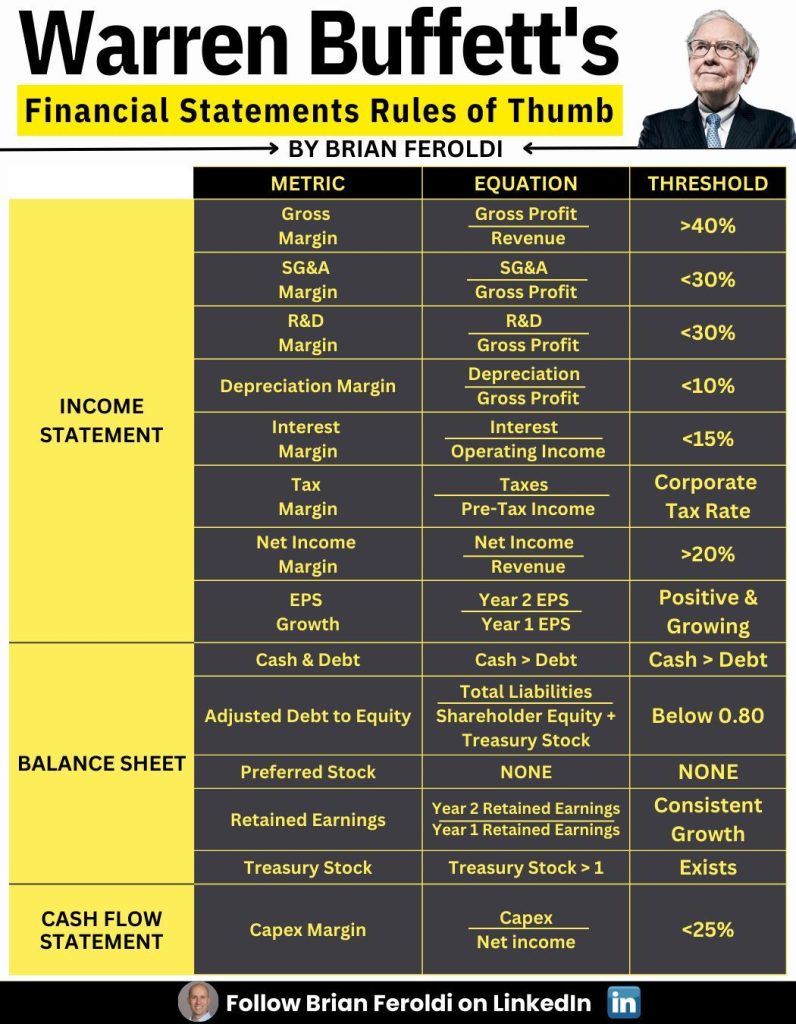

If you’re looking to understand what an ideal financial statement should look like according to Warren Buffett’s logic, you’re in the right place.

Buffett, one of the most successful investors of all time, has developed a set of straightforward rules of thumb for evaluating financial statements.

These rules focus on key metrics that indicate a company’s profitability, efficiency, and overall financial health.

By applying these principles to the income statement, balance sheet, and cash flow statement, you can gain valuable insights into a company’s performance and its potential for long-term success.

In the following sections, I will share specific examples and calculations to illustrate how these rules can be effectively utilized in assessing a business’s financial statements.

Let’s use financial statements and examples using the name “Protax” for our fictional trading business.

This will help clarify each of Warren Buffett’s financial statement rules with an explanation followed by the relevant calculations.

Protax Financial Statements

Income Statement for the Month Ended September 30, 2024

| Description | Amount (AED) |

|---|---|

| Revenue | |

| Sales Revenue | 25,000 |

| Cost of Goods Sold (COGS) | |

| Opening Inventory | 5,000 |

| Add: Purchases | 10,000 |

| Less: Closing Inventory | (3,000) |

| Total COGS | 12,000 |

| Gross Profit | 13,000 |

| Operating Expenses | |

| SG&A Expenses | 3,500 |

| R&D Expenses | 1,000 |

| Depreciation Expense | 500 |

| Interest Expense | 300 |

| Total Operating Expenses | 5,300 |

| Operating Income | 7,700 |

| Income Tax Expense | 1,540 |

| Net Income | 6,160 |

Balance Sheet as of September 30, 2024

| Description | Amount (AED) |

|---|---|

| Assets | |

| Current Assets | |

| Cash | 10,000 |

| Accounts Receivable | 5,000 |

| Inventory | 3,000 |

| Total Current Assets | 18,000 |

| Fixed Assets | |

| Equipment | 15,000 |

| Less: Accumulated Depreciation | (1,500) |

| Total Fixed Assets | 13,500 |

| Total Assets | 31,500 |

| Liabilities | |

| Current Liabilities | |

| Accounts Payable | 2,000 |

| Short-term Debt | 1,000 |

| Total Current Liabilities | 3,000 |

| Long-term Liabilities | |

| Long-term Debt | 5,000 |

| Total Liabilities | 8,000 |

| Equity | |

| Owner’s Equity | |

| Retained Earnings | 23,500 |

| Total Equity | 23,500 |

Application of Buffett’s Rules

Income Statement Rules

Gross Margin

Explanation: Gross margin indicates how much money a company retains from sales after deducting the cost of goods sold (COGS). A higher gross margin suggests effective pricing strategies and cost control.

