Amending your corporate tax registration is not only essential for compliance with UAE tax laws but also ensures that your business avoids fines and penalties.

If you’ve registered for corporate tax on the EmaraTax portal and realized you need to amend your details, don’t worry—you’re not alone.

Mistakes happen, businesses evolve, and sometimes updates are simply necessary.

In this comprehensive guide, we’ll walk you through the exact steps to amend your corporate tax registration on the EmaraTax portal.

We’ll also answer frequently asked questions, provide valuable tips, and explain why staying updated on your corporate tax records is crucial.

Why Amending Corporate Tax Registration is Important

Accurate registration details are vital to ensure seamless communication with the Federal Tax Authority (FTA). Incorrect or outdated information could result in:

- Penalties for non-compliance.

- Disruptions in tax filings and refunds.

- Misaligned tax obligations affecting your business operations.

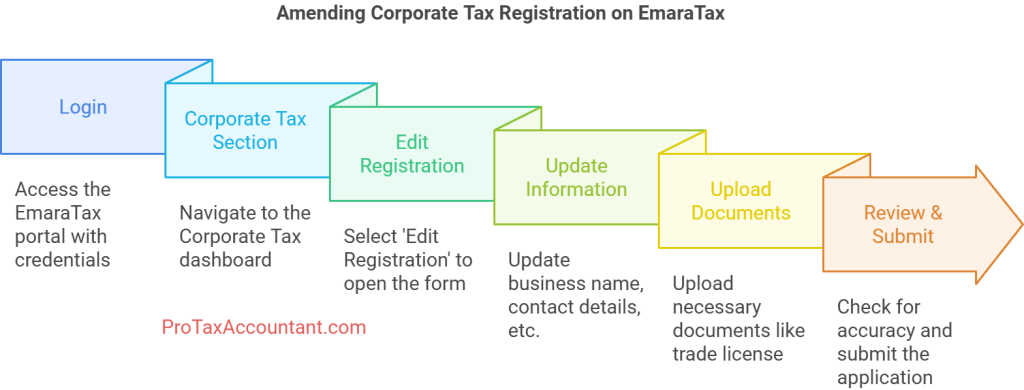

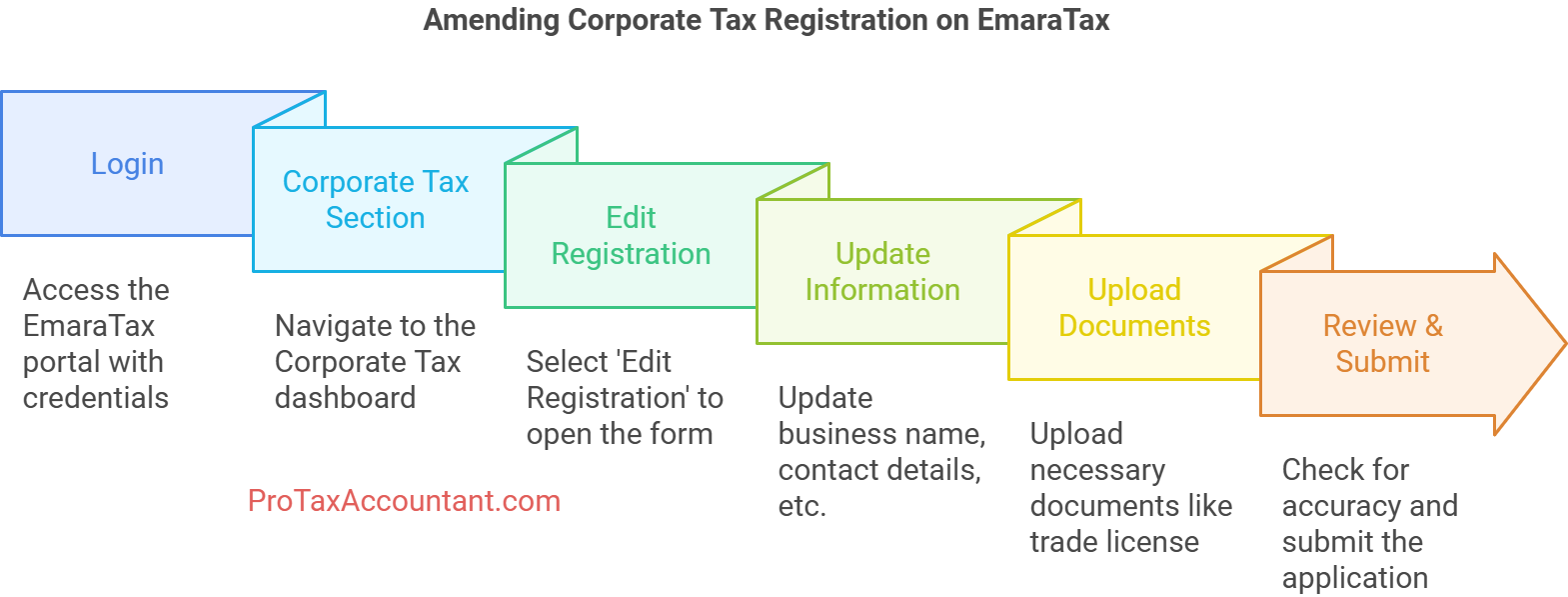

Steps to Amend Corporate Tax Registration on the EmaraTax Portal

Log in to the EmaraTax Portal

Visit the EmaraTax portal and log in using your credentials. Ensure you have your username and password handy.

Access the Corporate Tax Section

Once logged in, navigate to the Corporate Tax section on your dashboard. This is where all your corporate tax-related details are stored.

Select ‘Edit Registration’

Under the corporate tax menu, find and click the ‘Edit Registration’ option. This will open the amendment form, allowing you to make changes to your existing records.

Update Required Information

Carefully review your current details and update the necessary fields. Common amendments include:

- Business name or trade license changes.

- Contact information updates (email, phone number).

- Address modifications.

- Changes in business activity or ownership structure.

Upload Supporting Documents

If the amendment requires verification, upload the necessary documents. For example:

- Trade license copies for business name changes.

- Utility bills or tenancy contracts for address updates.

Ensure that all documents are clear and meet the FTA’s requirements.

Review and Submit

Double-check the information you’ve updated to avoid errors. Once satisfied, click ‘Submit’ to send your amendment request to the FTA for approval.

Track Your Application Status

After submission, monitor the status of your amendment request on the portal. You will receive notifications regarding the progress or if additional information is required.

Frequently Asked Questions About Amending Corporate Tax Registration

How long does it take to process an amendment request?

Processing times vary depending on the nature of the amendment. Simple changes like contact information updates may be approved within a few days, while more complex amendments could take longer.

Is there a fee for amending corporate tax registration?

Currently, there is no fee for amending your registration details on the EmaraTax portal.

