Introduction

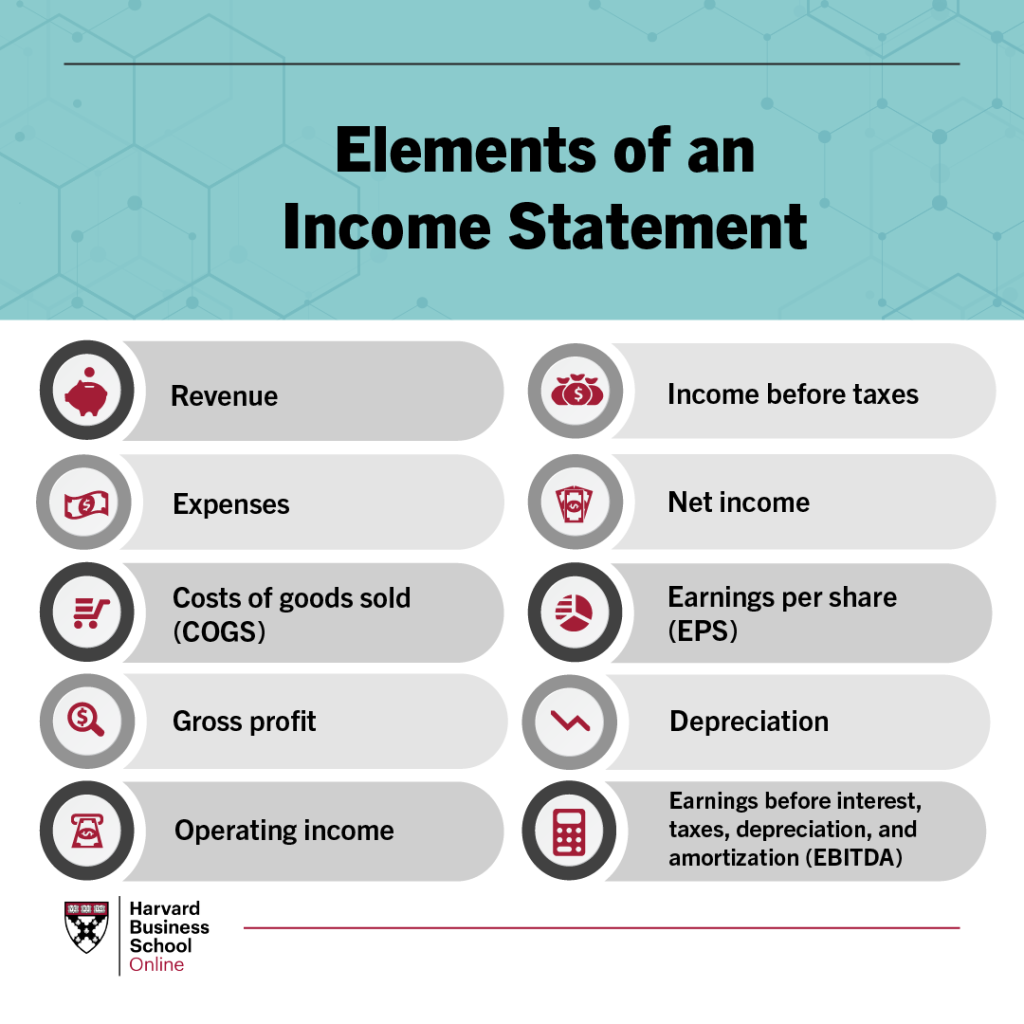

Understanding how to evaluate an income statement is crucial for business owners, investors, and financial analysts.

This comprehensive guide will walk you through the process using a practical example and detailed analysis of each component.

Learn more about professional bookkeeping services in Dubai

Sample Income Statement: Tech Solutions LLC

(All figures in thousands AED)

TECH SOLUTIONS LLC

Income Statement

For Years Ending December 31, 2022 and 2023

2023 2022 Change

Revenues 1,000 800 +25%

Cost of Goods Sold (400) (300) +33%

Gross Profit 600 500 +20%

Operating Expenses:

Salaries (200) (150) +33%

Selling and Marketing (100) (70) +43%

General & Administrative (50) (45) +11%

EBITDA 250 235 +6%

Depreciation & Amortization (30) (25) +20%

EBIT 220 210 +5%

Interest Expense (20) (15) +33%

Profit Before Tax 200 195 +3%

Tax Expense (15%) (30) (29) +3%

Net Profit 170 166 +2%Detailed Analysis

1. REVENUES

Key Findings:

