Are you planning a trip to the UAE and excited about shopping? Here’s some great news: tourists can claim a refund on the Value Added Tax (VAT) paid on their purchases. The VAT refund system is a fantastic way to save money while enjoying your shopping spree.

Let’s explore everything you need to know about VAT refunds for tourists in the UAE.

What is VAT Refund for Tourists?

VAT Refund for Tourists is a system that allows visitors to the UAE to claim back the 5% VAT they paid on goods purchased from participating stores. This system is designed to make your shopping experience more affordable by offering you a refund on the tax you paid, provided you meet certain criteria.

Whether you’re buying souvenirs, luxury items, or clothing, you can save a good amount by claiming your VAT back.

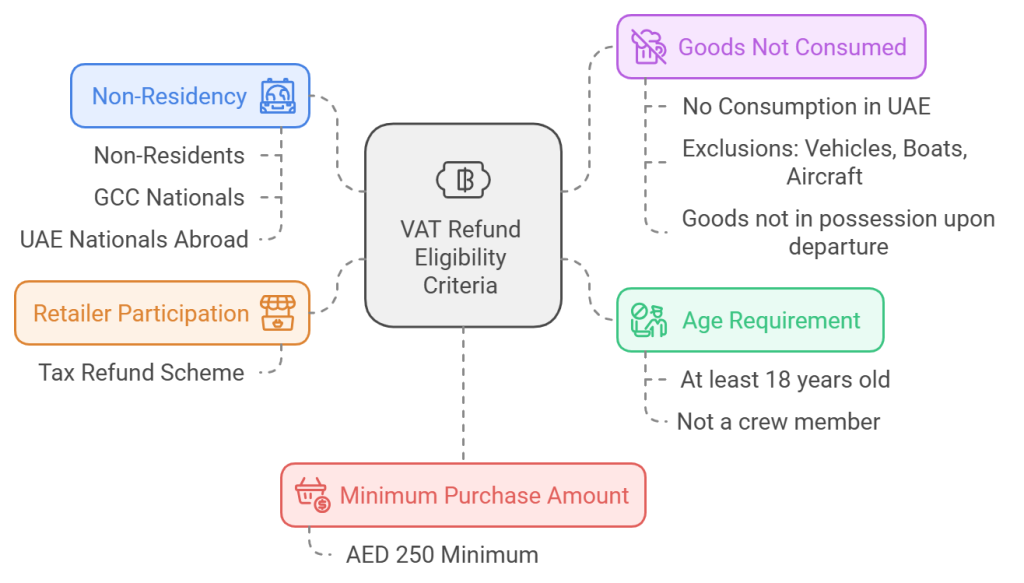

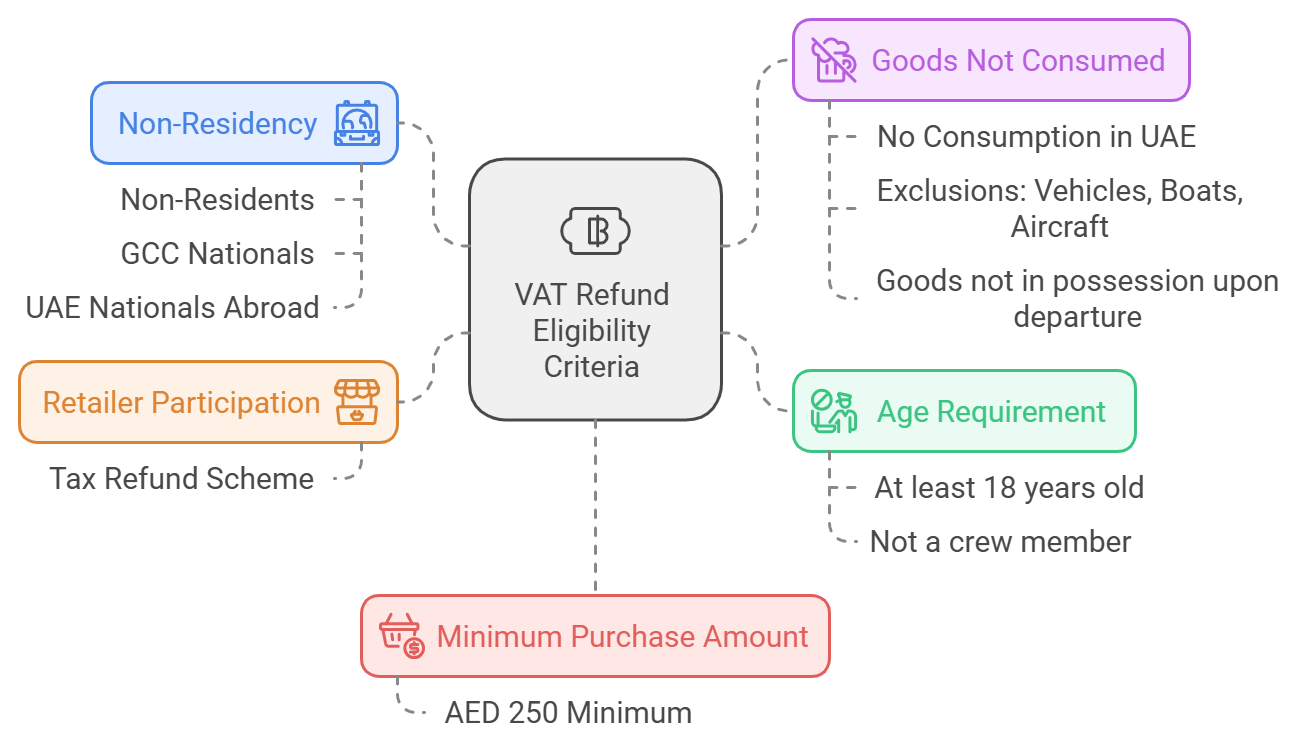

Eligibility Criteria for VAT Refund

To qualify for a VAT refund, you must meet a few simple requirements:

- Be a Tourist: You must be a visitor to the UAE and not a resident.

- Age Requirement: You must be at least 18 years old.

- Minimum Purchase Amount: You need to spend at least 250 AED in a single transaction at a store participating in the VAT refund program.

- Goods Exportation: You must take the items you purchased out of the UAE within 90 days from the purchase date.

- Eligible Stores: Only purchases made from participating stores are eligible for a VAT refund. Look for the “Tax-Free” sign at participating stores.

How Much VAT is Refunded?

The UAE VAT refund system allows you to claim back 87% of the VAT you paid. The remaining amount (about 13%) is taken as an administrative fee.

Additionally, there’s a small processing fee of 4.80 AED for each receipt you submit for refund.

The maximum refund you can receive is 35,000 AED per person, per trip, making it a great opportunity to save, especially on larger purchases.

How to Shop Tax-Free in the UAE

Shopping tax-free in the UAE is easy if you follow these simple steps:

- Look for Tax-Free Stores: Check that the store you are purchasing from displays the “Tax-Free” or “VAT Refund” sign.

- Spend Minimum AED 250: Ensure that your purchases add up to at least 250 AED in a single transaction.

- Show Your Passport: You must present your passport at the time of purchase to confirm that you are a tourist.

- Keep Your Receipts and Tags: Make sure to keep all your receipts and product tags, as you will need them when claiming your refund.

Methods of Shopping Tax-Free

There are a couple of methods for shopping tax-free in the UAE. Here’s what you need to know:

- In-store Purchases: When shopping in-store, simply ask the cashier for a Tax-Free Shopping form. Show your passport, and the tax will be added to your receipt. Keep the receipt, product tags, and any necessary forms safe.

