In the fast-paced business world of Dubai, staying ahead means more than just being innovative—it also means keeping your financial management efficient and accurate.

That’s where online accounting and bookkeeping services come in! It’s a game-changer for businesses looking to manage their finances without the hassle of paperwork.

If you’re tired of dealing with complicated spreadsheets, now is the time to explore how online accounting can make your life easier.

At Pro Tax Accountant, we are here to guide you through the benefits of online accounting and help answer any questions you may have.

Why Online Accounting and Bookkeeping Matter

Unmatched Convenience and Accessibility

Say goodbye to being stuck in the office with piles of documents. With virtual accounting, you can manage your finances from anywhere, at any time!

Cloud-based platforms let you access real-time financial data, work with your accountant remotely, and make quick decisions without needing to follow office hours.

Quick Tip: Pick a service provider like Pro Tax Accountant that offers a simple, easy-to-use platform with mobile access. That way, you can handle your finances even on the go!

Cost-Effective Solutions

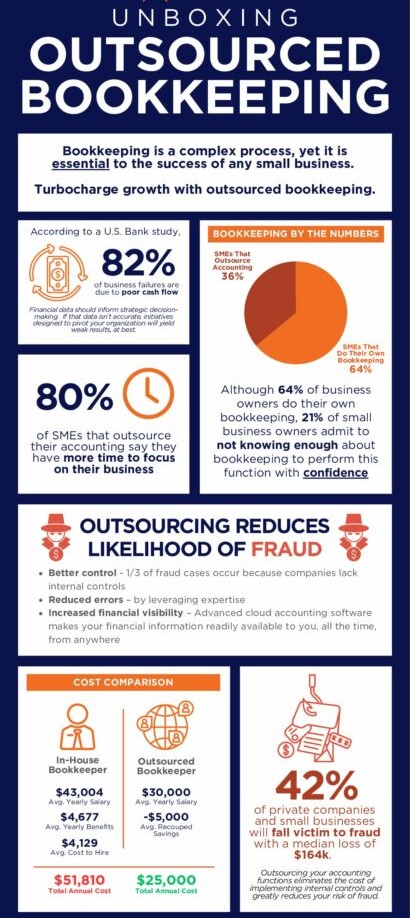

One of the biggest reasons businesses love online accounting is its cost-saving potential.

Traditional accounting usually means hiring staff, renting office space, and dealing with paperwork.

But with online accounting, you only pay for what you need—saving you a ton of money in the process!

Did You Know? Businesses can save up to 50% on accounting costs by switching to online services.

Enhanced Accuracy and Fewer Errors

Online accounting systems use automation to do tasks that are often done manually, like data entry and reconciliation.

This reduces the risk of mistakes, helping you keep your records accurate and up-to-date.

Fact: Automation can reduce manual errors by up to 90%. Learn more about how Pro Tax Accountant uses automation to keep your records in check.

Real-Time Financial Insights

With online accounting, you can get a clear picture of your financial situation instantly.

Track cash flow, monitor expenses, and see how well your business is doing—all in real time.

Pro Tip: Always review your financial dashboard regularly to keep tabs on your business performance.

Improved Security and Compliance

Worried about security? Online accounting services use encryption and other safety features to make sure your financial data is protected.

These services also help you comply with local laws and regulations, reducing the risk of penalties or fines.

Important: Check if your accounting provider meets international security standards. See how Pro Tax Accountant ensures your data is safe and compliant.

How Online Accounting Saves Time for Small Businesses

Switching to online accounting isn’t just about going paperless—it’s a massive time-saver that empowers small business owners to focus on what matters most: growing their business.

Automation Features that Save Time

Online accounting platforms come with powerful automation tools that eliminate many manual processes.

Here are some time-saving features:

Automated Invoicing:

Automatically generate and send invoices to clients, with options for recurring billing. This reduces the need to create and send invoices manually each month.

Expense Tracking and Categorization:

With linked bank accounts, your transactions are tracked in real-time.

The software can categorize expenses automatically, saving hours each week on bookkeeping.

Automatic Reconciliation:

Many online accounting tools automatically match transactions with invoices, making bank reconciliation a quick process that no longer needs hours of manual entry.

Real-Time Access and Collaboration

With online accounting, you don’t have to wait to meet your accountant or sift through documents to get updates.

You and your accountant can work on the same files at the same time, from anywhere, allowing instant updates and faster decision-making.

This accessibility not only saves time but also allows for better financial control and quicker responses to any issues that come up.

Freeing Up Time for Business Growth

Time is one of the most valuable resources for small businesses.

With online accounting, business owners and their teams can focus less on day-to-day financial tasks and more on strategic activities, such as:

Planning Marketing Campaigns:

With accounting tasks automated, small business owners can shift their focus to customer acquisition and other growth-driving activities.

Developing New Products or Services:

Freeing up time to think about product development can give your business a competitive edge.

