Ever wonder how to evaluate a company’s true operational performance? EBITDA is the answer.

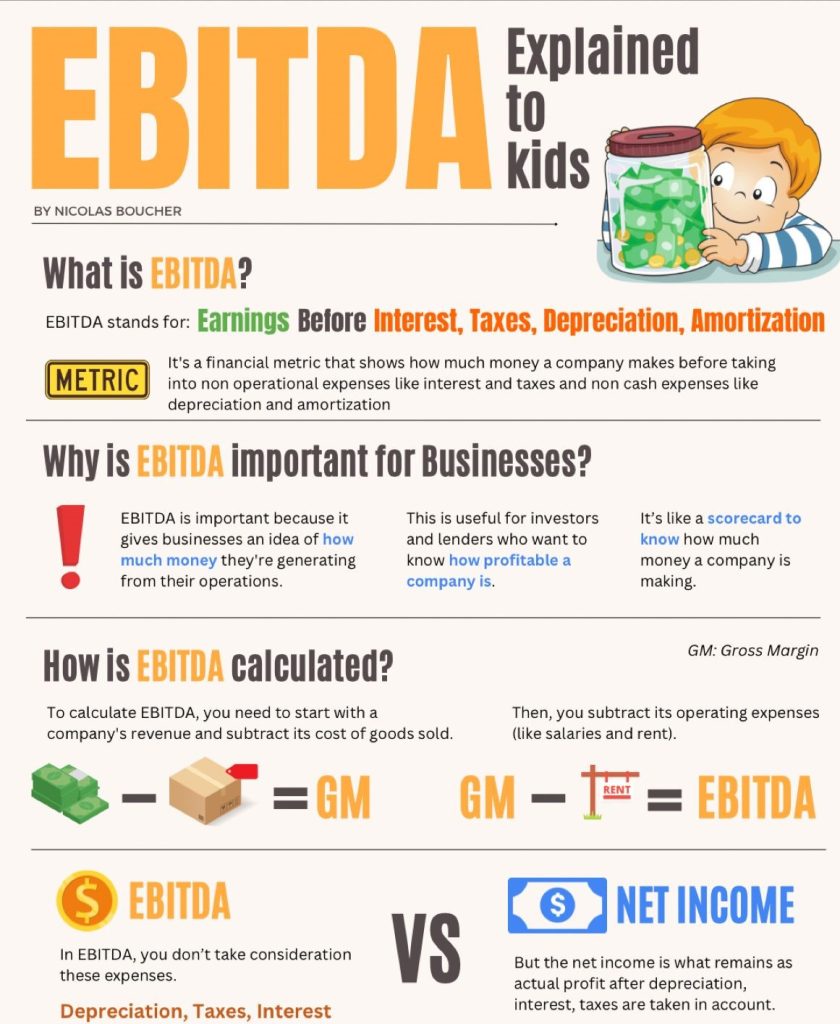

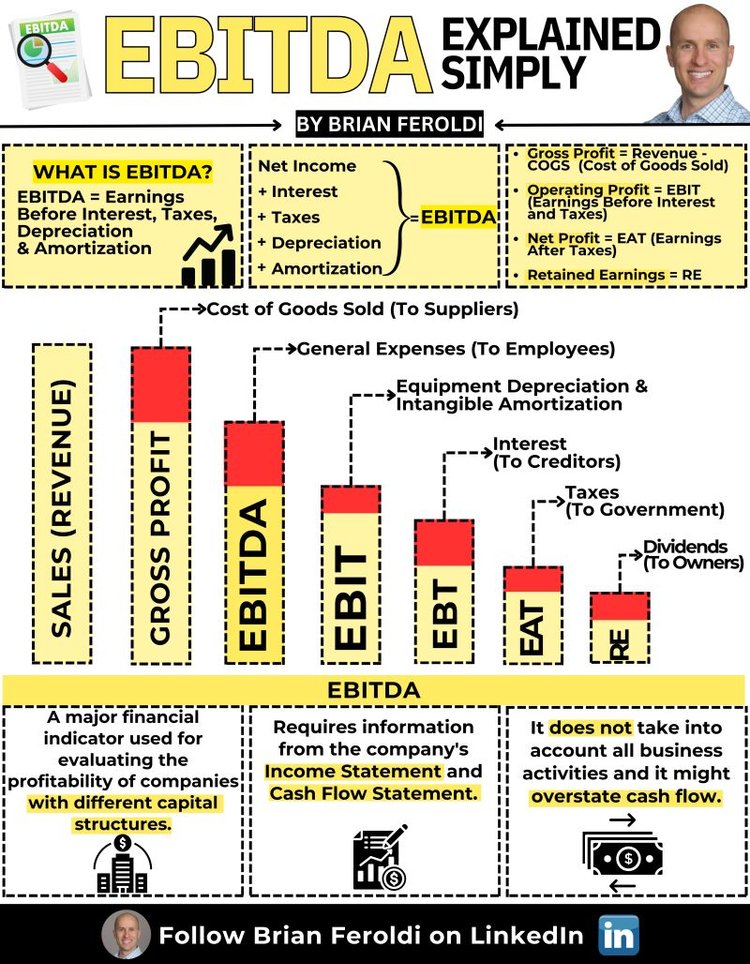

It stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

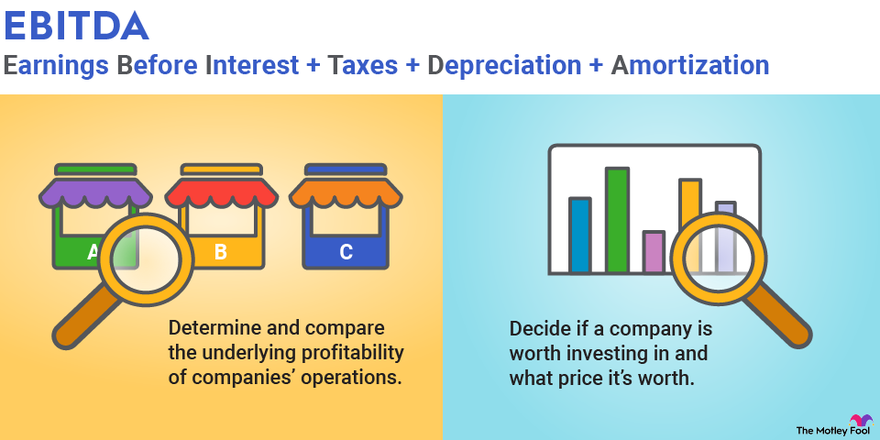

This financial metric is widely used by investors, analysts, and business owners to assess a company’s profitability and operational efficiency without the noise created by financing and accounting decisions.

In this blog, we’ll break down what EBITDA is, why it’s important, how to calculate it, and its pros and cons. We’ll also provide examples to illustrate its application in real-world scenarios.

What is EBITDA?

EBITDA strips away non-operational expenses to focus purely on core operations.

This allows for a cleaner comparison between companies and industries.

By excluding interest, taxes, depreciation, and amortization, EBITDA provides a clearer picture of operational performance.

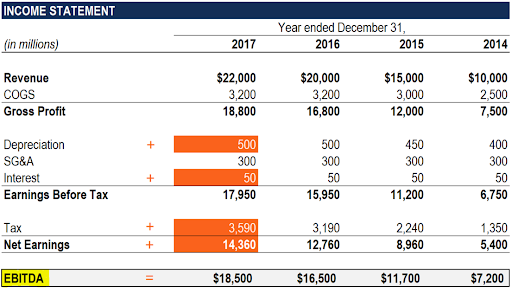

Formula for Calculating EBITDA

There are two common formulas to calculate EBITDA:

Using Operating Income:

EBITDA=Operating Income+Depreciation+Amortization

Using Net Income:

EBITDA=Net Income+Interest+Taxes+Depreciation+Amortization

Example Calculation of EBITDA

Let’s say we have a fictional company called Tech Innovations Inc. Here are some key figures from their income statement:

- Net Income: AED 200,000

- Interest Expense: AED 10,000

- Tax Expense: AED 30,000

- Depreciation Expense: AED 20,000

- Amortization Expense: AED 5,000

Using the second formula:

EBITDA=200,000+10,000+30,000+20,000+5,000

EBITDA=265,000

This means Tech Innovations Inc. has an EBITDA of 265,000.

Key Benefits of Using EBITDA

Highlights Operational Efficiency:

EBITDA focuses solely on operational performance by excluding non-operational costs like interest and taxes. This makes it easier to assess how well a company is generating profit from its core business activities.

Facilitates Comparisons:

Because it removes the effects of financing and accounting decisions, EBITDA allows for better comparisons between companies of different sizes or within different industries.

For example, comparing two tech companies with vastly different capital structures becomes easier.

Valuation Tool:

Investors often use EBITDA as a valuation metric in investment analysis.

