The United Arab Emirates is undergoing a significant digital transformation in its economic and tax landscape. For business owners, understanding and adapting to these changes is crucial, not just for compliance but for unlocking new efficiencies and growth opportunities.

At the forefront of this evolution are the existing Value Added Tax (VAT) framework and the upcoming mandatory e-invoicing system. This guide provides a comprehensive overview of both, helping businesses in the UAE prepare for a streamlined, digital future.

Understanding VAT in the UAE: A Quick Refresher for Business Owners

Value Added Tax (VAT) was introduced in the UAE on January 1, 2018, marking a pivotal moment in the nation’s fiscal policy.

This consumption tax is applied to most goods and services and serves as a vital new source of income, contributing to the continued provision of high-quality public services and reducing the country’s dependence on oil revenues. The system is designed to be fair and transparent, with businesses acting as collectors on behalf of the government, ensuring tax is primarily levied on the “value added” at each stage of production and distribution.

Key VAT Rates: Standard (5%), Zero-Rated, and Exempt Supplies

The standard VAT rate in the UAE is 5%, which applies to the majority of goods and services. However, it is important to distinguish between different categories of supplies:

Zero-rated supplies are those where VAT is charged at 0%. Businesses making these supplies can still reclaim any input VAT they have paid on their related purchases.

Examples include exports of goods and services outside the GCC, international transportation, and certain educational and healthcare services. This mechanism supports specific economic activities and ensures competitiveness in international trade.

Exempt supplies are not subject to VAT, meaning no VAT is charged on these goods or services. Crucially, businesses cannot reclaim input VAT on expenses related to these supplies.

Common examples include certain financial services, residential properties (excluding the first sale), and local passenger transport.

Do You Need to Register for VAT? Mandatory vs. Voluntary Thresholds

Determining whether your business needs to register for VAT is a critical first step. The Federal Tax Authority (FTA) has set clear thresholds:

-

- Mandatory Registration: Businesses must register for VAT if their annual taxable supplies and imports exceed AED 375,000 within a 12-month period. Failure to register within 30 days of becoming eligible can result in a penalty of AED 10,000.

-

- Voluntary Registration: Businesses can choose to register voluntarily if their taxable supplies and imports are between AED 187,500 and AED 375,000. This option is particularly beneficial for businesses, especially startups, that incur significant VAT on their expenses before generating substantial taxable turnover.

- By registering voluntarily, they can recover input VAT, which can significantly improve their cash flow and financial health in the crucial early stages of operation.

It is worth noting that for non-resident businesses selling directly to consumers (B2C) in the UAE, there is generally no minimum revenue threshold, meaning they must collect VAT on every sale. For non-resident B2B sellers, the reverse charge mechanism often applies, shifting the VAT liability to the UAE-registered business buyer.

Here’s a quick overview of the VAT registration thresholds:

| Category | Annual Taxable Supplies & Imports Threshold (AED) | Requirement | Benefit/Implication |

| Mandatory | ≥ 375,000 | Required | Failure to register incurs AED 10,000 penalty |

| Voluntary | 187,500 to 375,000 | Optional | Allows recovery of input VAT on expenses |

Your Basic VAT Responsibilities: Invoicing, Record-Keeping, and Returns

Once registered, businesses have specific ongoing responsibilities to ensure VAT compliance:

-

- Charging VAT: VAT-registered businesses must charge the applicable VAT rate on taxable goods or services they supply.

-

- Reclaiming Input VAT: They can reclaim any VAT paid on business-related goods or services, ensuring that the tax is ultimately borne by the end consumer.

-

- Record-Keeping: Maintaining accurate and up-to-date financial records is fundamental. Businesses must keep detailed records of their financial transactions, including tax invoices, receipts, and tax returns, for a minimum of five years. The FTA may request Arabic translations of these records during an audit.

-

- Filing VAT Returns: Businesses must file periodic VAT returns with the FTA, typically monthly or quarterly depending on their annual turnover. This return summarizes the total value of supplies and purchases, calculates the VAT liability (output tax minus input tax), and facilitates the remittance of the difference to the FTA.

A valid tax invoice must include specific details to be compliant: the words “Tax Invoice,” the supplier’s name, address, and Tax Registration Number (TRN), the recipient’s name and address, the invoice date and number, a description, quantity, and value of goods/services, and the VAT amount and rate applied.