- 25% year-over-year growth (800K to 1,000K AED)

- GAAP Compliance Check: Revenue recognition principles followed

- Steady growth trajectory indicating market expansion

Analysis Approach:

- Compare with industry growth rate (UAE tech sector average: 15%)

- Verify revenue recognition timing

- Check for any one-off items or seasonal impacts

Learn about financial variance analysis for small businesses

2. COST OF GOODS SOLD

Key Metrics:

2023 COGS Ratio: 40% (400/1,000)

2022 COGS Ratio: 37.5% (300/800)

Gross Margin 2023: 60%

Gross Margin 2022: 62.5%Analysis:

- COGS growing faster than revenue (33% vs 25%)

- Slight decline in gross margin indicates potential pricing pressure

- Need to investigate cost control measures

3. SALARIES

Key Metrics:

2023 Salary to Revenue: 20%

2022 Salary to Revenue: 18.75%Analysis:

- Salary expenses growing faster than revenue (33% vs 25%)

- Might indicate:

- Business expansion

- New hires

- Salary increments

- Potential inefficiency

4. SELLING AND MARKETING

Key Metrics:

2023 Marketing Ratio: 10%

2022 Marketing Ratio: 8.75%Analysis:

- 43% increase in marketing spend

- Revenue growth of 25% suggests reasonable ROI

- Higher than industry average (typical 8-9%)

5. GENERAL & ADMINISTRATIVE

Key Metrics:

2023 G&A Ratio: 5%

2022 G&A Ratio: 5.6%Analysis:

- Improved G&A efficiency

- Lower percentage of revenue despite business growth

- Good cost control in administrative areas

6. EBITDA

Key Metrics:

2023 EBITDA Margin: 25%

2022 EBITDA Margin: 29.4%Analysis:

- Positive EBITDA growth but margin compression

- Compare with industry average (UAE tech sector: 22%)

- Operational efficiency needs attention

7. DEPRECIATION AND AMORTIZATION

Key Metrics:

2023 D&A to Revenue: 3%

2022 D&A to Revenue: 3.1%Analysis:

- Consistent with business growth

- Check CAPEX relationship

- Review asset useful life assumptions

8. INTEREST

Key Metrics:

2023 Interest Coverage: 12.5x (250/20)

2022 Interest Coverage: 15.7x (235/15)Analysis:

- Strong interest coverage ratio

- Slight decline needs monitoring

- Compare with industry benchmark (10x typical minimum)

9. PROFIT BEFORE TAXATION

Key Metrics:

2023 PBT Margin: 20%

2022 PBT Margin: 24.4%Analysis:

- Margin compression evident

- Operating leverage impact visible

- Need cost optimization strategy

10. TAX

Key Metrics:

Effective Tax Rate 2023: 15%

Effective Tax Rate 2022: 14.9%Analysis:

- Consistent effective tax rate

- No unusual variations

- Check for available tax incentives

11. NET PROFIT

Key Metrics:

2023 Net Profit Margin: 17%

2022 Net Profit Margin: 20.75%Analysis:

- Margin compression through the P&L

- Still above industry average (15%)

- Need margin improvement strategy

Ratio Analysis Framework

1. Understanding Ratios

- Define the purpose of each ratio

- Establish calculation methodology

- Set benchmarks and targets

2. Result Interpretation

- Compare with historical trends

- Analyze deviations

- Identify patterns

3. Comparative Analysis

- Industry benchmarking

- Peer comparison

- Market position evaluation

4. Action Planning

- Identify improvement areas

- Set specific targets

- Develop implementation strategies

Recommended Actions for Tech Solutions LLC

- Cost Management:

- Review supplier contracts

- Optimize resource allocation

- Implement cost control measures

- Revenue Enhancement:

- Analyze pricing strategy

- Explore new market opportunities

- Strengthen customer relationships

- Operational Efficiency:

- Review staffing models

- Optimize marketing spend

- Improve administrative processes

Explore online bookkeeping services to streamline your finances

Conclusion

Effective income statement evaluation requires:

- Systematic analysis of all components

- Understanding of industry context

- Regular monitoring and comparison

- Action-oriented approach

Remember that numbers tell a story – your job is to understand that story and use it to make informed business decisions.

Additional Resources