Introduction

In the intricate world of business in the United Arab Emirates (UAE), understanding the nuances of corporate tax is paramount.

Whether you’re a seasoned entrepreneur or a budding startup, grasping the intricacies of who falls under the purview of UAE corporate tax law can have significant implications for your financial health and operational strategy.

This article aims to unravel the complexities surrounding UAE corporate tax, shedding light on who is subject to taxation, who enjoys exemptions, and the coveted status of qualifying as a free zone person.

We’ll delve into each aspect to provide you with a comprehensive understanding.

Definition of a Taxable Person

In the UAE, a taxable person refers to any entity or individual that meets the criteria set forth by the tax authorities to be liable for corporate taxation.

This includes companies, partnerships, and other business structures engaged in commercial activities within the country.

Understanding the parameters that define a taxable entity is crucial for compliance and strategic financial planning.

Taxable Activities

Certain activities conducted by businesses in the UAE attract corporate tax obligations.

These activities may include but are not limited to, trading, manufacturing, and rendering services.

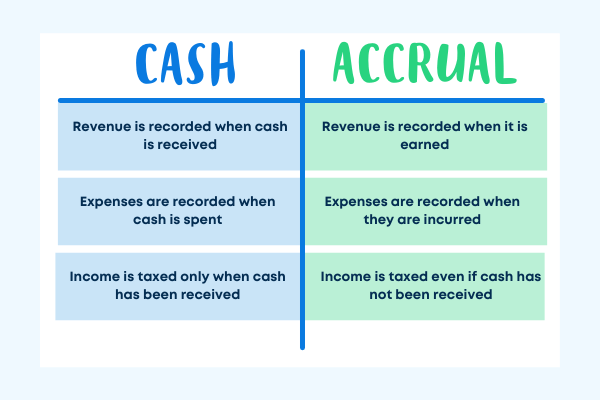

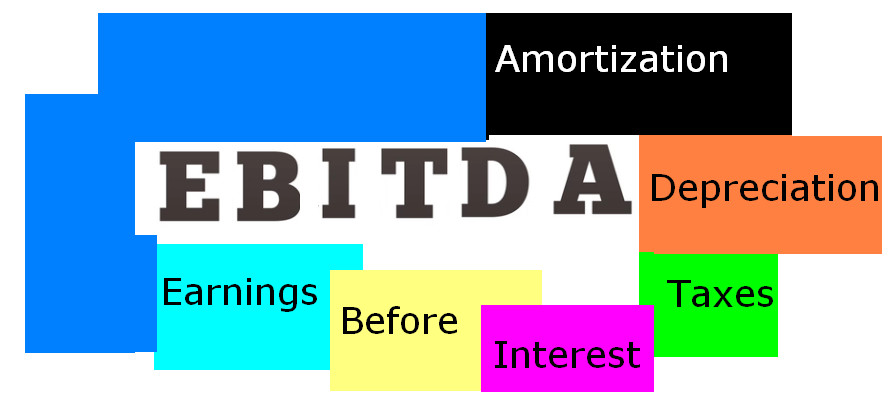

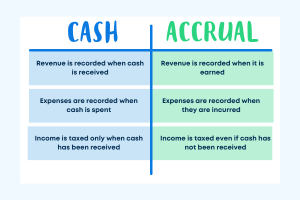

It’s essential for businesses to accurately determine their taxable income, taking into account revenue, expenses, and allowable deductions.

Navigating through the maze of regulations and guidelines governing taxable activities requires diligence and expertise.

Understanding Exempt Entities

While many entities are subject to corporate taxation in the UAE, there are exceptions. Exempt persons are those entities that are relieved from the obligation to pay corporate tax.

These may include certain government entities, charitable organizations, and entities engaged in specific sectors deemed vital for the country’s economic growth and development.

Exempted Activities

In addition to exempt entities, certain activities are also exempted from corporate tax liabilities.

These may include income derived from investments, dividends, and capital gains. Understanding the conditions for exemption and adhering to the relevant regulations are crucial to avoid potential penalties and ensure compliance with the law.

Qualifying as a Free Zone Person

Qualifying as a free zone person in the UAE offers distinct advantages in terms of tax incentives and operational flexibility.

Free zone entities enjoy benefits such as zero corporate tax, full repatriation of profits, and customs duty exemptions.

To qualify, entities must meet specific criteria established by the respective free zones, demonstrating their commitment to fostering economic growth and attracting foreign investment.

Advantages of Qualifying Free Zone Status

The advantages of qualifying as a free zone person extend beyond tax benefits. Free zone entities benefit from streamlined administrative processes, access to state-of-the-art infrastructure, and proximity to global markets.

By comparing the advantages with those of taxable and exempt entities, businesses can make informed decisions regarding their operational structure and strategic objectives.

Pro Tax Accountant’s Services

Navigating the intricacies of UAE corporate tax law requires expertise and guidance. Pro Tax Accountant offers specialized services tailored to meet the diverse needs of businesses operating in the UAE.

Our team of experienced professionals provides comprehensive support in corporate tax planning, compliance, and optimization.

With a deep understanding of local regulations and global best practices, we empower businesses to navigate the complexities of UAE corporate tax with confidence.

Conclusion

In conclusion, understanding who is subject to UAE corporate tax is crucial for businesses operating in the region.

From taxable entities to exempt persons and qualifying free zone entities, each category carries its implications and considerations.

By partnering with Pro Tax Accountant, businesses can access the expertise and support needed to navigate UAE corporate tax regulations seamlessly.

Contact us today to learn more about how we can assist you in optimizing your tax strategy and achieving your business objectives.

What are the penalties for non-compliance with UAE corporate tax regulations?

Find out about UAE corporate tax penalties here.