How to Build a Compliant Accounting Department for UAE Contractors

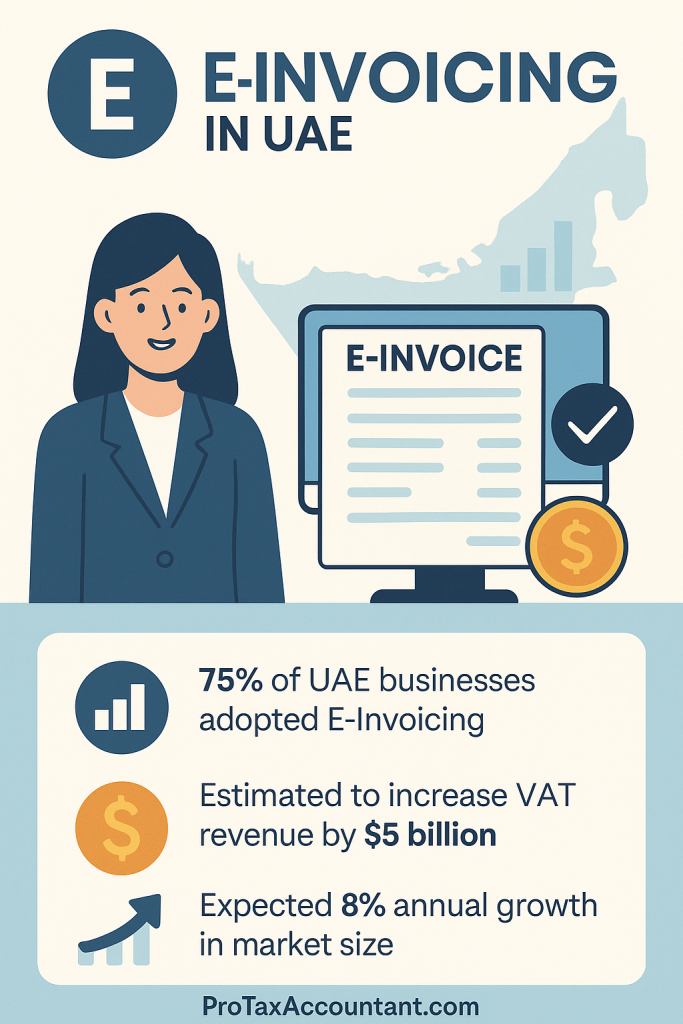

Finance Guide Accounting for UAE Contractors:FTA-Compliant Finance Function Blueprint A field-tested blueprint for contractors in the UAE to design a finance function that’s audit-ready, FTA-compliant, and built for margin protection. Updated Feb 2026 12 min read 5% of UAE GDP from construction 3.5% projected annual sector growth 72% contractors flag VAT pain points 9% UAE […]

How to Build a Compliant Accounting Department for UAE Contractors Read More »