- Online Purchases: You can also shop online at participating stores and request a VAT refund upon delivery or at the point of collection. However, this will depend on the store’s policy.

How to Get VAT Refund in the UAE

Once you’ve made your tax-free purchases, here’s how to claim your VAT refund:

- Validation at the Airport: Before leaving the UAE, you need to go to the Tax Refund Kiosk at the airport, seaport, or land border to validate your purchases.

- Documents You’ll Need: At the kiosk, present your passport, the goods you purchased, and your receipts. You’ll be asked to show the items for inspection, and the VAT refund process will begin.

- Refund Options: You can choose to get your refund in cash, or the amount can be credited to your credit/debit card. Some locations may also offer digital wallet refunds (e.g., WeChat).

Time Limits for Validation

There are strict time limits when it comes to validating your VAT refund:

- You must claim your refund before leaving the UAE within 90 days from the date of purchase.

- If you miss the 90-day deadline, you won’t be able to receive the refund, so be sure to plan ahead.

FAQs: VAT Refund for Tourists in the UAE

1. Can I claim VAT on all items?

No, VAT is only refundable on items that are exported out of the country. Items like food, drinks, and services such as accommodation or transportation are not eligible.

2. How do I know if a store participates in the VAT refund program?

Look for the “Tax-Free” sign at the store or ask the cashier.

3. What happens if I don’t have my passport when shopping?

You must have your passport with you to qualify for the VAT refund. Without it, you cannot claim the refund.

4. Can I claim VAT on items I bought online?

Yes, if the store offers VAT refund services for online purchases. Check the store’s refund policy before purchasing.

Additional Tips for Tourists

- Check Refund Status: You can track your VAT refund status online or via the app of the refund service provider.

- Keep Items Unused: Ensure the items are unused and in their original packaging to prevent complications when your items are inspected.

- Don’t Forget Your Tags: Always keep the tags from your items as proof that they are eligible for the refund.

Conclusion

The VAT refund system in the UAE is a great benefit for tourists who want to save money while shopping. By following the simple steps in this guide, you can easily claim back the 5% VAT you paid on eligible items.

Remember to keep all your receipts, follow the validation process, and file your claim correctly for a smooth experience. Happy shopping, and enjoy the extra savings during your visit to the UAE!