If you’re considering doing business in the UAE, understanding corporate tax registration costs is crucial. With the introduction of a corporate tax in the UAE, businesses must navigate a new tax landscape that can impact their profitability and operations.

In this blog, we’ll break down everything you need to know about the corporate tax registration cost in the UAE, from the basic registration process to key considerations and frequently asked questions.

Whether you’re a startup, small business, or large corporation, this guide will help you understand the nuances of corporate tax registration, why it’s important, and how to budget for it. So, let’s dive in!

What is Corporate Tax in the UAE?

Corporate tax in the UAE is a tax imposed on the income or profits of companies operating within the country. The UAE introduced this tax to diversify its revenue sources beyond oil and gas and to align with international tax standards.

The tax applies to both local and foreign businesses, but there are exemptions and rates that vary based on the nature and scale of the business.

The new tax system in the UAE was introduced on June 1, 2023, with a flat rate of 9% for businesses making profits above AED 375,000.

This progressive tax system is designed to ensure that businesses with higher profits contribute proportionally more to the economy, while smaller businesses and startups benefit from lower rates.

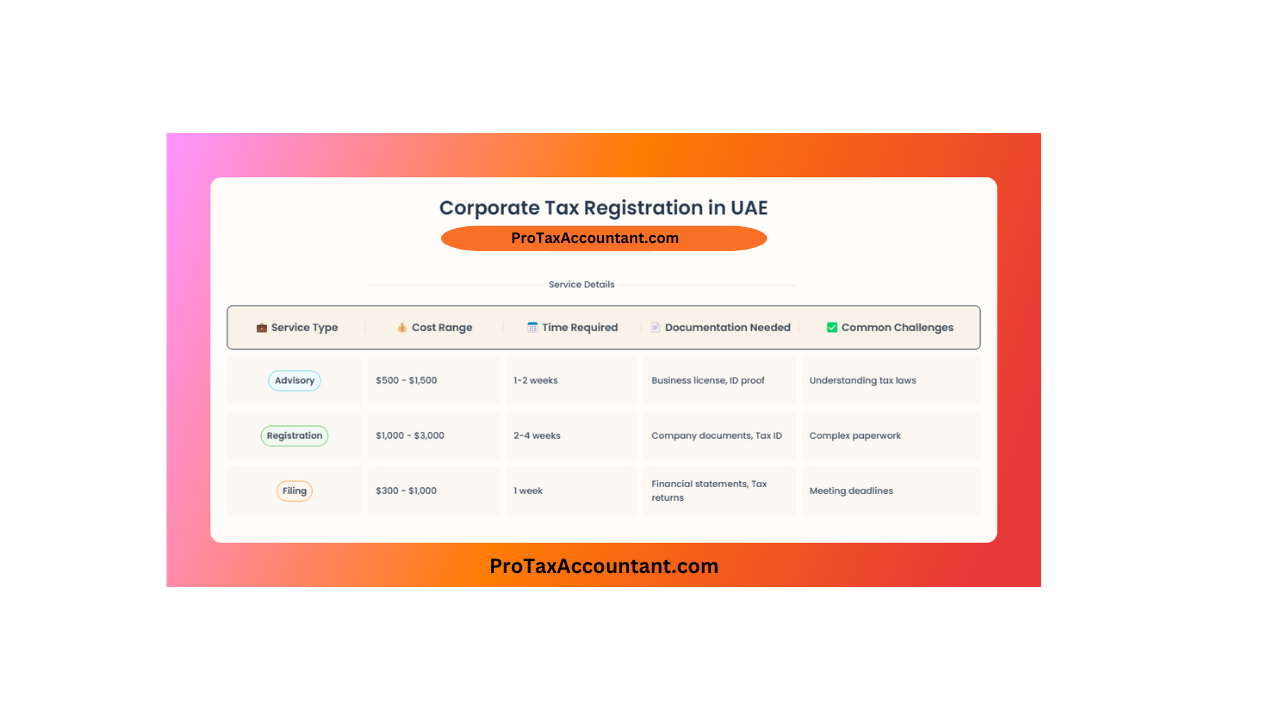

Key Points on Corporate Tax Registration Cost

1. Initial Registration Fees

When registering for corporate tax in the UAE, businesses must pay an initial registration fee to the Federal Tax Authority (FTA). This is a one-time cost required for all companies to register with the FTA, enabling them to obtain a Tax Registration Number (TRN).

The cost of registration typically ranges from AED 300 to AED 1,000, depending on the business structure and its location.

2. Annual Filing Costs

After the initial registration, companies must file their corporate tax returns annually. The cost of annual tax filing varies depending on the complexity of the company’s financials. Businesses typically incur fees for accounting services, audit reports, and other advisory services to comply with tax filing requirements.

These costs can range from AED 2,000 to AED 10,000 or more, depending on the size and complexity of the business.

3. VAT Registration (If Applicable)

Some businesses, particularly those involved in the import or sale of goods, may need to register for VAT as well. Although VAT registration is separate from corporate tax registration, it is an important consideration for businesses operating in the UAE.

VAT registration costs can range from AED 300 to AED 1,000, depending on whether you use a consultant or handle the process independently.