A common challenge for many businesses, especially smaller ones, is managing cash flow effectively when it comes to VAT payments. Since VAT is collected from customers on behalf of the government, some businesses mistakenly use these collected funds for other operational expenses.

This can lead to significant cash flow problems when the VAT filing deadline arrives and the funds are due to the FTA. Therefore, robust internal controls and proactive financial planning are essential to segregate collected VAT or ensure sufficient reserves are available.

It is also important to recognize that existing VAT legislation already imposes penalties for non-compliant tax invoices and poor record-keeping. The upcoming e-invoicing mandate will extend these penalties to include failures related to electronic invoices, creating a compounding risk for businesses that do not adapt promptly.

This interconnectedness underscores the urgency of addressing e-invoicing readiness, as it directly impacts a business’s existing VAT compliance posture and overall financial health.

E-Invoicing in the UAE: What’s Changing and Why It Matters

E-invoicing represents a fundamental shift in how businesses in the UAE will issue, exchange, and report invoices. This is far more than simply scanning paper invoices or sending PDFs via email; it involves a structured, machine-readable digital format that integrates directly with the tax authority’s system.

E-Invoicing Defined: Beyond a Simple PDF

At its core, e-invoicing means generating, exchanging, and storing invoices in structured, machine-readable electronic formats, typically XML (eXtensible Markup Language) or JSON (JavaScript Object Notation).

These digital invoices must adhere to standardized formats like PINT AE (Peppol Invoice Standard for UAE) or UBL (Universal Business Language), ensuring consistency and interoperability across different systems.

A crucial point for all business owners to understand is that manual invoices, scanned documents, or invoices saved in unstructured formats like PDFs or JPGs will not be considered valid e-invoices under the new mandate. This emphasizes the need for a complete overhaul of invoicing processes for many businesses.

The Vision Behind the Mandate: Efficiency, Transparency, and Combating Fraud

The UAE’s move to mandatory e-invoicing is part of a broader digital transformation initiative driven by the Ministry of Finance and the Federal Tax Authority (FTA). The primary goals are multifaceted: to reduce tax evasion, improve overall transparency in financial transactions, and streamline tax compliance processes.

International experience supports this vision. Countries that have implemented similar e-invoicing systems have reported significant benefits, including up to a 66% reduction in invoice processing costs for businesses and governments, alongside a sharp decline in VAT fraud.

Beyond financial gains, this initiative also aims to reduce paper usage, promoting environmental sustainability and aligning with the UAE’s broader goal of fostering a fully digitized and innovative economy.

The “5-Corner Model”: A Simplified Explanation of How It Works

The UAE is adopting a decentralized “five-corner” model, built upon the globally recognized Peppol network. This model is revolutionary because it requires stakeholders and systems to exchange data in real-time or near real-time.

The five parties involved in this model are:

-

- The Supplier: Generates the e-invoice.

-

- The Supplier’s Accredited Service Provider (ASP): Validates the invoice data, converts it to the required PINT AE format, applies digital signatures, and sends the e-invoice to the buyer’s ASP. Simultaneously, it sends a copy of the tax data to the FTA.

-

- The Buyer’s ASP: Collects the invoice from the supplier’s ASP (or FTA), converts it to the buyer’s preferred format, and delivers it to the buyer’s system. Upon successful validation, it also sends a Tax Data Document to the FTA.

-

- The Buyer: Receives and processes the e-invoice within their accounting or ERP system.

-

- The Federal Tax Authority (FTA) and UAE Ministry of Finance: Acts as the central checkpoint, validating invoices against tax regulations and securely storing the e-invoice data.

A key component facilitating this model is the Service Metadata Publisher (SMP), a decentralized database that manages registered business metadata and their access points within the Peppol network, enhancing compliance, security, and efficiency. The UAE’s choice of this decentralized model, unlike some centralized systems, significantly reduces the government’s technical burden while promoting flexibility and scalability for businesses.

This approach also enhances security by distributing data handling across multiple accredited providers, which should instill confidence in data integrity and reduce long-term fraud risks.

Key Dates: Your E-Invoicing Timeline to July 2026

The implementation of e-invoicing is a phased approach, providing businesses with time to adapt. However, proactive preparation is essential, as key milestones have already passed or are rapidly approaching:

-

- October 2024: The UAE launched its official e-invoicing portal.

-

- Q4 2024: Development of Service Providers’ certification requirements and the UAE Data Dictionary.

-

- March 2025: The portal for Accredited Service Provider (ASP) accreditation applications was launched.

