All UAE registered taxpayers must file VAT returns monthly or quarterly.

VAT registered businesses in UAE must submit VAT returns. The standard filing period is quarterly i.e. every 3 months.

However some businesses may be required by Federal Tax Authority (FTA) to file monthly returns.

The frequency of filing (monthly or quarterly) depends on the business turnover and other factors. Check with FTA for individual requirements.

“If output VAT is more than what can be recovered, the difference is VAT to be paid to FTA.”

When a business sells goods or services (output), it charges VAT to its customers. At the same time, the business incurs VAT on its purchases (input).

If output VAT is more than input VAT, the difference is VAT to be paid to FTA.

Businesses must keep track of their input and output VAT to be compliant and manage their VAT liability.

EmaraTax is for VAT payments in UAE.

EmaraTax is an online platform introduced by FTA for VAT registration, filing, and payments for businesses in UAE.

EmaraTax simplifies tax related processes, making it easier for taxpayers to manage their obligations online.

“If you are eligible for VAT registration and not registered on EmaraTax yet, follow this detailed guide to register and add your business details.”

Businesses eligible for VAT registration should register on EmaraTax portal as soon as possible.

The registration process requires providing basic business information such as trade license details, business activities, and contact information.

Once registered, businesses can proceed with VAT payments on EmaraTax.

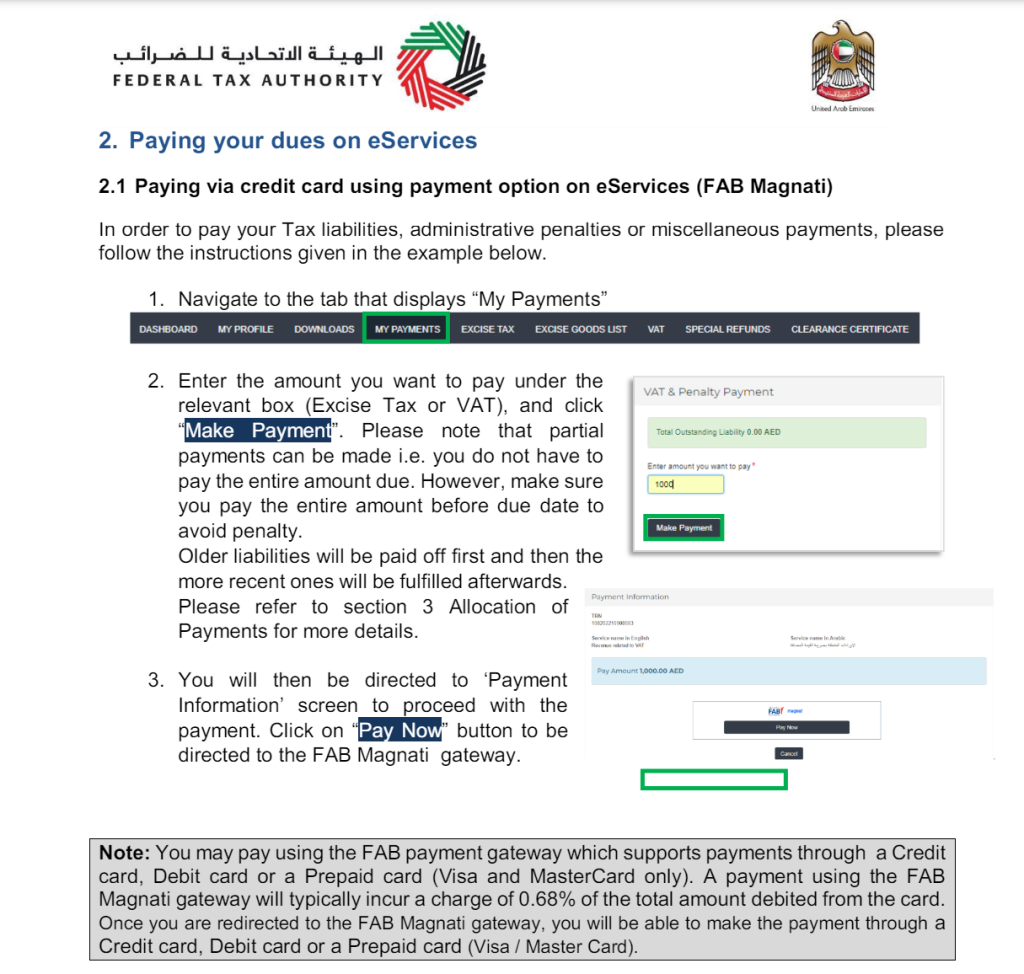

VAT Payment methods on EmaraTax:

There are two methods.

GIBAN (Local Transfer):

Businesses can transfer funds from certain UAE banks using the GIBAN provided by FTA.

FAB Magnati Pay (Credit Card):

Businesses can pay VAT using credit cards (Visa or MasterCard) through FAB Magnati gateway. A small transaction fee applies.

Here is detailed guide to do it step by step.

Penalties for late payment of VAT:

-

- 2% of the outstanding tax if payment is delayed.

-

- 4% if tax remains unpaid 7 days after the due date.

-

- 1% daily (up to 300%) if tax remains unpaid after 1 month from the due date.

What to do if I made a mistake in my VAT payment?

If a taxpayer realizes they made an error in their VAT payment, they should rectify it by submitting a Voluntary Disclosure form to FTA.