In the ever-evolving world of finance, understanding the classification of assets is crucial for businesses. One of the most debated questions among entrepreneurs and accountants alike is: “Is inventory a current asset?”

This blog delves deep into the subject, providing clarity, actionable insights, and practical examples.

Whether you’re a startup owner or a seasoned financial professional, this guide is tailored to enhance your understanding of inventory management and its role in your financial statements.

Why the Classification of Inventory Matters

Inventory plays a pivotal role in any business that deals with goods, whether in retail, manufacturing, or wholesale. It represents the products a company intends to sell within a specific period.

Categorizing inventory correctly on financial statements is vital, as it directly impacts your company’s working capital, liquidity, and overall financial health.

In this blog, we’ll answer common questions about inventory, explain why it is considered a current asset, and provide tools like tables and financial statement samples for better comprehension.

What Is a Current Asset?

Before diving into inventory specifics, let’s define a current asset. Current assets are resources that a company expects to convert into cash, sell, or use within one operating cycle (usually a year). They include:

-

- Cash and cash equivalents

-

- Accounts receivable

-

- Inventory

-

- Prepaid expenses

Is inventory a current asset?

The Simple Answer

Yes, inventory is classified as a current asset because it is expected to be sold or converted into cash within one year or the operating cycle of the business, whichever is longer.

Supporting Evidence

Here’s how inventory fits the criteria for current assets:

| Criteria | Inventory’s Fit |

|---|---|

| Convertibility to Cash | Inventory is sold to generate revenue, turning it into cash. |

| Short-Term Usage | Most inventories are sold within a year. |

| Role in Operating Cycle | Inventory is a key part of the production-to-sale process. |

Types of Inventory

To understand its classification better, let’s break down the types of inventory typically found on financial statements:

-

- Raw Materials: Basic inputs used to manufacture products.

-

- Work-in-Progress (WIP): Items currently being manufactured.

-

- Finished Goods: Products ready for sale.

Each type of inventory is treated as a current asset because they’re part of the operating cycle.

Frequently Asked Questions

1. How does inventory affect financial statements?

Inventory appears on the balance sheet under current assets. It also impacts the income statement, as the cost of goods sold (COGS) is deducted from revenue to calculate gross profit.

Sample Balance Sheet:

| Assets | Amount (USD) |

|---|---|

| Cash and Cash Equivalents | $50,000 |

| Accounts Receivable | $30,000 |

| Inventory | $70,000 |

| Prepaid Expenses | $10,000 |

| Total Current Assets | $160,000 |

2. Can inventory become a liability?

While inventory itself isn’t a liability, overstocking or holding obsolete inventory can tie up cash flow and increase storage costs. This highlights the importance of efficient inventory management.

3. How Is Inventory Valued?

Inventory valuation methods include:

-

- FIFO (First-In, First-Out): Older items are sold first.

-

- LIFO (Last-In, First-Out): Newer items are sold first.

-

- Weighted Average Cost: Average cost per unit is calculated.

The valuation method affects your financial reporting and taxes.

-

- According to a PwC Report, businesses with efficient inventory management systems see up to a 30% increase in cash flow.

-

- A study by Harvard Business Review found that firms with high inventory turnover ratios outperform their competitors by 20% in profitability.

Practical Insights for Managing Inventory

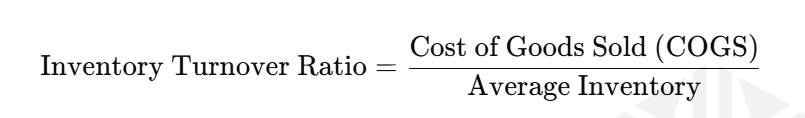

1. Inventory Turnover Ratio

Formula:

This ratio indicates how efficiently inventory is sold and replaced.

2. Just-In-Time (JIT) Inventory

Adopting JIT strategies minimizes holding costs and reduces waste.

For further insights, explore Virtual Bookkeeping in UAE.

Key Takeaways

-

- Inventory Is a Current Asset: Its short-term usage aligns it with the definition of current assets.

-

- Efficient Management Is Crucial: Poor inventory practices can harm your cash flow and operational efficiency.

-

- Regular Monitoring: Use tools like turnover ratios to track performance.

Also Read.

Conclusion

Inventory is undeniably a vital component of any business. Proper classification as a current asset ensures accurate financial reporting and aids in making informed business decisions.

By managing inventory effectively and understanding its role in your financial ecosystem, you can optimize operations and maximize profitability.

Need professional help? Contact ProTaxAccountant.com for expert guidance on bookkeeping, inventory management, and accounting solutions tailored to your business needs.