-

- April 2025: Introduction of PINT AE (Peppol International for UAE) and testbeds for businesses to begin testing their systems.

-

- Latter half of 2025 (Q2 2025 onwards): Final regulations and technical specifications are being released, ASP accreditations are commencing, and pilot programs for large taxpayers and early adopters are beginning.

-

- July 2026: Mandatory e-invoicing goes live for Phase 1.

This phased implementation, starting with larger entities, is a deliberate strategy to manage the transition. It allows the FTA to test the system with a more capable group first, identify and resolve any issues, and provide sufficient time for smaller businesses to prepare. This means that while the full mandate for all entities is still some time away, all businesses, regardless of size, should begin their planning and preparation now to avoid last-minute complications.

Here is a summarized timeline for key e-invoicing implementation milestones:

| Date/Period | Milestone/Event | Significance for Businesses |

| October 2024 | Official e-invoicing portal launched | Initial access to official information and resources |

| Q4 2024 | Development of ASP certification & UAE Data Dictionary | Defines technical standards for compliance |

| March 2025 | ASP accreditation applications launched | Enables selection of accredited service providers |

| April 2025 | Introduction of PINT AE & Testbeds | Allows businesses to test their systems for compliance |

| Latter half of 2025 | Final regulations, legislation, pilot programs | Provides clarity on rules and allows early adoption/testing |

| July 2026 | Mandatory e-invoicing goes live for Phase 1 | First group of businesses must comply |

Who Must Comply? Scope of the Mandate (B2B, B2G, Large Businesses, Non-VAT Registered)

Initially, the e-invoicing mandate will apply to large businesses, high-volume invoice issuers, and businesses engaging in Business-to-Business (B2B) or Business-to-Government (B2G) transactions. This includes various sectors such as hospitality, services, construction, and real estate for their B2B and B2G engagements.

A significant aspect of the mandate is its broad scope: even non-VAT registered entities (or deregistered ones) are expected to comply for B2B transactions if they issue professional invoices.

This means that businesses previously operating outside the direct purview of VAT reporting will now need to engage with the tax system. These non-VAT registered businesses will need to register for a Tax Identification Number (TIN) to comply with the e-invoicing requirements.

This requirement for a TIN for non-VAT registered entities indicates that the FTA aims for universal transparency across all business transactions, regardless of their VAT registration status, highlighting a broader push for comprehensive economic oversight and data collection.

While Business-to-Consumer (B2C) transactions are currently out of scope, they are expected to follow in future phases. Retailers, for example, will initially focus on e-invoicing their B2B clients (e.g., bulk buyers or corporate customers). Businesses should therefore prepare their Point of Sale (POS) and e-commerce platforms for future B2C compliance.

The Essential Role of Accredited Service Providers (ASPs)

A cornerstone of the UAE’s e-invoicing framework is the mandatory use of Accredited Service Providers (ASPs). Businesses cannot send e-invoices directly to the FTA; instead, ASPs act as crucial intermediaries in the e-invoicing ecosystem.

Why ASPs are Mandatory for E-Invoicing in the UAE

ASPs are licensed and accredited by the Ministry of Finance (MoF) and are indispensable for the secure and compliant transmission of tax data to the FTA. They form a key component of the decentralized “5-corner” model, ensuring a secure and standardized invoice exchange process. From July 2026 onwards, e-invoicing in the UAE cannot be done without the support of an ASP.

What ASPs Do: Validation, Conversion, Digital Signatures, and Real-time Reporting

ASPs perform several critical functions:

-

- Data Validation and Conversion: They validate the invoice data provided by businesses and convert it into the correct XML format, specifically the PINT AE standard, if it is not already in that format. This validation process is crucial, as ASPs act as primary compliance gatekeepers, reducing the direct burden on businesses to ensure every field is perfectly compliant. However, this also implies that businesses must ensure their internal systems generate data that can be easily validated by the ASP, shifting the compliance focus upstream to data quality and internal system configuration.

-

- Digital Signatures: ASPs apply mandatory digital signatures to e-invoices, ensuring their authenticity and integrity and preventing any tampering with the invoice content.

-

- Real-time Reporting: They transmit e-invoices to the buyer’s ASP and, in parallel, report the required tax data to the FTA in real-time or near real-time.

-

- Secure Storage: ASPs are also responsible for securely storing e-invoices, providing a reliable audit trail and ensuring compliance with tax regulations.

