible UAE corporate tax expenses.

How Online Bookkeeping Works for UAE Businesses

-

Step 1: Connect your UAE bank account to cloud software (e.g., Xero).

-

Step 2: A certified bookkeeper categorizes transactions, flags errors.

-

Step 3: Receive real-time dashboards + monthly reports. Understand EBITDA for operational performance.

A Dubai freelance visa holder reduced tax errors by 80% using virtual bookkeeping services.

Must-Have Features for Dubai Bookkeeping Services

-

FTA VAT Compliance

-

Look for: Tax agents registered with the UAE Federal Tax Authority (FTA). Avoid VAT audit surprises.

-

-

Free Zone Expertise

-

Knowledge of DMCC, DIFC, or Abu Dhabi Global Market (ADGM) setup.

-

Top Online Bookkeeping Services in Dubai (2025)

-

Pro Tax Accounting

-

Best For: Startups & SMEs

-

Perks: Free VAT registration, direct CEO access.

-

FAQs: Online Bookkeeping in Dubai

How much does VAT filing cost?

Most services include it in packages (AED 499+/month). Avoid firms charging per filing.

Full VAT deregistration guide.

Can online bookkeeping help with corporate tax?

Yes! Learn about UAE taxable income adjustments and tax loss carryforwards.

Why 150+ Dubai Businesses Chose Pro Tax Accounting

-

Direct CEO Access: Skip support tiers—get instant answers from experts.

-

Free Compliance Audit: Spot VAT/tax risks before penalties hit. Corporate tax vs. VAT explained.

Managing your finances is the backbone of running a successful business, but bookkeeping can often feel like an overwhelming and time-consuming task.

What is Online Bookkeeping?

At its core, online bookkeeping refers to managing your financial records using cloud-based software. This allows businesses to track their income, expenses, invoices, and other financial data digitally.

What’s more, an online bookkeeper—usually a certified professional—handles everything remotely, saving you both time and money.

According to Forbes, nearly 60% of small businesses use some form of cloud-based accounting or bookkeeping software, and that number continues to grow as more companies see the advantages of going digital.

Why Choose Online / Virtual Bookkeeping Services?

Choosing online bookkeeping services isn’t just about convenience—it’s also about improving accuracy, saving money, and gaining real-time insights into your financial health.

Here’s why so many businesses, from startups to established companies, are making the switch:

1. Cost Savings

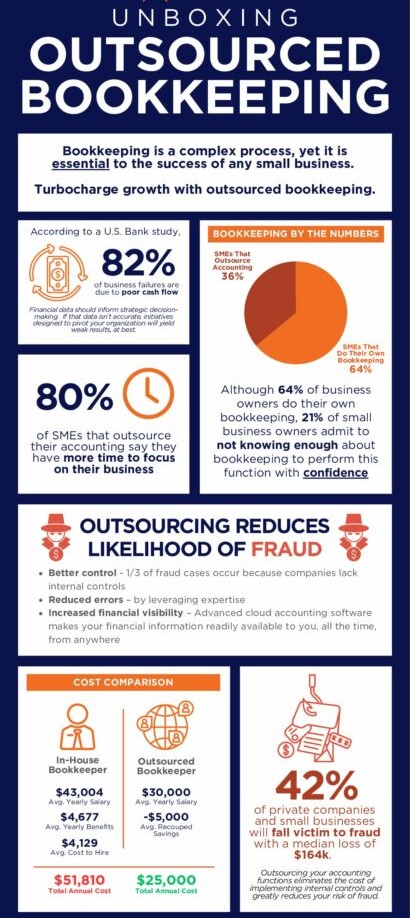

Online bookkeeping services eliminate the need for hiring a full-time employee. By outsourcing, you only pay for the services you need, which significantly reduces your overall costs.

Whether you require weekly, monthly, or quarterly bookkeeping, the flexible pricing models of online services allow you to get the best value for your money.

