UAE Business Setup Guide (2026 Update)

A practical, scan-friendly guide for entrepreneurs and SMEs starting and operating in the UAE — updated for 2026 with VAT, Corporate Tax governance, compliance priorities, and E-Invoicing readiness.

Helpful services: bookkeeping, VAT support, Corporate Tax resources.

Chapter 1 — UAE: An Overview (2026)

The UAE is still one of the fastest and most structured places to build an SME — but in 2026, the winners are those who treat bookkeeping, documentation, and compliance as a system from day one.

A. A thriving economy (what changes in 2026)

2026 focuses more on “operational discipline”: clean invoices, reconciled bank trails, and verifiable documentation. If you want monthly reporting + bookkeeping support, start with UAE bookkeeping experts.

B. The importance of SMEs

SMEs grow faster when their finance stack is stable: budgeting, monthly closes, and cash-flow forecasting. If you need a low-overhead setup, explore online accounting & bookkeeping.

C. How the UAE supports SMEs

The UAE offers strong infrastructure and ecosystems. Your best advantage is choosing a structure that matches your customers, invoicing model, and tax profile. For Free Zone context, see Designated Free Zones.

D. Doing business basics (2026 expectation)

Treat compliance as monthly habits: keep tax invoices, contracts, bank reconciliations, and a clear expense policy. For VAT references and procedures, use the FTA portal: tax.gov.ae.

E. Regional access

The UAE is a regional HQ for many sectors. If you sell online or cross-border, reconcile payment gateways and evidence properly. Example: e-commerce bookkeeping.

F. Investor incentives

Incentives vary by activity and authority. 2026 approach: pick based on operations + documentation needs + future funding. If you operate across emirates, explore local accounting pages like Abu Dhabi and Sharjah.

G. Common SME challenges (and how to solve them)

Most problems come from weak bookkeeping and missing documents. Fix it with monthly closes and checklists. Need a partner? Contact Pro Tax Accountant.

Chapter 2 — Starting Your Business in the UAE (2026)

Start correctly so you don’t “pay twice” later (banking issues, tax cleanups, restructuring). If you need Free Zone accounting support: Dubai, Sharjah, Abu Dhabi.

A. 2026 setup checklist (10 essentials)

Define activity, pick jurisdiction, plan VAT exposure, set up bookkeeping from month one, create invoice & contract templates, plan visas, document ownership/management, prepare bank onboarding, plan Corporate Tax governance, and keep records audit-ready.

B. Mainland vs Free Zone vs Offshore

Choose based on where you operate and who you invoice. Always verify VAT rules on tax.gov.ae.

C. Key differences you must validate

Validate permitted activities, office requirements, visas, local trading ability, audit expectations, and Corporate Tax positioning. Reference: Designated Free Zones.

D. Steps & documents (practical sequence)

Activity selection → name approval → initial approval → lease/office docs (if required) → license issuance → immigration file (if needed) → bank onboarding → accounting system + monthly close process.

E. Banking readiness (2026)

Banks look for clear activity, ownership docs, contracts/invoices, and consistent transaction trails. Use monthly reconciliations and separate personal vs business spend. Need help? Online accounting & bookkeeping.

Chapter 3 — Running & Operating Your Business (2026)

Most SMEs win by building simple operating systems: contracts, payroll discipline, HR calendars, and consistent invoicing. If you want payroll + bookkeeping handled, see payroll & bookkeeping services.

A. HR + payroll discipline

Keep staff files, contracts, payroll records, and renewal calendars organized. Align headcount to budgeting to protect cash flow.

B. Business development operations

Use standardized quotes, contracts, and invoice templates. For VAT invoice formatting support, see UAE Tax Invoice Generator.

Chapter 4 — Compliance & Regulation (2026)

2026 is about audit-ready records: reconciliations, correct VAT handling, and Corporate Tax governance. Reference the FTA portal: tax.gov.ae.

A. VAT + Corporate Tax (what “good” looks like)

VAT: compliant invoices, correct TRN capture, timely returns, and evidence for treatments where relevant. Corporate Tax: clean financials, documented expenses, and consistent accounting method. Read: Corporate Tax resources.

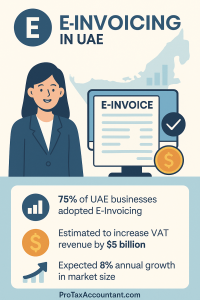

B. E-Invoicing readiness (add this in 2026)

Prepare now by standardizing invoice fields (customer details, TRN, item descriptions), improving document retention, and adopting software that can support structured e-invoice outputs when required. Follow official program updates via UAE Ministry of Finance: mof.gov.ae.

C. UBO + legal records

Keep UBO details current and document ownership/management changes. Legal reference portal: uaelegislation.gov.ae.

Chapter 5 — Scaling & Growth (2026)

Scaling needs reporting, cash-flow forecasting, and clean documentation. Helpful tool: financial ratio calculator.

A. Investor-ready finance

Investors expect clean statements, reconciled accounts, clear revenue recognition, and a tax-risk narrative. Start with Corporate Tax resources.

Chapter 6 — Supporting Services (2026)

Choose vendors that support audit trails: proper invoices, contracts, and documentation.

Tax & Accounting support

Pro Tax helps with bookkeeping, VAT, and Corporate Tax readiness. Start with bookkeeping and VAT registration.

Chapter 7 — Relocation & Family (2026)

Use checklists for schools, housing, healthcare, and driving so you don’t lose time after licensing.

Practical checklist

Keep documents digitized, track renewals, and align housing/commute with your operational needs.

2026 FAQ

1) When should a business register for VAT?

Register once you meet the mandatory threshold per UAE VAT rules, or earlier if you qualify for voluntary registration. Verify updates at tax.gov.ae.

2) What is E-Invoicing and why plan for it in 2026?

It’s a shift toward structured electronic invoices. Prepare by standardizing invoice data fields and using software that can support structured outputs. Follow updates at mof.gov.ae.

3) Do Free Zone companies still need bookkeeping?

Yes — bookkeeping supports banking, audit readiness, VAT compliance (where applicable), and Corporate Tax governance.