Navigating VAT return filing in the UAE is essential for businesses to stay compliant with Federal Tax Authority (FTA) regulations. While the process may seem daunting, our guide simplifies VAT submission in the UAE to help you avoid penalties and ensure accuracy.

Whether you’re a small business owner or managing a large enterprise, our expert tips will make filing VAT returns in the UAE hassle-free.

Let’s walk you through everything you need to know—from understanding deadlines to filing online—and make the process hassle-free!

What is a VAT Return, and Why Is It Important?

A VAT return is a document submitted to the FTA detailing your VAT-registered business’s taxable supplies, output VAT (VAT collected), and input VAT (VAT paid).

Key Points to Remember:

- VAT returns must be filed quarterly or monthly, depending on your business type.

- Late VAT filing in the UAE or incorrect returns can result in hefty penalties ranging from AED 1,000 to AED 10,000.

- Maintain organized records using VAT-compliant accounting software.

Step-by-Step Guide to Filing VAT Return in UAE

1. Log into the FTA Portal

Visit the official FTA e-Services portal. Use your registered email and password to access your account.

Pro Tip: Ensure your account details are up to date. Changes in business information must be reported to the FTA.

2. Access the VAT 201 Form

Once logged in, navigate to the “VAT Return” section and select the VAT 201 form. This is the official form for filing VAT returns in the UAE.