Choosing the Right ASP for Your Business

Selecting the appropriate ASP is a pivotal decision for any business. Given the ASP’s central role in validation, transmission, and reporting, a poor choice can lead to invoice rejections, compliance issues, and even the blockage of input VAT recovery, directly impacting a business’s cash flow.

Businesses should look for ASPs that:

-

- Are Accredited: They must achieve and maintain active Peppol certification by successfully completing OpenPeppol conformance tests and adhering to Peppol interoperability rules.

-

- Offer Comprehensive Features: Evaluate ASPs based on their ability to provide end-to-end process automation, real-time validation, seamless integration with the UAE’s official portal for reporting, built-in compliance checks, and flexible deployment options (cloud-based or on-premises).

-

- Ensure Security: Prioritize ASPs with robust security features, such as ISO/IEC 27001 certification, to ensure that sensitive invoice data is handled in a secure, compliant, and regulator-approved environment.

-

- Support Business Needs: Partner with a service provider that not only complies with country-specific e-invoicing regulations but also supports both domestic compliance and international business operations.

E-Invoicing and VAT: The Interconnected Future of UAE Tax Compliance

The e-invoicing mandate is not an isolated regulatory change; it is intrinsically linked with and designed to enhance the existing VAT compliance framework. This integration aims to create a more transparent, efficient, and robust tax ecosystem.

How E-Invoicing Enhances VAT Oversight and Reduces Leakage

The core benefit of e-invoicing for the tax authority is its ability to provide near real-time reporting of B2B and B2G invoices to the FTA. This real-time access to structured invoice data allows the FTA to significantly improve VAT oversight, making it easier to detect any tax evasion early and automate tax audit processes.

This represents a shift from a reactive audit model to a proactive monitoring and intervention model, enabling quicker enforcement actions for anomalies or potential fraud. The system is designed to minimize both intentional and unintentional VAT errors, thereby ensuring accurate tax reporting and effectively reducing “VAT leakage”.

Streamlining VAT Returns and Input Tax Recovery

The standardized, machine-readable data generated from e-invoices will bring substantial benefits to businesses by facilitating the automatic pre-population of certain fields in VAT returns.

This automation is expected to significantly expedite VAT refund processing, improving cash flow for businesses. However, it is crucial to note that non-compliant invoices, those that do not meet the e-invoicing standards, can lead to invoice rejection and ultimately block input VAT recovery, directly impacting a business’s cash flow. This underscores that the success of automated VAT return pre-population and expedited refunds hinges entirely on the accuracy and completeness of the e-invoice data. Data quality within a business’s ERP or accounting system becomes paramount, as this data will directly feed into official tax filings.

Ensuring Your E-Invoices are VAT-Compliant

For an e-invoice to be valid, it must not only meet the technical e-invoicing format requirements (XML/JSON, PINT AE) but also contain all necessary VAT-related details. These include the VAT amount and rate, as well as the Tax Registration Numbers (TRNs) of both the supplier and the buyer. The e-billing system is designed to directly link e-invoicing data with VAT return filings, creating a seamless flow of information.

It is permissible for an e-invoice to include a mix of taxable supplies alongside exempt or out-of-scope transactions. However, it is essential that the invoice clearly distinguishes between these different types of items to ensure accurate VAT reporting and compliance with regulatory standards.

Here are the essential data fields required for an e-invoice in the UAE:

| Field Category | Specific Field | Requirement | Notes |

| Supplier Details | Supplier Name | Mandatory | Legal name of the business |

| Supplier Address | Mandatory | Full registered address | |

| Supplier TRN | Mandatory | Tax Registration Number | |

| Buyer Details | Buyer Name | Mandatory | Legal name of the recipient |

| Buyer Address | Conditional | Required if applicable | |

| Buyer TRN | Conditional | Required if VAT-registered | |

| Invoice Details | Invoice Number | Mandatory | Unique identifier for each invoice |

| Invoice Date | Mandatory | Date of invoice generation | |

| Currency Used | Mandatory | Currency of the transaction | |

| Item Details | Description of Goods/Services | Mandatory | Clear description of items supplied |

| Quantity | Mandatory | Number of units | |

| Unit Price | Mandatory | Price per unit | |

| Line Item Total (Excl. VAT) | Mandatory | Total for each item before VAT | |

| VAT & Totals | VAT Amount | Mandatory | Total VAT charged on the invoice |

| VAT Rate Applied | Mandatory | Applicable VAT percentage (e.g., 5%, 0%) | |

| Total Amount Payable (Incl. VAT) | Mandatory | Final amount due | |

| Payment Terms | Conditional | If applicable |

Your Step-by-Step Guide to E-Invoicing Readiness

Preparing for e-invoicing requires a structured and proactive approach. Here is a comprehensive guide to help your business transition smoothly and ensure compliance by July 2026.

