Effective accounting is essential, not just for compliance but also for strategic decision-making and growth.

Yet, selecting the best accounting services for a small business in Dubai can be overwhelming, given the diverse options available.

In this guide, we’ll explore everything small business owners need to know about choosing the right accounting services in Dubai.

We’ll address common questions, highlight the benefits of professional accounting support, and provide actionable insights to help you make the best choice for your business needs.

Why Small Businesses in Dubai Need Accounting Services

When you do it on your own, you make the following mistakes most of the time:

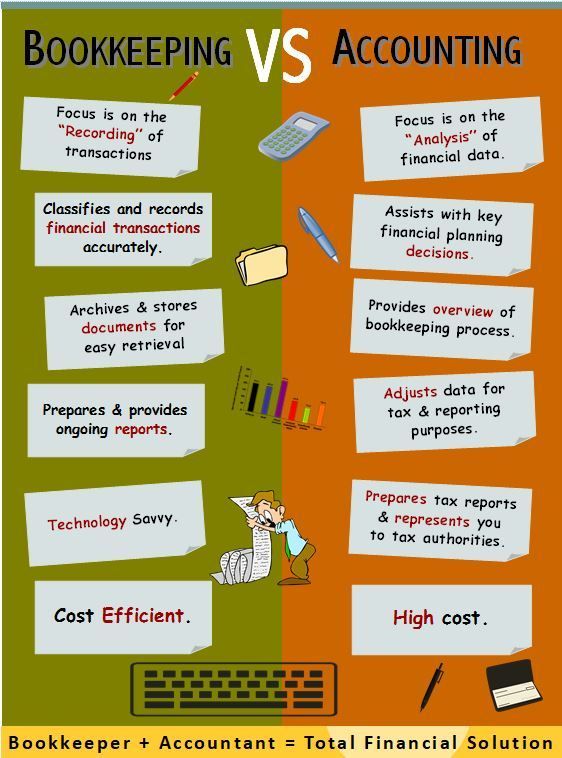

Accounting services go beyond basic bookkeeping—they’re the backbone of a healthy financial system.

For small businesses in Dubai, professional accounting offers:

Compliance with UAE regulations:

From VAT to corporate tax, staying compliant with the UAE’s evolving financial regulations is crucial to avoid penalties.

Better financial management:

Professional accounting services ensure accurate tracking of cash flow, assets, liabilities, and profits, helping you make informed decisions.

Time savings:

Outsourcing accounting tasks allows business owners to focus on growth rather than paperwork.

Strategic planning:

Accountants provide valuable insights and financial reports that support long-term planning and business expansion.

For more on setting up your business successfully in Dubai, check out this comprehensive guide for foreign entrepreneurs.

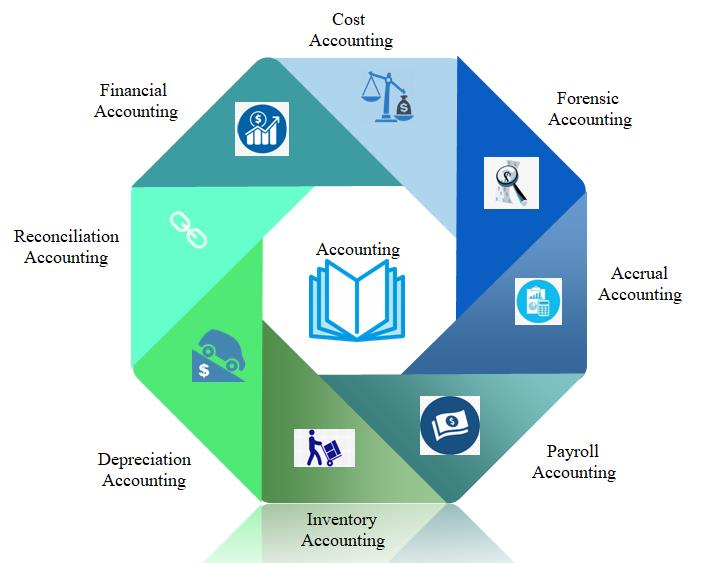

Types of Accounting Services for Small Businesses in Dubai

Bookkeeping and Payroll Services

Manages daily financial transactions, employee payroll, and records all business expenses.

A reliable bookkeeping service helps ensure that financial records are always accurate and updated.

Tax Preparation and Filing

UAE introduced corporate tax in 2023, impacting many small businesses.

Professional accounting services ensure compliance and optimize tax benefits.

For details on corporate tax, consider understanding UAE corporate tax registration requirements.

Financial Statement Preparation

Accountants prepare income statements, balance sheets, and cash flow statements that are essential for financial transparency and investor relations.

For quick insights, learn how to analyze a balance sheet.

Budgeting and Forecasting

Accountants help businesses plan for future expenses, ensuring cash flow is sufficient for growth.

Why a budget is important for your business explains budgeting benefits for small businesses.

VAT Services

VAT compliance is a significant aspect of accounting in Dubai, and a knowledgeable accountant will handle VAT registration, filing, and payment.

For a step-by-step guide, check out how to make VAT payment in UAE.

FAQs on Choosing Accounting Services for Small Businesses in Dubai

What Should I Look for in a Small Business Accounting Service?

When choosing an accounting service, consider these key factors:

Experience and expertise:

The firm should have a strong background in UAE’s financial regulations and tax laws.

Range of services:

Look for firms that offer a comprehensive range of services and have experience in tax planning, VAT compliance, and financial analysis.