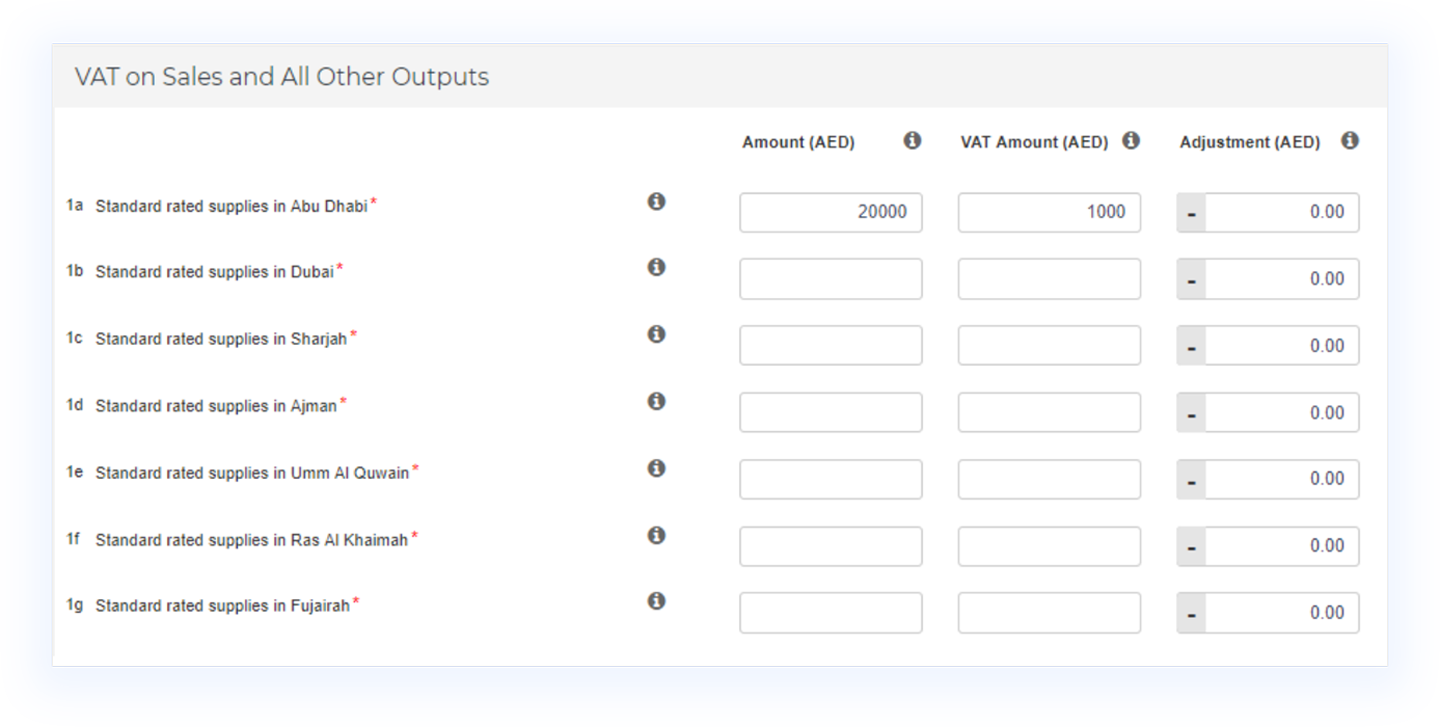

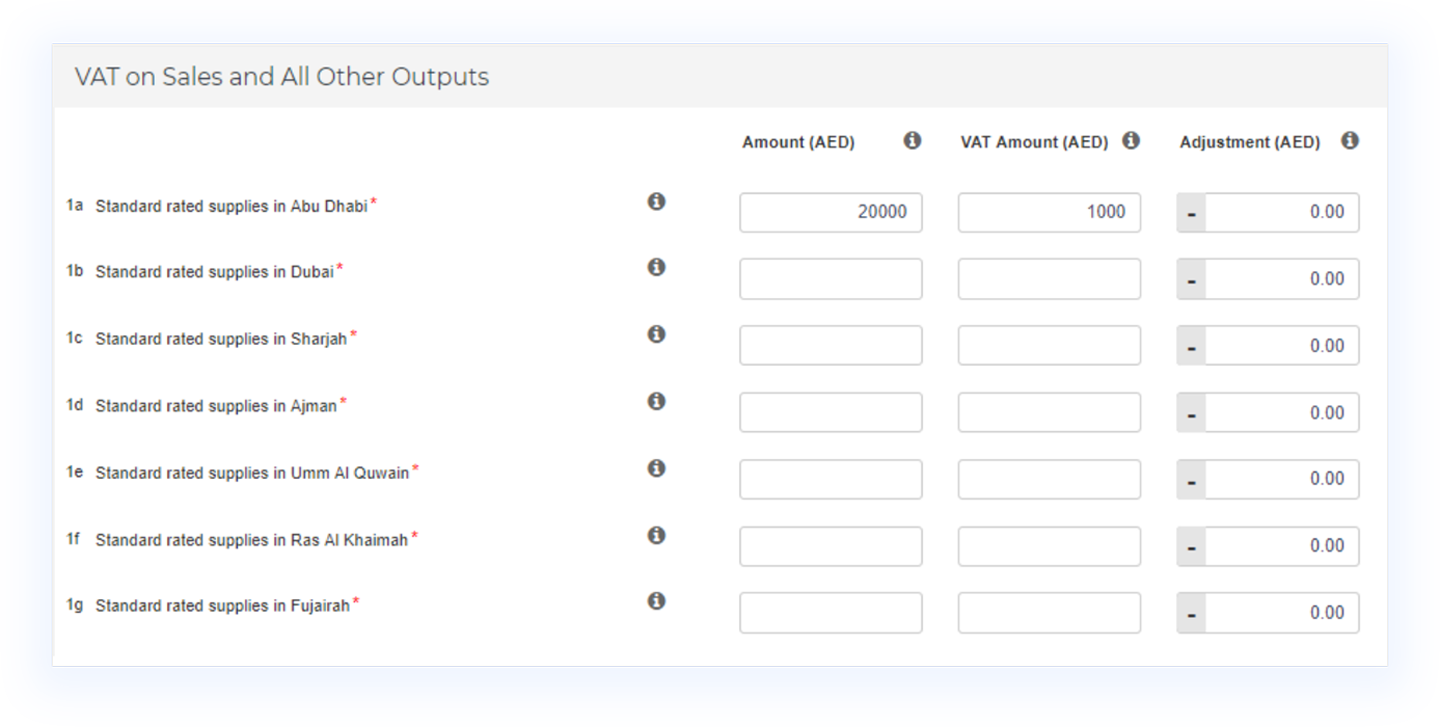

Key Fields in the VAT 201 Form:

- Taxable Supplies: Record your sales and calculate the VAT amount collected.