In fact, a study by Business.com found that businesses can save up to 40% on bookkeeping and accounting expenses by opting for online services over in-house staff.

2. Real-Time Access to Your Financials

With online bookkeeping, your financial data is available to you in real-time. Whether you’re checking invoices, payments, or expense reports, you can access everything from anywhere, anytime.

This real-time access allows for better decision-making and ensures you always know where your business stands financially.

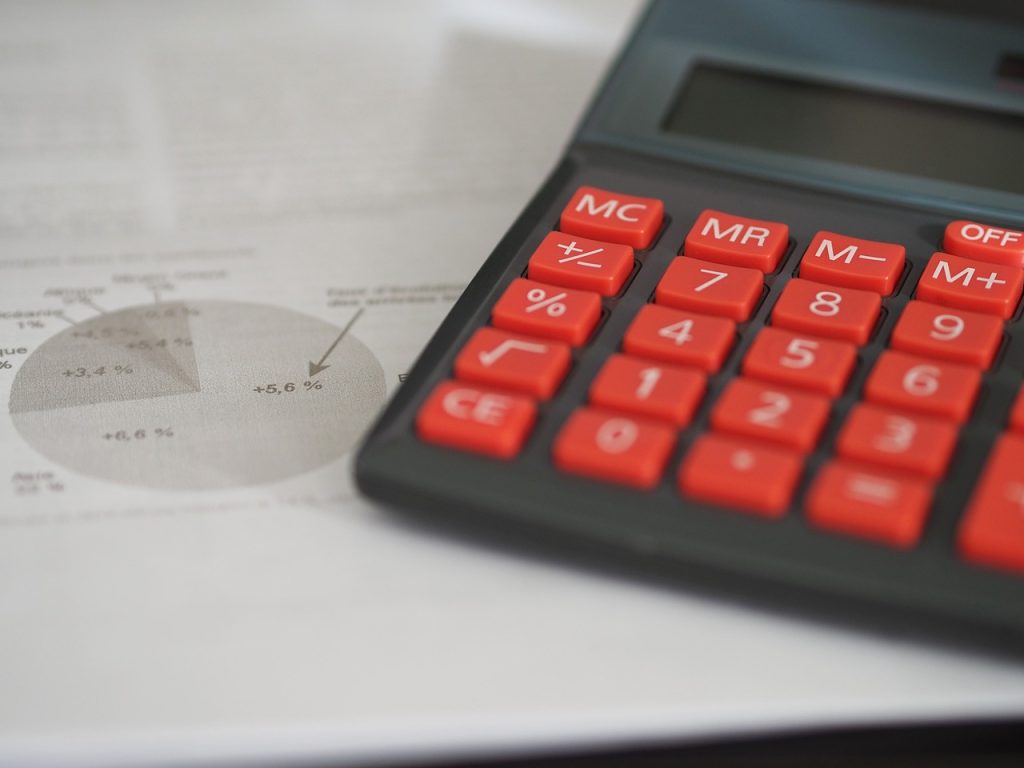

3. Accuracy and Efficiency

The best online bookkeeping services use automation to minimize human error.

Cloud-based platforms like Xero or QuickBooks integrate with your bank accounts and automatically track your transactions, making sure that nothing slips through the cracks.

This automation ensures that your books are always accurate and up-to-date.

According to Xero, businesses that switch to automated bookkeeping solutions see a 25% increase in financial accuracy, reducing costly mistakes and preventing tax-related issues.

4. Scalability

One of the most significant advantages of online bookkeeping services is their scalability. As your business grows, your bookkeeping needs will evolve.

Online services allow you to scale up or down depending on your requirements, whether you’re a solopreneur, a startup, or an established company with complex financial operations.

5. Compliance and Tax Filing

Staying compliant with local regulations and ensuring accurate tax filing is crucial for any business.

Many virtual bookkeeping services offer tax filing support, ensuring that your business stays compliant with UAE tax laws and VAT regulations.