Building Client Relationships:

With financial processes streamlined, business owners can spend more time nurturing client relationships, leading to better customer satisfaction and potential referrals.

The Role of Online Bookkeeping in Scaling Your Business

As small businesses grow, managing finances becomes increasingly complex.

Online bookkeeping services provide scalable solutions that help businesses handle growth without needing to expand their accounting teams.

Scalable Solutions Without Extra Hiring

Online bookkeeping services are designed to adapt to a business’s evolving needs.

Whether you’re just starting or rapidly expanding, these platforms can scale with you. Here’s how:

Cloud-Based Systems for Easy Scaling:

Since data is stored and managed in the cloud, scaling your bookkeeping setup doesn’t require extra servers, software, or physical space.

Add-On Features for Growing Needs:

As your business grows, you can add features like payroll management, inventory tracking, and expense reporting to your online bookkeeping service—without hiring additional staff.

Support for Multiple Users and Permissions:

Online bookkeeping platforms allow you to add team members with specific access levels.

For example, you could allow your accountant access to all areas, while granting limited access to other employees, without needing to manage multiple spreadsheets or paper files.

Reducing Operational Costs and Complexity

Hiring additional in-house accounting staff can be costly and time-consuming.

With “online accounting services for small business,” you can avoid the hiring process and additional payroll expenses by outsourcing accounting tasks to an online provider.

Improved Efficiency:

With online bookkeeping services, you can streamline finance operations without expanding your team, reducing overhead costs.

Focus on Core Business Activities:

Without the distraction of growing your accounting team, you can allocate resources to core activities that directly impact your business growth.

Common Mistakes in Traditional Accounting That Online Services Solve

Traditional accounting often relies on manual data entry, physical files, and disconnected systems.

This can lead to errors and inefficiencies that impact a business’s financial health.

Online accounting services, however, bring enhanced accuracy and simplicity to financial management.

Data Entry Errors

Manual data entry is prone to human error, such as entering incorrect amounts, mislabeling expenses, or duplicating records.

These errors can lead to inaccuracies in financial statements and even potential tax penalties. Online accounting services solve this issue by automating data entry processes.

Automated Transaction Syncing:

Many online platforms link directly to bank accounts and credit cards, automatically syncing transactions and reducing the need for manual entry.

Invoice and Payment Matching:

The software automatically matches payments with invoices, which reduces reconciliation errors and keeps records accurate.

Delays in Financial Reporting

In traditional accounting, generating financial reports can be time-consuming, as it involves consolidating data from multiple sources.

Online accounting services generate real-time reports, which means you can get updated financial insights instantly.

Real-Time Dashboards:

Online accounting software provides real-time dashboards showing cash flow, profit and loss, and other key metrics.

This enables better decision-making and avoids delays associated with paper-based reports.

Instant Access to Financial Health:

With on-demand reporting, business owners can spot potential financial issues sooner and take corrective action.

Security and Compliance Risks

Paper records and local storage are vulnerable to data breaches, loss, and non-compliance with modern data security regulations.

Online accounting services ensure enhanced security with robust encryption, secure cloud storage, and automatic backups.

Enhanced Security Standards:

Most online accounting services adhere to international security standards, including data encryption and multi-factor authentication, reducing the risk of unauthorized access.

Compliance with Local and International Regulations:

Online platforms are updated regularly to ensure compliance with the latest financial regulations, so your business remains in line with local laws and avoids penalties.

Enhanced Accuracy with Online Accounting Services

By solving these traditional accounting issues, online accounting services enhance accuracy, reduce error risks, and provide business owners with peace of mind.

This allows small businesses to manage their finances confidently and focus on scaling their operations.

How to Switch to Online Accounting Services

Switching to online accounting services can simplify your financial management, boost efficiency, and save time.

Here’s a step-by-step guide to make the transition seamless.

1. Evaluate Your Current Accounting Needs

Before choosing an online accounting platform, it’s crucial to understand what your business really needs.

Start by assessing your current accounting process and identifying gaps or inefficiencies.

- Review Current Tasks: List the tasks you perform regularly, such as invoicing, payroll, expense tracking, and financial reporting. This step ensures that you only choose necessary features on the platform.

- Identify Pain Points: Are there any specific areas where you encounter bottlenecks, such as manual data entry, time-consuming reconciliations, or delayed reporting?

- Set Goals: Decide what you want to achieve with online accounting—whether it’s reducing errors, improving accuracy, or gaining faster access to financial data. To understand more about the benefits of online accounting, visit Why Every Startup in Dubai Needs a Corporate Tax Accountant and Accounting Outsourcing in Dubai.

Quick Tip: Make a list of must-have features (like invoicing, real-time dashboards, or multi-user access) to guide your platform selection.

2. Choose the Right Online Accounting Platform

With your list of requirements in hand, you’re ready to evaluate different online accounting platforms. Each platform has its strengths, so compare options to find the best fit for your business.