Step 1: Assess Your Current Invoicing Systems

Begin by thoroughly examining your existing infrastructure, including ERP systems, legacy systems, Point of Sale (POS) tools, or other invoicing software. Understand how invoices are currently issued, received, and validated. This diagnostic step is crucial for identifying any potential gaps or compatibility issues with the upcoming FTA requirements and the PINT AE standard.

Step 2: Update and Clean Your Master Data

The e-invoicing mandate introduces a requirement for up to 50 mandatory fields for standard tax invoices and 49 for commercial tax invoices, many of which were not previously required for VAT compliance. This means that e-invoicing is fundamentally about data quality, not just document format.

Businesses must review and verify their master data for suppliers and customers, ensuring accuracy of names, TRNs, locations, and VAT registration numbers. Implementing digital onboarding processes for new customers and suppliers can help automate record-keeping and data verification, ensuring that the underlying data is perfectly structured and compliant. Neglecting this step can lead to invoice rejections by ASPs and the FTA, causing significant compliance issues and potential penalties.

Step 3: Optimize Transaction Data Management

Evaluate your business services and products to accurately categorize transaction types (e.g., B2B, B2C, B2G, Reverse Charge Mechanism) and document types (e.g., standard tax invoice, commercial invoice, credit notes, debit notes). Ensure that the correct tax codes and rates are applied for accurate e-invoice generation.

Conduct thorough testing of e-invoice generation under various scenarios, such as discounted transactions, multiple currency transactions, continuous supplies, and exports, to confirm compliance with the PINT AE format. This step also involves performing compliance checks, integration testing, and evaluating current system performance and security measures.

Step 4: Choose Your System Integration Method

Seamless integration of your ERP or accounting software with the e-invoicing solution and Peppol access points is vital for automated workflow. Businesses can consider various integration methods:

-

- API Connectivity: Ideal for real-time data transfer and updates.

-

- SFTP: Suitable for scheduled and secured data transfers.

-

- DB SSIS: For centralized data sharing or complex workflows integrating multiple data sources.

Look for plug-and-play connectors or customized middleware that ensures your existing ERP modules (finance, procurement, sales) can effortlessly communicate with the e-invoicing platform.

The complexity of integrating legacy systems suggests that businesses need to carefully assess their technical capabilities and potentially invest in middleware or system upgrades, rather than assuming a simple plug-and-play solution.

Step 5: Select an FTA-Compliant Accredited Service Provider (ASP)

As previously discussed, partnering with an FTA-approved ASP is mandatory due to the UAE’s adoption of the 5-corner Peppol model. Businesses should evaluate ASPs based on their expertise, global experience in e-invoicing and indirect tax compliance, and the key features they offer, ensuring alignment with UAE authority criteria.

Prioritize ASPs that demonstrate robust data security, ideally with ISO/IEC 27001 certification.

Step 6: Set Up Your Production Environment

Decide on the optimal implementation environment for your e-invoicing solution—whether on-premises, private cloud, or public cloud—based on your business’s specific needs for scalability, control, and cost. Ensure that the entire system architecture, including servers, networks, and integration points, is fully compatible with the e-invoicing architecture and ready for deployment.

Step 7: Seamlessly Integrate with Your ERP or Accounting Software

Deep integration between your e-invoicing solution and your existing ERP or accounting software is critical. This allows for the generation of e-invoices within familiar systems and facilitates easy transmission between your ERP, UAE authorities, and accredited access points.

The goal is to achieve real-time reporting and updates on e-invoice status with minimal changes to your current ERP and e-invoicing workflows. The chosen solution should offer scalability and flexibility to accommodate current and future business needs, while adhering to compliance and validation checks.

Step 8: Implement Robust Security and Data Storage Measures

Protecting sensitive financial data is paramount. Businesses must prioritize robust security features, including encryption, to safeguard data both in transit and at rest, preventing leakage, intrusion, tampering, and forgery. Implement time-stamping and validation for e-invoices to ensure their authenticity and security.

