In this blog, I will help you understand why is budgeting important to a business.

I will also list ten advantages of budgeting to provide a clearer understanding for small business owners.

Why is a budget important?

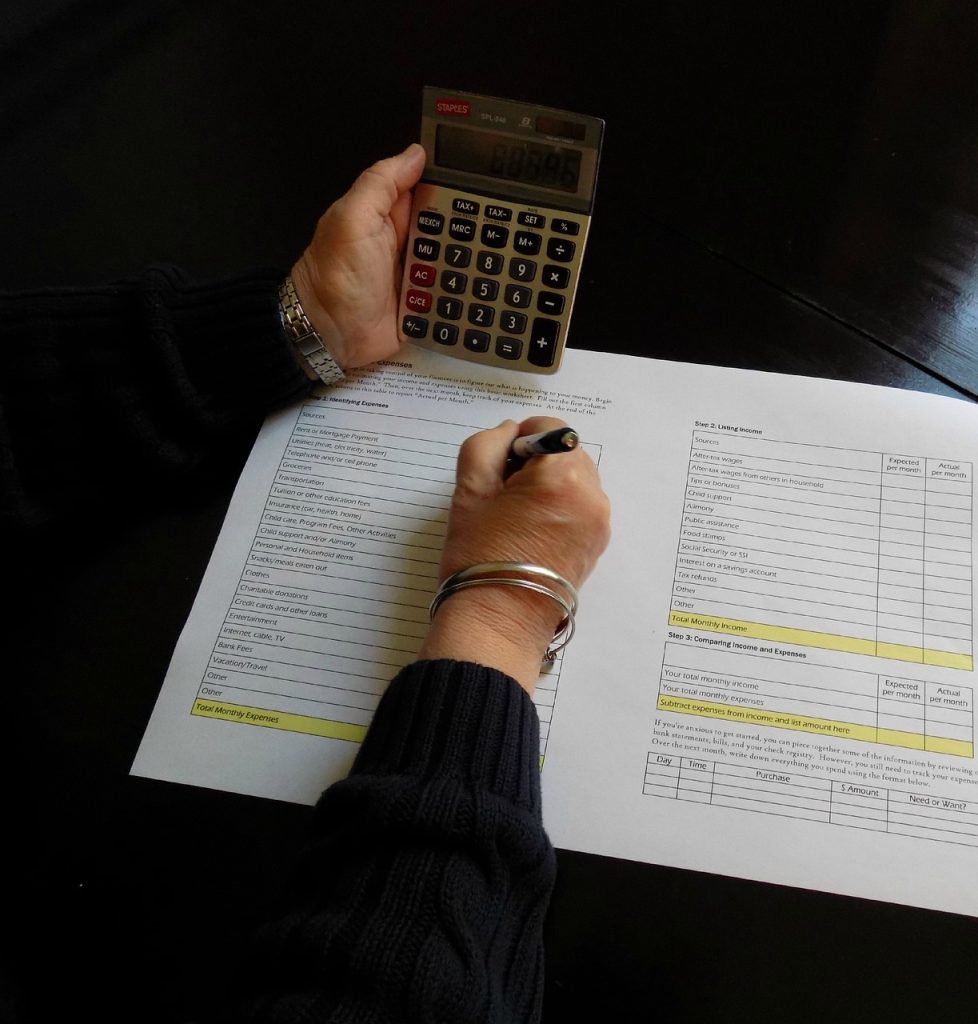

A budget is like a financial roadmap for your business. It helps you plan where you want to go, how to get there, and what resources you need along the way.

Let’s explore the ten main advantages of having a budget in simple terms.

Planning

What It Means:

A budget serves as a strategic plan that outlines your financial goals and the steps needed to achieve them.

It involves assessing your current financial situation, setting specific objectives, and determining how much money is required for various activities like hiring, marketing, and purchasing inventory.

Essentially, it’s about mapping out your financial future.

Why It Matters:

Planning is crucial because it provides direction and clarity. Without a plan, you may find yourself reacting to situations instead of proactively managing your resources.

For example, if you want to grow your business by 50%, having a detailed budget allows you to identify necessary investments, such as hiring additional staff or increasing inventory, ensuring that you are prepared to meet demand.

“Failing to plan is planning to fail.” – Alan Lakein

Control

What It Means:

A budget acts as a control mechanism that allows you to monitor your actual income and expenses against what you planned.

It provides benchmarks that help you evaluate whether you’re on track financially. If expenses exceed the budgeted amounts, it signals that corrective action may be needed.

Why It Matters:

Control is essential for maintaining financial health. By regularly comparing your actual performance against your budget, you can identify overspending or unexpected costs early on.

This proactive approach enables you to make adjustments before minor issues escalate into significant financial problems.

Example:

If you set a monthly budget of AED 5,000 for marketing and notice you’ve already spent AED 4,000 halfway through the month, this early warning allows you to reassess your spending strategy and avoid overshooting your budget.

Coordination

What It Means:

Budgeting facilitates coordination among different departments and teams within your organization.

It encourages collaboration by aligning everyone’s efforts toward common financial goals. Each department can see how their activities impact the overall budget and work together accordingly.

Why It Matters:

Effective coordination ensures that all parts of the business are working in harmony rather than in silos.

When teams understand how their budgets fit into the larger organizational goals, they can make more informed decisions about resource allocation and prioritization.