Calculation:

Gross Profit = Revenue – Total COGS

Gross Profit = AED 25,000 – AED 12,000 = AED 13,000

Gross Margin = Gross Profit / Revenue = 13,000 / 25,000 = 52%

Rule: Aim for a gross margin of 40% or higher.

Interpretation: Protax has a healthy gross margin, indicating strong pricing power.

SG&A Margin (Selling, General & Administrative Expenses)

Explanation: This margin reflects the overhead costs associated with running the business. A lower SG&A margin indicates efficient management of operating expenses.

Calculation:

SG&A Margin = SG&A Expense / Gross Profit

3,500 / 13,000 = 26.9%

Rule: Keep this margin at 30% or lower.

Interpretation: The company is efficiently managing its selling and administrative expenses.

R&D Margin (Research & Development)

Explanation: This shows how much is spent on developing new products or services. High R&D expenses can indicate a focus on innovation but should be balanced against profitability.

Calculation:

R&D Margin = R&D Expense / Gross Profit

1,000 / 13,000 = 7.7%

Rule: Limit this margin to 30% or lower.

Interpretation: The company invests modestly in research and development relative to its gross profit.

Depreciation Margin

Explanation: Depreciation accounts for the reduction in value of tangible assets over time. A low depreciation margin indicates that the company does not heavily rely on depreciating assets.

Calculation:

Depreciation Margin = Depreciation / Gross Profit

500 / 13,000 = 3.8%

Rule: Aim for this margin to be 10% or lower.

Interpretation: Protax has low depreciation expenses compared to its gross profit.

Interest Expense Margin

Explanation: This margin reflects how much interest the company pays on its debts relative to its operating income. A lower interest expense margin indicates less reliance on debt financing.

Calculation:

Interest Expense Margin = Interest Expense / Operating Income

300 / 7,700 = 3.9%

Rule: Keep this number at 15% or lower.

Interpretation: The company is not overly reliant on debt financing.

Income Tax Expenses

Explanation: This shows how much tax the company pays relative to its pre-tax income. A reasonable tax rate reflects profitability and compliance with tax regulations.

Calculation:

Tax Rate = Taxes Paid / Pre-Tax Income

1,540 / 7,700 = 20%

Rule: This should align with the current corporate tax rate.

Interpretation: The tax rate is reasonable and reflects the company’s profitability.

Net Margin (Profit Margin)

Explanation: This indicates how much profit a company makes from its total revenue after all expenses are deducted. A high net margin suggests effective cost management and strong profitability.

Calculation:

Net Margin = Net Income / Sales

6,160 / 25,000 = 24.6%

Rule: Target a net margin of 20% or higher.

Interpretation: Protax is converting a significant portion of its revenue into profit.

Earnings Per Share Growth

Since this is a single month’s data without historical EPS figures provided here for comparison.

Rule: Look for positive and growing EPS.

Interpretation: This requires historical data to assess growth over time.

Balance Sheet Rules

Cash & Debt

Rule: Always have more cash than debt.

Interpretation: Protax’s cash balance (AED 10,000) exceeds its total debt (AED 6,000), indicating good liquidity.

Adjusted Debt to Equity

Explanation: This ratio helps assess how much debt a company uses relative to its equity financing.

Calculation:

Adjusted Debt to Equity Ratio = Total Liabilities / Total Equity

8,000 / 23,500 = 0.3423

Rule: Keep this ratio below 0.80.

Interpretation: The company is primarily financed through equity rather than debt.

Retained Earnings

Explanation: Retained earnings represent cumulative profits that are reinvested in the business rather than paid out as dividends.

Rule: Look for consistent growth in retained earnings year over year.

Interpretation: Retained earnings are strong at AED 23,500; however, historical data would be required to assess growth trends.

Cash Flow Statement Rules

Capex Margin

Explanation: Capex refers to funds used by a company to acquire or upgrade physical assets like property or equipment.

Rule: Keep this margin below 25%.

Interpretation: Requires additional data regarding capital expenditures and net income for calculation.

Conclusion

The financial statements of Protax, along with the application of Warren Buffett’s rules of thumb, provide valuable insights into the company’s financial health and operational efficiency.

By following these guidelines and understanding how they apply to your business’s financials—whether you’re running a trading company or another type of business—you can make informed decisions that promote long-term success.

For expert assistance tailored to your business needs in navigating these financial statements and optimizing your operations for compliance and savings, Pro Tax Accountant provides the best services for small businesses!