They also handle tax preparation, helping you avoid penalties or errors that could cost you down the line.

Top Features of the Best Online Bookkeeping Services

Not all virtual bookkeeping services are created equal.

The best online bookkeeping services offer a range of features that make them stand out. Here are some of the top features you should look for:

1. Cloud-Based Software

The best services rely on secure cloud-based platforms like QuickBooks, Xero, or Zoho Books. These platforms allow for seamless data entry, real-time reporting, and integration with other financial tools, such as payment processors and payroll services.

According to QuickBooks, more than 7 million small businesses around the world use their cloud-based software, making it one of the most trusted names in online bookkeeping.

2. Customizable Services

Your business is unique, and so are your bookkeeping needs. The top services offer customizable packages tailored to your specific requirements. Whether you need basic bookkeeping or a more comprehensive package that includes payroll, invoicing, and tax filing, having the flexibility to choose the right services is crucial.

3. Security and Data Protection

Handling sensitive financial data requires a high level of security. The best online bookkeeping services use encryption, two-factor authentication, and other security measures to ensure your information is always safe.

Look for services that prioritize data protection and comply with local regulations, especially when operating in the UAE.

4. User-Friendly Interface

Managing your finances should be easy, not confusing. The best services come with intuitive, user-friendly interfaces that make navigating your financial data a breeze.

Whether you’re logging in to check an invoice or running a financial report, you want to be able to access your information without frustration.

5. Dedicated Bookkeepers

Many online bookkeeping services assign a dedicated bookkeeper to your account. This person gets to know your business and ensures that your books are handled professionally and efficiently.

Having a dedicated contact also means you can reach out for support whenever you need it.

How to Choose the Best Online Bookkeeping Service for Your Business

When it comes to selecting the best online bookkeeping service for your business, there are a few key factors to consider.

Let’s break them down:

Assess Your Needs

The first step is to determine exactly what bookkeeping tasks you need help with. Do you need someone to handle daily transaction recording, or do you only require monthly financial reporting?

Understanding your specific needs will help you choose a service that offers the right solutions.

Check for Industry Expertise

Some industries have specific bookkeeping requirements. For instance, if you run an e-commerce business, you may need a bookkeeper who understands inventory management and sales tax compliance.

If you operate in the US, UK, or UAE, look for a service that has expertise in corporate tax and VAT compliance and local tax regulations.

Consider Pricing

While affordability is important, make sure you’re getting value for your money. Some services charge a flat monthly fee, while others offer a pay-as-you-go model.

Compare pricing plans and ensure that the service you choose fits within your budget without compromising on quality.

Look for Integration Capabilities

The best online bookkeeping services integrate with the other tools you use to run your business, such as payment gateways, payroll services, and e-commerce platforms.

These integrations save you time by automating many financial tasks and ensuring that your data is always up-to-date.

Read Reviews and Testimonials

Before choosing a service, take the time to read customer reviews and testimonials. These will give you insight into the service’s reliability, customer support, and overall performance.

Many businesses have had positive experiences with providers like Xero and QuickBooks, and reviews can help you gauge whether the service is right for you.

Top Online Bookkeeping Services for Startups in 2025

Here is a list of the top online bookkeeping services, including their features and pricing:

| Service | Features | Pricing |

|---|---|---|

| Fund | All-in-one accounting, tax services, tax credits | Starting at $499/month |

| Bench | Accounting software, financial data access, tax services | Starting at $249/month (billed annually) or $299/month |

| Kruze Consulting | Accounting, CFO, tax, HR services for Seed to Series B startups | Starting at $600/month |

| Pilot | Back-office services, bookkeeping, controller, CFO services | Starting at $499/month |

| Bean Ninjas | Bookkeeping, sales tax collection, financial reporting for ecommerce | Custom pricing |

| Cleartax | Tax consulting, accounts receivable, financial services | Custom pricing |

| Accountalent | Comprehensive income tax, bookkeeping, R&D study, financial services | Starting at $199/month |