It can be used in multiples (like EV/EBITDA) to assess whether a company is overvalued or undervalued compared to peers.

Focus on Cash Flow Potential:

Since EBITDA provides insights into earnings before accounting deductions like depreciation and amortization, it can serve as a proxy for cash flow from operations.

“EBITDA is often considered a more accurate reflection of a company’s profitability than net income.” – Investopedia

Limitations of EBITDA

While EBITDA is a useful metric, it has its limitations:

Ignores Capital Expenditures (CapEx):

EBITDA does not account for capital expenditures necessary for maintaining or growing the business. This can be critical in asset-heavy industries like manufacturing or utilities where significant investments are required.

Doesn’t Reflect Changes in Working Capital:

Changes in working capital—like inventory levels or accounts receivable—are not reflected in EBITDA calculations. This can lead to an incomplete picture of cash flow health.

May Mislead Investors:

Relying solely on EBITDA can be misleading if used without context. For example, a company may have high EBITDA but could be facing liquidity issues due to high debt levels or poor cash management.

Not GAAP Compliant:

While useful for internal analysis and comparisons, EBITDA is not recognized by Generally Accepted Accounting Principles (GAAP), which means it may not be suitable for all financial reporting purposes.

“While EBITDA provides valuable insights into operational performance, it should be used alongside other metrics for a complete financial picture.” – Harvard Business Review

Conclusion

EBITDA is a powerful tool for evaluating a company’s operational performance by focusing on earnings generated from core business activities while ignoring non-operational factors like interest and taxes.

By calculating and analyzing EBITDA alongside other financial metrics, businesses can gain valuable insights into their efficiency and profitability.

How Pro Tax Accountant Can Help

At Pro Tax Accountant, we specialize in helping small businesses navigate their financial reporting needs.

Whether you need assistance calculating EBITDA or understanding how to use this metric effectively in your business strategy, our experienced team is here to help you make informed decisions that drive growth.

For more information on managing your finances effectively or if you have questions about accounting practices in your industry, feel free to reach out!