Example:

If your sales team plans to launch a new product, they’ll need support from marketing for promotions and from finance for budgeting resources.

A budgeting meeting brings everyone together to discuss how they can align their efforts toward this goal, ensuring that all departments are working in harmony.

“Teamwork is the ability to work together toward a common vision.” – Andrew Carnegie

Prioritization

What It Means:

A budget helps prioritize spending by distinguishing between essential and non-essential expenses.

This prioritization is crucial during times when cash flow is limited or when unexpected costs arise.

Why It Matters:

Knowing where to allocate funds ensures that critical areas of the business receive necessary resources first.

This strategic focus helps maintain operations even when funds are tight, allowing businesses to navigate challenges more effectively.

Example:

When funds are limited, managers can use the budget to decide where to allocate money first—whether it’s for employee training (essential) or upgrading office decor (non-essential).

By prioritizing essential expenses, businesses can ensure they are investing in areas that drive growth and productivity.

Forecasting

What It Means:

Budgeting aids in forecasting future financial performance by analyzing historical data and trends.

This process involves estimating future revenues and expenses based on past performance, market conditions, and business objectives.

Why It Matters:

Accurate forecasting helps businesses prepare for seasonal fluctuations or changes in market demand.

By anticipating future income and expenses, companies can make informed decisions about resource allocation and strategic planning.

Example:

If last year’s sales data shows that your business typically sees a spike during holiday seasons, your budget can reflect this trend by allocating more resources for inventory and marketing during those months.

This proactive approach helps ensure that you’re prepared for increased demand.

“Good forecasting is about looking at historical data and trends.” – Findout More

Decision-Making

What It Means:

A budget provides a framework for making informed decisions based on data rather than gut feelings.

During the budgeting process, businesses analyze past performance metrics and current market conditions to guide their choices.

Why It Matters:

Data-driven decision-making reduces risks associated with guesswork.

When decisions are based on solid financial data from the budgeting process, businesses are more likely to choose options that will lead to positive outcomes.

Example:

During the budgeting process, if analysis reveals that one product line isn’t selling well compared to others, management can decide to discontinue it instead of continuing to invest resources blindly.

This informed decision helps optimize resource allocation.

Accountability

What It Means:

A budget assigns specific responsibilities for expenses and revenue targets to various stakeholders within the organization.

Each department or team has its own budgetary limits that they must adhere to throughout the fiscal period.

Why It Matters:

Accountability fosters a culture of responsibility among employees.

When team members know they are responsible for staying within their budgets, they tend to be more mindful of their spending habits and performance metrics.

Example:

If the marketing department has a set budget of AED 10,000 for campaigns, the manager will be accountable for ensuring that they don’t exceed this amount.

This accountability encourages careful spending and fosters a culture of financial responsibility within the team.

“Accountability breeds response-ability.” – Stephen R. Covey

Performance Evaluation

What It Means:

Many companies use budgets as benchmarks for assessing team performance over time.

By comparing actual results against budgeted figures at regular intervals (monthly or quarterly), management can evaluate how well teams are meeting their financial targets.

Why It Matters:

Performance evaluations based on budgets provide insights into both individual and team contributions toward organizational goals.

This information can guide promotions, bonuses, or additional training needs based on performance gaps.

Example:

At the end of the year, if the sales team met their revenue target but went over their budget on expenses, management can discuss what worked well and what didn’t during performance reviews.

This evaluation can inform future budgeting decisions and help set realistic targets moving forward.

Risk Management

What It Means:

A budget helps identify potential financial risks by requiring businesses to look ahead at expected income and expenses over a defined period (usually annually).

This foresight allows companies to prepare for uncertainties in advance.

Why It Matters:

Being proactive about potential risks can save your business from financial pitfalls later on.

By identifying risks early through budgeting processes—such as rising costs or declining sales—you can create contingency plans or adjust strategies accordingly.

Example:

If your budget reveals that certain expenses (like rent or utilities) are likely to rise significantly in the coming months due to market trends or inflation forecasts, you can prepare by either adjusting other areas of spending or finding ways to reduce those costs before they become an issue.

“The greatest risk is not taking one.” – Anonymous

Investor Relations

What It Means:

A well-prepared budget demonstrates sound financial management practices to current or potential investors.

Investors want assurance that their money is being managed wisely; a clear budget shows them that you have a plan for growth and sustainability.

Why It Matters:

Building trust with investors is crucial for securing funding or maintaining support over time.

A transparent budgeting process indicates responsible stewardship of resources and strategic planning capabilities—qualities investors highly value when considering where to allocate their capital.

Example:

If you’re seeking investment for expansion, presenting a detailed budget outlining how funds will be used demonstrates professionalism and strategic thinking.

Investors are more likely to feel confident in backing a business that has clear financial goals and plans in place.

Conclusion

Creating and maintaining a budget is essential for any business aiming for success.

From planning and control to performance evaluation and risk management, the advantages of budgeting are numerous and far-reaching.

By implementing effective budgeting practices, small business owners can make informed decisions that lead to sustainable growth and profitability.

For expert assistance tailored specifically to your business needs in navigating these financial concepts and optimizing your operations for compliance and savings, Pro Tax Accountant provides the best services for small businesses!

By elaborating on each advantage with clear explanations and relatable examples, I hope this makes understanding budgeting even easier!

If there’s anything else you’d like me to add or clarify further, just let me know!