Use of technology:

Tech-savvy firms that use online accounting software are more efficient, accurate, and accessible.

Reputation and reviews:

Client reviews and testimonials offer valuable insights into the reliability and quality of services.

Cost-effectiveness:

The services should align with your budget without compromising on quality.

For tips on choosing the right bookkeeping company, refer to key factors for selecting a bookkeeping service in UAE.

Should I Opt for In-house accounting or outsource the service?

This decision depends on the size of your business, budget, and needs.

In-house accounting:

Suitable if you need a full-time accountant and can afford the cost.

Outsourcing:

Ideal for small businesses as it’s cost-effective and provides access to expert services without a long-term commitment.

Outsourcing is increasingly popular; learn more about its benefits in Why Accounting Outsourcing is Trending in Dubai.

Can Online Accounting Services Save My Business Money?

Absolutely! Online accounting services offer several advantages, such as lower overhead costs, real-time access to financial data, and secure cloud storage.

In fact, using online accounting can reduce costs by up to 60%.

Explore how online services can streamline your finances in How Online Accounting Services in the UAE Cut Costs by 60%.

How Does Corporate Tax in the UAE Affect My Small Business?

Corporate tax was introduced in 2023, making it vital for businesses to ensure compliance.

Small businesses must understand the tax’s impact on cash flow and profitability and seek professional help for seamless tax management.

For detailed guidance, check out Who is Subject to UAE Corporate Tax?.

Key Benefits of Hiring Professional Accounting Services

Compliance and Risk Mitigation

Professional accountants are well-versed in UAE’s tax and compliance regulations, helping to avoid costly penalties.

Cost Savings and Efficiency

Outsourcing accounting functions reduces overhead expenses associated with full-time employees and provides access to specialized expertise.

Better Decision-Making with Accurate Financial Reporting

Accountants generate clear financial statements, allowing owners to understand profitability, liquidity, and overall financial health.

Time Management

By delegating financial management, small business owners can focus on core business activities.

Tax Optimization

Skilled accountants implement strategies to minimize tax liability legally, helping businesses retain more of their income.

For insights into tax-related benefits, consider corporate tax guidance for startups in Dubai.

Steps to Choosing the Best Accounting Service for Your Business in Dubai

Step 1: Determine Your Needs

Identify whether you need bookkeeping, tax planning, financial analysis, or all of the above. This helps in choosing a service that meets your specific requirements.

Step 2: Research Potential Accounting Firms

Read reviews, seek recommendations, and evaluate their experience in serving small businesses in Dubai.

Look for firms specializing in industries similar to yours.

Step 3: Check Credentials and Licensing

Ensure the firm’s accountants are certified and have a good reputation in the UAE.

Certification demonstrates a commitment to professionalism and expertise.

Step 4: Compare Pricing Plans

Evaluate pricing structures of various firms to ensure the services fit within your budget.

Opt for flexible packages that allow you to scale up as your business grows.

Step 5: Schedule Consultations

Most firms offer a free initial consultation. Use this opportunity to gauge their understanding of your needs, responsiveness, and communication style.

Comparing Top Accounting Software for Small Businesses

Here are five popular accounting software options suitable for small businesses in Dubai:

| Software | Best For | Key Features | Monthly Price | Website |

|---|---|---|---|---|

| QuickBooks | Overall Functionality | Intuitive platform; seamless integration; strong invoicing capabilities; excellent tax planning features. | Starting at $35 | QuickBooks |

| Xero | User Experience | User-friendly interface; integrates with over 800 apps; excellent reporting tools. | Starting at $15 | Xero |

| FreshBooks | Freelancers & Non-Accountants | Simplified invoicing; expense tracking; time tracking features; user-friendly design. | Starting at $19 | FreshBooks |

| Sage | Growing Businesses | Comprehensive features including inventory management; robust reporting capabilities; scalable plans. | Starting at $59 | Sage |

| Zoho Books | Automation & Integration | Automated invoicing; expense tracking; integrates with other Zoho apps; multi-currency support. | Starting at $0 | Zoho Books |

Mistakes to Avoid When Choosing an Accounting Service

Choosing Based on Price Alone

Low-cost services may lack the necessary expertise. Aim for value over price, as a reliable accountant can save you more money in the long run.

Ignoring Experience with Dubai’s Regulations

UAE’s financial landscape is unique, with specific regulations and compliance needs.

Ensure the firm is knowledgeable about local tax laws and business regulations.

Lack of Clear Communication

Miscommunication can lead to costly mistakes. Choose a service that prioritizes clear, timely, and transparent communication.

Not Leveraging Technology

In today’s digital age, firms that use modern accounting software offer more accurate, efficient, and secure services.

Conclusion

For small businesses in Dubai, choosing the right accounting service is a crucial decision that impacts compliance, profitability, and growth.

From VAT filing and corporate tax compliance to financial planning and online bookkeeping, accounting services cover a wide range of needs.

By understanding the types of services available, evaluating firms based on expertise, and prioritizing compliance and technology, small business owners can make informed choices that support their financial health and business success.

When making your final decision, remember to consider not only your current needs but also the scalability of the services to grow with your business.

For more on how professional accounting can benefit your small business, check out this ultimate guide to hiring a bookkeeping service in Dubai.

Choosing the best accounting service may seem challenging, but with the right approach, you can secure a reliable partner like Pro Tax Accountant that helps you focus on what matters most—growing your business!

Accounting services for small business: Monthly Cost

Monthly accounting services in Dubai can cost you from 499 per month to 1999.

You can calculate cost based on monthly transaction volume.