What documents are required for amendments?

The documents depend on the type of change. Common requirements include:

- Trade license copies for business name changes.

- Updated memorandum of association for ownership changes.

- Proof of address for location updates.

Can I amend my corporate tax registration multiple times?

Yes, you can make amendments as needed. However, ensure the changes are legitimate and supported by accurate documentation to avoid delays or rejections.

What happens if my amendment request is rejected?

If your request is denied, the FTA will provide reasons for rejection. Address the issues highlighted and reapply.

Tips for a Smooth Amendment Process

- Keep Documents Handy: Organize all required documents before starting the amendment process to avoid delays.

- Double-Check Details: Minor errors can result in rejected applications. Ensure all information is accurate.

- Maintain Updated Records: Regularly review your corporate tax registration to ensure it reflects the latest business details.

- Seek Professional Help: If you’re unsure about the process, consult a tax advisor to guide you.

The Impact of Accurate Corporate Tax Records

Keeping your corporate tax registration up to date is not just a legal requirement—it’s also good business practice. Accurate records:

- Enhance credibility: Showcase your commitment to compliance.

- Prevent penalties: Avoid hefty fines for outdated or incorrect information.

- Streamline processes: Ensure smooth communication with the FTA for filings, refunds, and audits.

Why Use the EmaraTax Portal?

The EmaraTax portal is designed to simplify tax management for businesses in the UAE. Its user-friendly interface and automated processes make it easy to:

- Register and manage taxes.

- File returns efficiently.

- Track applications in real time.

Whether you’re updating contact details or making significant changes to your registration, the EmaraTax portal ensures a hassle-free experience.

Common Mistakes to Avoid During Amendments

- Skipping Document Uploads: Ensure you provide all required documents for the changes you’re making. Missing files can delay approval.

- Entering Incorrect Information: Double-check every field before submitting to avoid rejection.

- Ignoring Notifications: Stay alert for any messages from the FTA regarding your application status or required corrections.

Conclusion

Amending your corporate tax registration on the EmaraTax portal is a straightforward process, but attention to detail is key.

By following the steps outlined in this guide, you can ensure your business stays compliant and avoids unnecessary penalties.

Accurate and up-to-date tax records not only reflect your commitment to UAE tax laws but also streamline operations and build trust with stakeholders.

If you’re looking for professional assistance in managing corporate tax compliance, ProTaxAccountant is here to help. Our experienced team ensures a seamless amendment process, so you can focus on growing your business.

Share this blog with your network to help other UAE businesses navigate corporate tax amendments effortlessly!