Other essential security measures include multi-factor authentication, strong password protections, audit trails, role-based access management, and firewall protection. It is also vital to verify that your chosen ASP complies with all security measures and certifications required by UAE authorities. Businesses must also archive invoices in their original format (usually XML) for audit purposes.

Step 9: Train Your Team for the New Era

Technological implementation is only half the battle; people make it successful. Address potential resistance to change by thoroughly educating your finance, sales, and IT teams about the UAE e-invoicing implementation. Conduct webinars, educational sessions, and Q&A sessions, and create self-learning tutorials to raise awareness of upcoming mandates, amendments, timelines, and regulatory updates.

Ensure your teams are familiar with the new workflow and e-invoicing system through demos and test transactions before going live. This focus on the human element acknowledges that even the most sophisticated e-invoicing solution will fail if employees are not adequately trained or do not understand the new workflows, making change management and continuous education critical success factors.

Step 10: Go Live and Continuously Monitor Performance

Once your e-invoicing system has been selected, integrated, and tested, proceed with live implementation of e-invoice generation and workflow. After going live, regularly monitor system performance to identify and resolve any errors or anomalies promptly.

Businesses cannot afford to wait for audits; they must implement internal processes to identify and correct errors efficiently, possibly leveraging ASP dashboards for real-time status. Ensure that your systems are updated regularly to align with evolving business needs and changing government regulations.

Beyond Compliance: Strategic Benefits of E-Invoicing for Your Business

While compliance is the immediate and compelling driver for adopting e-invoicing, proactive implementation offers substantial strategic advantages that can fundamentally transform business operations and improve profitability.

Significant Cost Savings and Operational Efficiency

One of the most compelling reasons to embrace e-invoicing is the potential for significant cost reduction. E-invoicing can lead to a substantial decrease in invoice processing costs, with some countries reporting reductions of up to 66%. These savings come from eliminating time-consuming manual tasks such as printing, scanning, data re-entry, and manual verification.

The introduction of a standardized format allows systems to automatically read, validate, and process data, accelerating every stage of the invoice lifecycle, from issuance and delivery to approval and archiving. This automation drastically reduces administrative overhead and minimizes the risk of errors, which can otherwise lead to costly delays or duplicate payments.

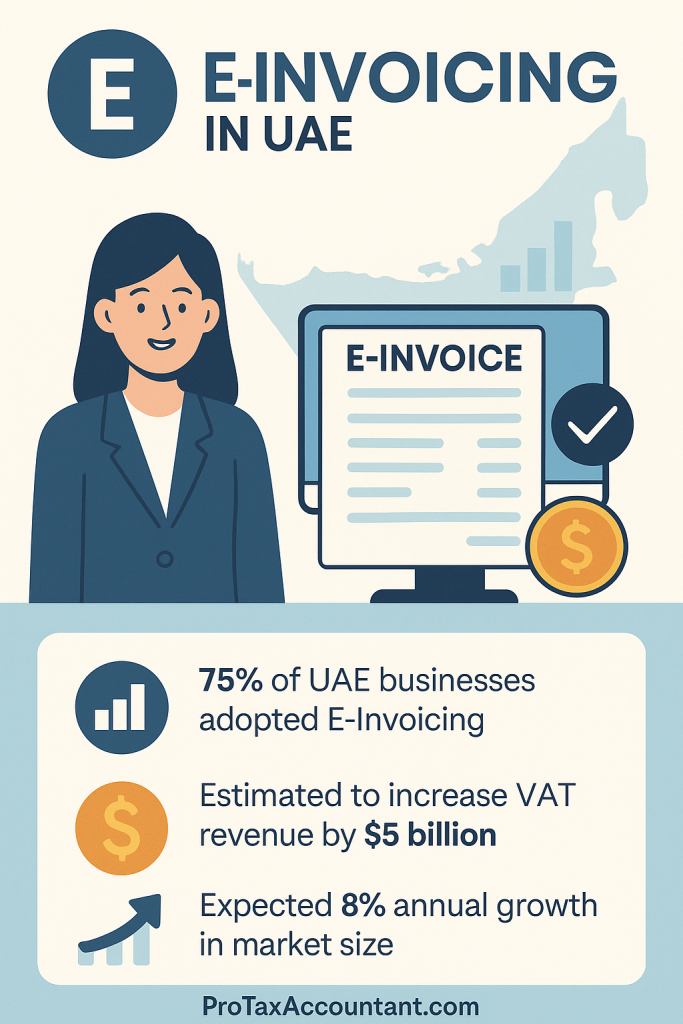

[Image: Infographic showing e-invoicing benefits]

Improved Cash Flow and Faster Payment Cycles

By standardizing and automating the invoice creation and exchange process, e-invoicing significantly reduces errors and ensures that invoices are delivered to buyers in near real-time.

