Introduction

Running a business in the UAE can be exciting and rewarding, but when it comes to managing finances, things can get overwhelming.

From balancing books to ensuring compliance with tax regulations, accounting is a vital but time-consuming task for every business.

That’s where online accounting services come in—a game-changer for UAE businesses, offering convenience, accuracy, and peace of mind.

Whether you’re a small startup or an established enterprise, shifting to online accounting services can save you time, reduce errors, and keep your business on track.

But how do these services work? What are their benefits, and how do you choose the right one for your business in the UAE?

In this guide, we’ll answer all your questions, provide valuable insights, and help you make an informed decision.

What Are Online Accounting Services?

Online accounting services allow businesses to manage their financial records, reports, and taxes through digital platforms, removing the need for traditional, paper-based methods.

These services offer the support of professional accountants, often on a subscription basis, without the need for in-house staff.

From tracking expenses to filing VAT returns, online accounting services in the UAE are designed to streamline financial management while staying compliant with local regulations.

Key Features of Online Accounting Services:

Cloud-based access to your financial data from anywhere.

Automated bookkeeping, reduces manual errors.

Real-time financial insights and reporting.

FAQs About Online Accounting Services in the UAE

1. Why Should I Use Online Accounting Services in the UAE?

The UAE’s business environment is competitive and fast-paced. Online accounting services offer an edge by automating tedious tasks and giving you real-time access to your financial data.

This means you can focus more on running and growing your business while experts handle the numbers.

Key Benefits:

Time-saving: Automation of bookkeeping, payroll, and VAT filing saves hours of manual labor.

Cost-effective: Hiring full-time accounting staff is expensive, while outsourcing to online platforms is often more affordable.

Tax compliance: The UAE’s VAT laws require accurate filing. Online services ensure you’re always on the right side of the law.

Ease of use: Most platforms are designed to be user-friendly and integrate with your existing business software.

According to Business.com, companies that use online accounting software can save an average of 50% on bookkeeping costs compared to in-house staff.

2. How Much Do Online Accounting Services Cost in the UAE?

The pricing for online accounting services in the UAE varies based on the complexity of your business and the service level required. Basic bookkeeping packages start as low as AED 200 per month, while more advanced services that include tax filing, payroll management, and financial reporting can range from AED 500 to AED 1,500 per month or more.

Most providers offer scalable plans, allowing businesses to upgrade or downgrade services as their needs evolve. It’s important to compare packages based on the specific services your business requires to get the best value.

3. Are Online Accounting services Secure in the UAE?

Data security is a top priority for any business, especially when it comes to sensitive financial information. Online accounting services in the UAE use advanced encryption methods to protect your data.

Many services offer two-factor authentication (2FA), regular security audits, and ISO certifications to ensure top-notch security standards.

Tips for Ensuring Data Security:

Always choose a service provider that complies with international security standards.

Check customer reviews and testimonials for insights into data security.

Regularly back up your financial data, even if the provider does it automatically.

4. What Services Do Online Accounting Platforms Offer in the UAE?

Online accounting platforms in the UAE offer a variety of services depending on the provider and your business needs. Some of the most common services include:

Bookkeeping: Automating daily financial tasks like tracking expenses and recording transactions.

Tax Filing: Assisting with VAT registration, filing, and returns—critical for businesses in the UAE to stay compliant.

Payroll Management: Handling employee payments, deductions, and other HR-related financial tasks.

Financial Reporting: Generating real-time reports that give you a clear view of your business’s financial health.

Audit Support: Assisting with audits and ensuring that your financial records are always accurate and up to date.

These services ensure that your business remains compliant with UAE tax laws, while also helping you make informed financial decisions.

How to Choose the Best Online Accounting Service in the UAE

Choosing the right accounting service depends on your business size, industry, and specific needs. Here are some key factors to consider:

1. Compliance with UAE Laws

Make sure the service provider is familiar with UAE tax laws, including VAT regulations. The right provider will help you navigate these laws and ensure compliance, avoiding penalties and fines.

2. Scalability

Your business might be small now, but you’ll want a service that can grow with you. Look for providers that offer flexible plans, so you can upgrade as your business expands.

3. Ease of Use

Opt for a platform that is easy to navigate, even if you’re not a financial expert. A user-friendly interface with clear instructions can save you time and reduce the risk of mistakes.

4. Customer Support

Ensure that the provider offers excellent customer support. Whether it’s 24/7 availability or dedicated account managers, responsive support is crucial when dealing with financial matters.

5. Integration with Other Tools

Your online accounting platform should easily integrate with other business tools like CRM systems, inventory management software, and e-commerce platforms.

Why UAE Businesses Are Switching to Online Accounting

1. Real-Time Financial Insights

Online accounting services provide real-time insights into your business’s finances. With just a few clicks, you can generate reports, view cash flow, and track profitability. This allows business owners in the UAE to make informed decisions quickly and efficiently.

2. Cost Reduction

Hiring in-house accountants is expensive—especially when factoring in benefits, office space, and equipment. Online accounting services offer the same professional expertise at a fraction of the cost. Many UAE-based businesses have seen a reduction in operational costs after switching to online platforms.

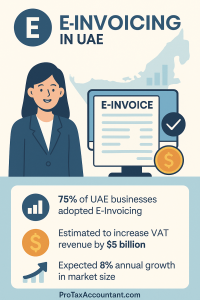

3. VAT Compliance

With VAT regulations in place, ensuring accurate filing and documentation is crucial. Online services help businesses automate VAT filing, ensuring that deadlines are met and avoiding costly penalties.

4. Increased Productivity

When you no longer have to focus on repetitive tasks like invoicing and payroll, you can invest that time in areas that matter more—like growing your business. By outsourcing accounting tasks, you can focus on core business activities.

Online accounting services can reduce costs by up to 60%.

No in-house accounting staff: Hiring full-time accountants comes with salaries, benefits, office space, and equipment costs.

By outsourcing to an online service, you avoid these expenses. Online accounting is typically subscription-based, and the overall cost is much lower.

Automation: Online platforms automate time-consuming tasks like bookkeeping, invoicing, and payroll management. Automation reduces the need for manual work, minimizing errors and the extra costs of fixing those mistakes.

Scalability: With online services, you only pay for what you need. You can start with a basic plan and scale up as your business grows, avoiding the upfront costs of hiring extra staff when your business is small.

Reduced Errors: Online accounting software is highly accurate, reducing the risk of costly financial mistakes or penalties from non-compliance.

This can save money on legal fees and fines, especially when it comes to VAT filing and tax returns.

Real-Time Financial Insights: The ability to access real-time financial data allows businesses to make informed decisions quickly.

This can prevent cash flow problems, reduce unnecessary expenses, and optimize financial strategies.

By avoiding in-house accounting costs, reducing errors, and streamlining operations through automation, businesses can see significant cost savings with online accounting services

Conclusion

Online accounting services are becoming a must-have for businesses in the UAE, offering not only convenience but also critical support in tax compliance and financial management.

Whether you’re looking to save time, cut costs, or simply gain better control over your finances, these services can provide real value.

By choosing a reliable provider, you’ll gain peace of mind, knowing that your business’s financial health is in capable hands.

Explore your options today and discover how online accounting can revolutionize the way you manage your business.

Take the first step toward stress-free finances—start using an online accounting service in the UAE today!