- Consider Usability: Look for a user-friendly platform that’s easy to navigate, especially if you or your team are new to online accounting. Read more on Virtual Bookkeeping in the UAE to explore tools that streamline bookkeeping.

- Check Scalability: Select a platform that can grow with your business. Ensure it offers add-ons like payroll or inventory management if you need them in the future.

- Research Security and Compliance: Verify that the platform uses strong security measures like data encryption and complies with local regulations. Many platforms also offer data backups to prevent loss.

Pro Tip: Some popular online accounting services, like QuickBooks Online, Xero, and FreshBooks, offer free trials.

Testing the platform first can help you make an informed decision. For more on choosing the right online service, visit Best Online Bookkeeping Services.

3. Set Up Data Migration for a Smooth Transition

Migrating from traditional accounting to an online system requires careful planning to avoid data loss or errors.

Follow these steps for a smooth data migration:

- Back Up Your Current Data: Ensure all your current accounting data, spreadsheets, and financial records are securely backed up before transferring them.

- Organize Your Data: Review and clean up your records. Remove duplicates, correct any errors, and organize files to avoid confusion during the transfer. Consider tips from Month-End Closing Essentials for efficient data preparation.

- Use Built-in Migration Tools or Assistance: Many online accounting platforms offer data migration tools or customer support to help with the transition. Follow the migration process step-by-step to ensure everything is transferred correctly.

Important: Allow time for a data verification step post-migration to ensure accuracy. This helps identify any data discrepancies or errors early on.

4. Utilize Automation for Improved Accuracy

One of the biggest benefits of switching to “accounting services online” is the automation capabilities, which can save time and improve accuracy.

Make the most of these features to simplify daily accounting tasks:

- Automate Invoicing: Set up recurring invoices for clients to save time on billing each month. This feature also allows automated reminders, reducing the risk of late payments.

- Expense Tracking Automation: Link your bank accounts and credit cards to automatically import and categorize expenses, minimizing manual entry errors.

- Schedule Payroll Processing: Many online accounting platforms allow for automated payroll processing, ensuring timely and accurate payments to employees.

Did You Know? Automated accounting features can reduce human error by up to 90%, providing you with more accurate financial records and fewer headaches.

Learn more about how automation can save time and money at Affordable Virtual Bookkeeping Services.

5. Monitor Your Financial Data with Real-Time Dashboards

One of the most valuable aspects of online accounting is access to real-time financial data. Using a financial dashboard allows you to keep track of key metrics like cash flow, expenses, and revenue in an instant.

- Set Up Custom Dashboards: Customize your dashboard to display metrics that matter most to your business, such as sales, outstanding invoices, or profit and loss.

- Review Data Regularly: Schedule time to review your dashboard weekly or monthly. This allows you to spot trends, track your financial health, and make timely adjustments if necessary.

- Enable Notifications: Many online platforms let you set up alerts for specific events, like overdue invoices or low cash reserves, keeping you informed without manually checking each time.

Quick Tip: Encourage your accountant to monitor the dashboard and communicate regularly.

This allows you to make more informed, data-driven business decisions. For more on real-time tracking and accuracy, check out The Role of Accounting Services for Small Businesses in Dubai.

Transitioning to online accounting and bookkeeping services offers a range of benefits, from automation to real-time data access.

By following these steps, you can ensure a smooth and effective switch that helps your business save time, reduce costs, and improve financial accuracy. For more insights on cost-effective online accounting, see Online Accounting Services in the UAE.

If you’re ready to optimize your accounting process, now is the time to explore how online bookkeeping services can make your life easier.

With the right tools and approach, you’ll be well on your way to a more streamlined, efficient accounting experience.

FAQs About Online Accounting and Bookkeeping

What are the benefits of using online accounting services?

Online accounting offers benefits like increased convenience, reduced costs, better accuracy, real-time insights, and enhanced security.

It simplifies financial management so you can focus on growing your business.

How does online accounting compare to traditional methods?

It’s faster, more efficient, and accurate! No more paper records, fewer manual errors, and you get access to real-time data, which is often missing in traditional accounting.

Are online accounting services secure?

Yes! Good online accounting services use encryption and other security tools like multi-factor authentication to protect your data.

How much can I save by outsourcing my accounting online?

By outsourcing your accounting online, you can save up to 50% of what you’d spend on in-house accounting teams and infrastructure.

Can online accounting help with tax preparation?

Absolutely! Many online accounting services come with tax preparation features, making it easier to manage taxes, track deductions, and ensure compliance.

Conclusion

Switching to online accounting and bookkeeping is a smart move if you want to optimize your financial management.

It’s convenient, cost-effective, accurate, and secure—everything a business needs to succeed.

If you’re ready to take your business finances to the next level, Pro Tax Accountant is here to help.

Don’t miss out—contact us today to discover how we can streamline your accounting and bookkeeping services!