This accelerated delivery and processing directly translates into faster payment cycles, which in turn leads to improved cash flow for businesses.

Enhanced Data Accuracy and Audit Readiness

Automating Accounts Receivable (AR) and Accounts Payable (AP) processes streamlines the entire invoicing lifecycle, from issuance to archiving. This automation dramatically reduces manual errors and significantly enhances tax data accuracy.

The system facilitates real-time data sharing with the FTA, ensuring accurate VAT reporting and improving overall transparency. Furthermore, e-invoicing strengthens audit and record-keeping capabilities by maintaining structured digital records that are easily accessible and verifiable.

Positioning Your Business for Digital Growth

Adopting e-invoicing aligns businesses with the UAE’s broader national goal of creating a fully digitized and innovative economy. It makes the latest technology accessible to businesses of all sizes, including the vast majority of micro-businesses in the UAE. The machine-readable format of e-invoices creates a wealth of opportunities for advanced data analysis and proactive decision-making.

This granular, real-time data can be leveraged for better financial analysis, demand forecasting, supplier management, and overall business intelligence, moving businesses beyond mere compliance to data-driven strategic planning. Organizations that act early stand to gain significant advantages not only in compliance but also in operational efficiency and cost savings, providing a competitive edge by optimizing processes and reaping benefits ahead of their competitors.

Avoiding Pitfalls: Common Mistakes and Penalties to Watch Out For

Non-compliance with VAT and the upcoming e-invoicing regulations can lead to significant financial penalties and operational disruptions. Being aware of common pitfalls is crucial for avoiding costly mistakes and maintaining a healthy financial standing.

VAT Registration and Invoicing Errors

Businesses frequently encounter issues related to VAT registration and invoicing:

-

- Uncertainty about VAT thresholds: Many businesses are unsure if they meet the mandatory or voluntary registration thresholds, leading to delays or incorrect assumptions about their obligations.

-

- Delays in registration: Failing to register for VAT within 30 days of becoming eligible incurs a steep penalty of AED 10,000.

-

- Incorrect VAT classification: Misapplying the correct VAT rate (standard, zero-rated, or exempt) on supplies can lead to incorrect tax calculations and compliance issues.

-

- Missing VAT details on invoices: Invoices lacking essential information such as the Tax Registration Number (TRN) or a clear breakdown of VAT can lead to non-compliance and rejected tax claims.

-

- Errors in invoice format: Incorrect structuring of VAT invoices, even if the data is correct, can result in issues during audits.

Late Filings and Payments: Understanding the Penalties

Strict deadlines apply to VAT filings and payments, and non-adherence carries significant penalties:

-

- Late VAT return filing: A penalty of AED 1,000 is imposed for the first offense, increasing to AED 2,000 for a repeat offense within 24 months.

-

- Late VAT payment: Penalties for late payment are tiered: 2% of the unpaid tax immediately after the due date, an additional 4% after 7 days, and a daily penalty of 1% after one month, capped at 300% of the unpaid tax.

- A common mistake, particularly among small businesses, is misusing collected VAT funds for other expenses, leading to liquidity issues when payment to the FTA is due.

Non-Compliant E-Invoices: Risks to Input VAT Recovery

The e-invoicing mandate introduces new layers of compliance, and non-adherence can have severe consequences, often compounding existing VAT penalties:

-

- Not issuing an e-invoice when required: This can lead to a penalty of AED 2,500, which doubles to AED 5,000 for repeat offenses.

-

- Failure to comply with e-invoicing conditions and procedures: This specifically includes not adhering to the digital format, structured data standards, or using an Accredited Service Provider. Each instance of non-compliance can incur a penalty of AED 2,500.

-

- Failure to maintain proper records: This carries a penalty of AED 10,000 for the first offense and AED 20,000 for repeat offenses. Businesses are required to keep all invoices, receipts, and tax returns for a minimum of five years.

-

- Incorrect or missing data: Beyond penalties, incorrect or missing data within an e-invoice can lead to its rejection by the ASP or FTA, directly blocking a business’s ability to recover input VAT. This has a direct negative impact on cash flow.

