Introduction

In the world of corporate finance, recapitalization stands out as a vital strategy for businesses seeking financial stability, growth, or restructuring.

Whether you’re an entrepreneur, a CFO, or a curious reader, understanding recapitalization can provide key insights into how companies adapt to financial challenges.

But what does recapitalization really mean, and why is it so significant? Let’s dive into this topic to uncover everything you need to know.

What is Recapitalization?

Recapitalization is a corporate strategy that involves restructuring a company’s capital structure by altering its debt-to-equity ratio.

This adjustment could mean issuing more equity, taking on additional debt, or replacing one with the other.

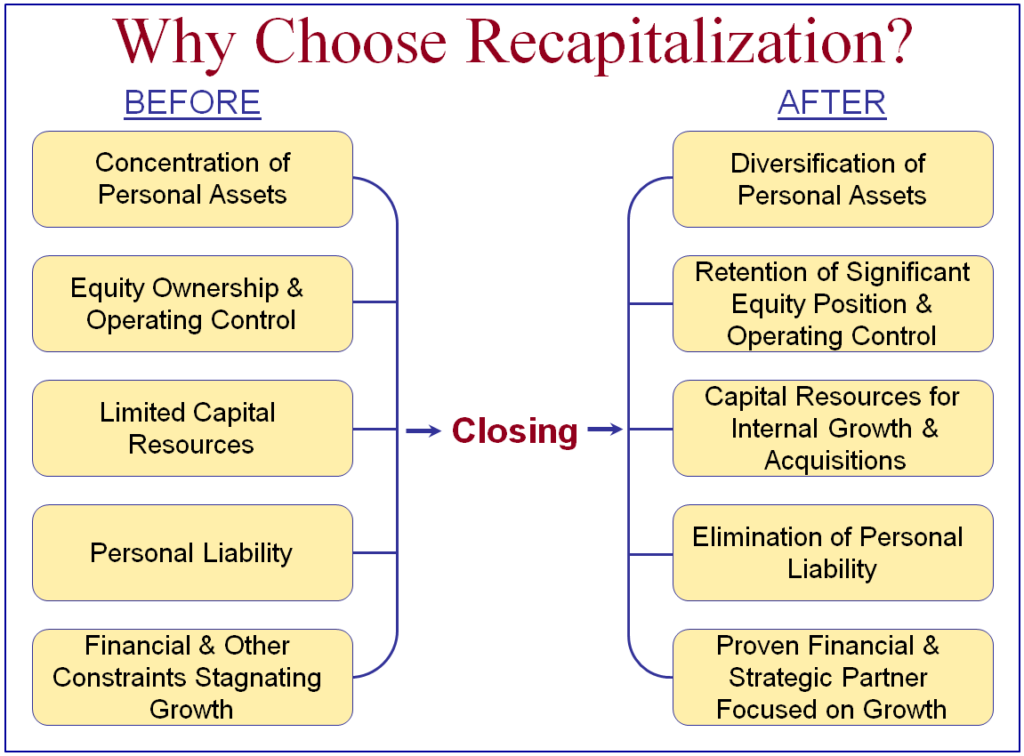

Businesses pursue recapitalization for several reasons, including mitigating financial risks, enhancing shareholder value, or positioning the company for growth.

Frequently Asked Questions About Recapitalization

1. Why do companies opt for recapitalization?

Companies use recapitalization to address financial instability, reduce debt burdens, or fund expansion plans. It’s also a common tactic during economic downturns or when facing hostile takeovers.

2. Is recapitalization always about debt and equity?

Primarily, yes. However, it can also involve hybrid financial instruments like convertible bonds that blend debt and equity characteristics.

Types of Recapitalization

Equity Recapitalization

This involves issuing new shares to raise capital. Companies often choose this method when they want to reduce debt levels or fund major projects without taking on new loans.

Debt Recapitalization

Debt recapitalization occurs when a company takes on additional debt to buy back shares or pay off existing liabilities. It’s ideal for businesses that can leverage favorable interest rates.

Leveraged Recapitalization

This is a strategy where companies take on significant debt to pay dividends to shareholders or buy back equity. It’s popular among private equity firms aiming for maximum returns.

Distressed Recapitalization

This approach is for businesses facing severe financial issues. It often involves negotiating with creditors and equity holders to restructure debt and maintain operations.