| FlowFi | Financial statements, CFO, accounting, tax professionals | Custom pricing |

| Inkle | Tax and bookkeeping automation, state and federal filings | Starting at $30/month |

| Grooved | Automated reporting, SaaS metrics | Starting at $199/month |

| Graphite Financial | Accounting, strategy, tax preparation | Starting at $900/month |

| Zinance | Syncs business products with finance software, compliance | Starting at $179/month |

| Fake | Taxes, bookkeeping, financial statements | Starting at $100/month |

| Less Accounting | Simple bookkeeping software, expense recording, invoicing | Starting at $24/month |

| Bookkeeper360 | Payroll, tax, CFO advisory solutions | Starting at $399/month |

| Punch Financial | High-level financial strategy and accounting services | Starting at $1,500/month |

| Manay CPA | Full-service accounting and tax service | Custom pricing |

| QuickBooks Live Bookkeeping | Assisted bookkeeping, full-service bookkeeping | Starting at $15/month (assisted), $300/month (full-service) |

| Tukel, Inc. | Bookkeeping, reporting, tax services | Starting at $389/month |

| Fincent | Combines software with certified bookkeepers | Starting at $299/month |

| Acuity | Virtual bookkeeping, accounting services, CFO insights | Starting at $449/month |

FAQs About the Best Online Bookkeeping Services

How much do online bookkeeping services cost?

Online bookkeeping services typically charge between $199 and $500 per month, depending on the level of service you require.

Most providers offer flexible pricing models, so you only pay for the services you need.

Can online bookkeeping services handle payroll?

Yes, many online bookkeeping services also offer payroll management as part of their packages.

They can automate payroll calculations, generate pay stubs, and ensure compliance with local labor laws.

Is my financial data secure with an online bookkeeping service?

Reputable online bookkeeping services use encryption and other security measures to protect your financial data.

Cloud-based platforms like Xero and QuickBooks are known for their robust security protocols, ensuring that your data is always safe.

How do I get started with an online bookkeeping service?

Getting started is easy! Most services allow you to sign up online, where you’ll be paired with a dedicated bookkeeper who will help you get your financial records in order.

You’ll also need to connect your bank accounts and financial software to begin tracking your transactions.

Can online bookkeeping services help with VAT compliance in the UAE?

Yes, many online bookkeeping services specialize in VAT compliance and can ensure that your business meets all regulatory requirements in the UAE.

They can also handle tax preparation and filing to keep you in good standing with the authorities.

Why Choose Pro Tax Accounting?

While the services listed above offer a range of benefits, Pro Tax Accounting stands out for several reasons:

Direct Contact with the CEO

Unlike many other services where you might interact with support staff, Pro Tax Accounting offers the unique advantage of direct contact with the CEO.

This ensures that you receive personalized attention and expert guidance from the top, tailored to your specific financial needs.

Customized Solutions

Pro Tax Accounting provides customized bookkeeping and tax services that are designed to meet the unique challenges of your startup.

With direct access to the CEO, you can expect solutions that are highly tailored and effective.

Expertise and Trust

Dealing directly with the CEO builds trust and ensures that you are working with someone who has a deep understanding of your business’s financial health and goals.

This level of expertise is invaluable for making informed financial decisions.

Scalability and Flexibility

As your startup grows, Pro Tax Accounting can adapt to your changing needs, offering scalable solutions that ensure your financial management remains robust and efficient.

In conclusion, while there are many excellent online bookkeeping services available, Pro Tax Accounting offers a unique blend of personalized attention, expert guidance, and direct CEO involvement that can significantly benefit your startup’s financial health and growth.

Conclusion

The best online bookkeeping services offer a cost-effective, efficient way to manage your business’s finances without the hassle of manual record-keeping.

By choosing the right service, you can ensure accurate financial reporting, stay compliant with tax laws, and make better business decisions—all without breaking the bank.