The penalties for e-invoicing non-compliance are explicitly linked to and often mirror existing VAT penalties. This creates a compounding effect: a single error, such as an improperly formatted e-invoice, can trigger multiple penalties (e.g., for non-issuance and for non-compliance with format).

This highlights that businesses need to be exceptionally diligent, as the financial risk of non-compliance is amplified by the interconnectedness of the e-invoicing and VAT frameworks. Furthermore, the system is designed to return invoices with errors to the issuer , requiring businesses to implement proactive internal processes to identify and correct errors promptly. This proactive stance is critical for maintaining cash flow by ensuring input VAT recovery and avoiding accumulating penalties.

Here is a summary of common VAT and e-invoicing penalties:

| Violation Type | Penalty Amount/Condition (AED) | Relevant Source/Article |

| Failure to register for VAT within 30 days | 10,000 | Cabinet Decision No. 49 of 2021 |

| Late VAT return filing | 1,000 (first offense), 2,000 (repeat within 24 months) | Cabinet Decision No. 49 of 2021 |

| Late VAT payment | 2% of unpaid tax (immediate), 4% after 7 days, 1% daily after 1 month (max 300%) | Cabinet Decision No. 49 of 2021 |

| Not issuing a tax invoice or e-invoice when required | 2,500 (first offense), 5,000 (repeat) | Cabinet Decision No. 49 of 2021 |

| Failure to comply with e-invoicing conditions/procedures | 2,500 (per instance) | Cabinet Decision No. 49 of 2021 |

| Failure to maintain proper records | 10,000 (first offense), 20,000 (repeat within 24 months) | Cabinet Decision No. 49 of 2021 |

Key Takeaways and Your Next Steps

The shift to mandatory e-invoicing in the UAE by July 2026 is a significant milestone in the nation’s digital journey. It represents a strategic opportunity for businesses to not only ensure compliance but also to unlock substantial operational efficiencies and cost savings.

Summary of Critical Actions for Immediate Attention

To navigate this transition successfully, businesses should focus on these critical actions:

-

- Understand the Mandate: Recognize that e-invoicing will be mandatory for B2B and B2G transactions from July 2026, and this includes businesses that are not VAT registered but issue professional invoices.

-

- Embrace Structured Data: Move away from traditional PDFs and paper invoices towards machine-readable XML or JSON formats, adhering to the PINT AE standard.

-

- Partner with an ASP: This is a non-negotiable requirement. Businesses cannot send invoices directly to the FTA; an Accredited Service Provider is essential.

-

- Clean Your Data: Proactively update and verify all master data (supplier and customer details, TRNs, addresses) to meet the new mandatory field requirements for e-invoices. This data cleansing and enrichment is a significant pre-implementation task that will prevent future rejections.

-

- Integrate Systems: Ensure that your existing ERP or accounting software can seamlessly connect and communicate with your chosen ASP. This integration is crucial for real-time, error-free data flow that minimizes disruption to current workflows.

-

- Train Your Team: Prepare your finance, IT, and sales teams for the new processes, workflows, and regulatory updates through comprehensive training and educational sessions. The success of this digital transformation heavily relies on the human element and their adaptation to new systems.

When to Seek Expert Advice

While this guide provides a comprehensive overview, the complexity of tax regulations and system integrations means that expert advice can be invaluable. Businesses should consider seeking professional guidance if:

-

- Their current invoicing systems are complex, outdated, or not readily compatible with new digital formats.

-

- They are unsure about the specific requirements for master data updates or the categorization of various transaction types under the new e-invoicing framework.

-

- They need assistance in selecting the right Accredited Service Provider and ensuring seamless integration with their existing IT infrastructure.

-

- They face complex VAT scenarios, such as intricate cross-border transactions, reverse charge mechanisms, or specific industry-related VAT treatments.

-

- They require assurance of full compliance and wish to proactively avoid potential penalties and operational disruptions.

The phased rollout, accreditation processes, and data dictionary releases indicate that preparation for e-invoicing is a multi-stage process that has already begun. The strong recommendation for “early and thorough planning” and “early engagement with an ASP” reinforces that businesses should not delay.

Waiting until 2026 will likely lead to rushed, error-prone implementations and potential penalties, causing businesses to miss out on the strategic benefits of proactive adoption. This transition is not merely an IT project or a tax compliance task; it is a holistic business transformation that requires cross-functional collaboration and a top-down commitment, recognizing that the benefits extend far beyond simply meeting a regulatory requirement.