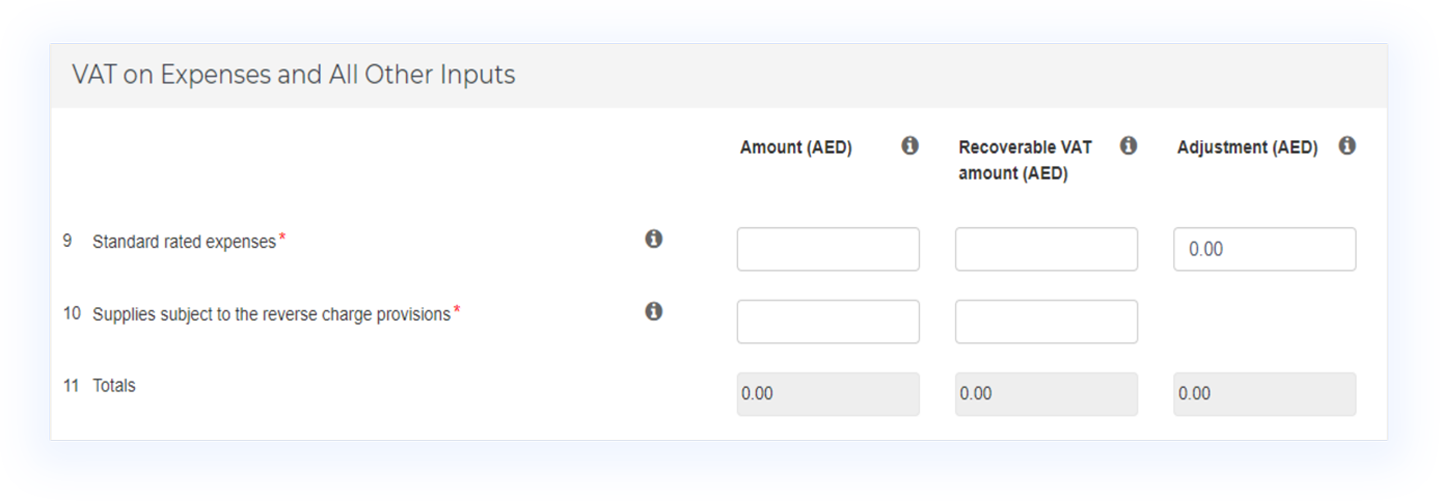

- Input VAT: Enter the VAT amount paid on purchases.

- Adjustments: Include any corrections or exemptions.

3. Calculate Output and Input VAT

Output VAT:

This is the VAT you collect from your customers on taxable supplies.

Example Calculation:

If your sales for the quarter are AED 100,000, the output VAT at 5% is AED 5,000.

Input VAT:

This is the VAT you’ve paid to your suppliers.

Example Calculation:

If your purchases are AED 50,000, the input VAT at 5% is AED 2,500.

Net VAT Payable/Refundable:

Net VAT = Output VAT – Input VAT

In this case: AED 5,000 – AED 2,500 = AED 2,500 payable to the FTA.

4. Review the Form for Accuracy

Double-check every entry before submission. Mistakes can lead to penalties or delays.

Common Errors to Avoid:

- Incorrect taxable supply values.

- Forgetting to include zero-rated or exempt supplies.

- Ignoring currency conversion for international transactions.

Struggling with calculations? Explore our VAT accounting services for small businesses.

5. Submit Your VAT Return

Once satisfied, click “Submit.” You’ll receive a confirmation email from the FTA with your VAT return reference number.

Late submission? Avoid penalties with our VAT deregistration guide.

6. Make the Payment

Pay any VAT due using one of these methods:

- E-Dirham Card

- Bank Transfer (GIBAN)

Tip: Retain proof of payment for your records.

FAQs

1. When is the VAT return filing deadline?

VAT returns are typically due on the 28th day of the month following the end of the tax period.

2. What happens if I file late?

The FTA imposes a late submission penalty of AED 1,000 for the first offense and AED 2,000 for subsequent offenses within 24 months.

3. Are there any VAT exemptions in UAE?

Yes, certain goods and services are zero-rated or exempt, such as education, healthcare, and residential property.

4. Can I amend a filed VAT return?

Yes, but amendments must be made within 20 business days. Use the “Voluntary Disclosure” form available on the FTA portal.

5. Do I need an authorized tax agent?

While not mandatory, hiring a VAT consultant in Dubai minimizes errors.

Valuable Insights for Businesses

Stay Organized

Maintain digital and physical records of all taxable transactions, invoices, and receipts. This simplifies VAT calculations.

Utilize Accounting Software

Use VAT-compliant software to automate calculations and reduce manual errors. Popular options include QuickBooks, Zoho Books, and Tally ERP.

Regular Training

Ensure your finance team is up to date with the latest FTA regulations through regular training sessions.

Conclusion

Filing VAT returns in the UAE doesn’t have to be a stressful task. With proper planning, accurate records, and the steps outlined in this guide, you can file seamlessly and stay compliant.

Avoid penalties, maintain your reputation, and focus on growing your business.

Remember, staying informed and proactive is the key to mastering VAT compliance. Start implementing these steps today, and watch your VAT filing become a breeze!

Contact us for affordable, error-free VAT return filing services in Dubai..