How Recapitalization Works

Let’s break it down with a simple example:

A company has a $500,000 capital structure, consisting of $300,000 in debt and $200,000 in equity.

After recapitalization, it may shift to $250,000 in debt and $250,000 in equity, reducing its interest obligations and improving financial flexibility.

Pros and Cons of Recapitalization

Advantages

-

- Stabilizes Finances: Helps companies reduce debt burdens or strengthen their equity position.

-

- Enhances Shareholder Value: By restructuring, companies can make themselves more attractive to investors.

-

- Supports Growth: Provides funds for expansion, acquisitions, or new projects.

Disadvantages

-

- Costly Process: The restructuring can incur significant fees.

-

- Risk of Dilution: Issuing more equity may dilute existing shareholder value.

-

- Increased Debt Risks: Leveraging debt can lead to repayment challenges if cash flow diminishes.

Recapitalization vs. Restructuring

Although these terms are often used interchangeably, they are not the same. Restructuring involves comprehensive changes to the company’s operations, management, and finances, whereas recapitalization focuses solely on altering the capital structure.

Comparison Table:

| Aspect | Recapitalization | Restructuring |

|---|---|---|

| Definition | Adjusting a company’s debt-to-equity ratio to stabilize or grow. | Comprehensive reorganization of a company’s operations, finances, or management. |

| Focus Area | Capital structure (debt and equity). | Overall business structure, including finances, management, and operations. |

| Purpose | Improve financial stability, reduce risk, or fund expansion. | Address financial distress, improve efficiency, or adapt to market changes. |

| Timing | Often proactive or during moderate financial challenges. | Typically reactive, during severe financial or operational difficulties. |

| Examples of Actions | Issuing equity, taking on debt, or using convertible instruments. | Selling assets, merging, layoffs, renegotiating debt, or management changes. |

| Impact on Ownership | May dilute existing shareholders (in case of equity issuance). | Can result in changes in ownership or management structure. |

| Legal Involvement | Limited legal requirements. | Often involves legal processes, especially in cases like bankruptcy. |

| Risk Level | Moderate risk; depends on debt-to-equity adjustments. | High risk; may involve drastic measures to save the business. |

| Common Use Cases | Growth opportunities, managing debt, or fending off takeovers. | Insolvency, bankruptcy, or severe operational inefficiencies. |

| Long-Term Impact | Positions the company for growth and financial health. | Provides a fresh start but may involve significant business downsizing. |

The table highlights how recapitalization and restructuring differ in focus, purpose, and application, offering businesses distinct tools depending on their financial and operational needs.

Check out my guide on financial variance analysis.

When is Recapitalization Necessary?

-

- Economic Downturns: Companies recapitalize to weather financial instability.

-

- Hostile Takeovers: Recapitalization can help fend off unwanted acquisitions.

-

- Growth Opportunities: It supports expansion without over-reliance on one type of capital.

Learn which accounting method suits you in in our guide to cash vs. accrual accounting.

Key Statistics

-

- Private Equity Role: Private equity firms accounted for 40% of leveraged recapitalizations in 2022.

-

- Survival Rates: Companies that undergo distressed recapitalization have a 70% survival rate over five years.

Real-Life Examples

Tesla’s Convertible Bonds

Tesla issued convertible bonds, blending debt and equity, to fund its ambitious projects. This recapitalization strategy allowed it to secure financing without diluting existing shareholder value immediately.

General Motors Bailout

During the 2008 financial crisis, GM underwent a government-aided recapitalization. The strategy involved debt restructuring and equity issuance, allowing the company to recover.

Tips for Businesses Considering Recapitalization

-

- Evaluate Financial Health: Analyze your debt-to-equity ratio and cash flow.

-

- Consult Experts: Work with financial advisors to weigh the pros and cons.

-

- Monitor Market Conditions: Timing is crucial for maximizing benefits.

Conclusion

Recapitalization is more than just a financial buzzword; it’s a strategic tool that can redefine a company’s future. Whether aimed at reducing debt, funding growth, or stabilizing finances, recapitalization offers flexible solutions for businesses at various stages.

However, it’s essential to evaluate the process thoroughly and consult experts to ensure the strategy aligns with long-term goals.

For expert financial advice, explore our online accounting services.