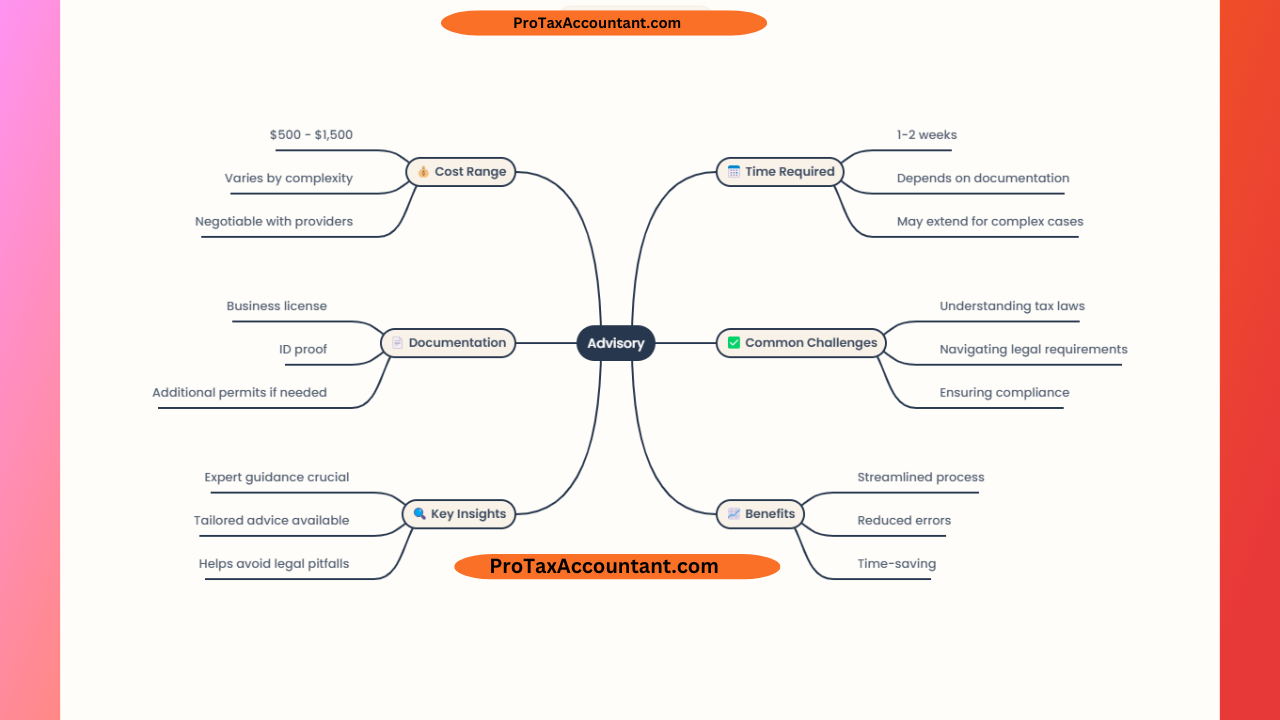

4. Tax Advisory Services

Navigating the corporate tax registration process can be complicated for many businesses. As a result, many opt to hire tax advisory services to help with the registration process, filing returns, and ensuring compliance with the tax laws.

Tax consultants in the UAE typically charge fees that range from AED 2,000 to AED 8,000 per year, depending on the level of service and the size of your business.

5. Penalties for Non-Compliance

Failing to comply with corporate tax registration and filing deadlines can lead to penalties. The UAE government imposes fines for late registrations, missed filing deadlines, and incorrect tax filings.

These penalties can be substantial, with fines ranging from AED 1,000 to AED 50,000, depending on the nature and severity of the violation.

Why is Corporate Tax Registration Important for UAE Businesses?

1. Legal Requirement

Under UAE law, every company operating in the country is required to register for corporate tax if it meets the necessary criteria. Failure to do so can result in fines and legal issues, which can jeopardize the business’s ability to operate.

2. Ensuring Compliance

By registering for corporate tax, businesses ensure that they comply with UAE tax laws and regulations. This helps avoid potential audits and investigations by the Federal Tax Authority (FTA), which can lead to significant financial and reputational damage.

3. Building Trust

Proper tax registration demonstrates a company’s commitment to compliance and corporate responsibility. This is especially important for businesses that engage with international clients, as many countries have tax treaties and agreements that require transparency in financial dealings.

4. Avoiding Penalties

As mentioned earlier, businesses that fail to comply with tax registration requirements face penalties. By registering on time and filing returns accurately, businesses avoid costly fines and legal complications, allowing them to focus on growing their operations.

FAQs about Corporate Tax Registration Cost in the UAE

1. How much does it cost to register for corporate tax in the UAE?

The initial registration fee for corporate tax in the UAE typically ranges from AED 300 to AED 1,000. However, businesses may incur additional costs for VAT registration, accounting, audit services, and tax advisory.

2. Are there any exceptions for small businesses?

Yes, small businesses with annual profits below AED 375,000 are exempt from corporate tax under the current system. However, they must still register with the Federal Tax Authority for record-keeping and regulatory purposes.

3. How often do businesses need to file tax returns?

Corporate tax returns must be filed annually. The FTA sets deadlines for tax filing, and businesses must adhere to these deadlines to avoid penalties.

4. Can businesses use external consultants for tax registration?

Yes, many businesses hire tax consultants to help with corporate tax registration, filing, and compliance. Consultants charge fees depending on the complexity of the business, but their services can save time and reduce the risk of errors.

5. What happens if a business misses the registration deadline?

Businesses that fail to register for corporate tax by the deadline may face fines ranging from AED 1,000 to AED 50,000. The severity of the fine depends on the nature of the violation.

6. Do I need to register for VAT as well?

If your business involves the sale of taxable goods or services and meets the mandatory VAT threshold (AED 375,000 in annual taxable supplies), you will need to register for VAT.

VAT registration is separate from corporate tax registration but must be completed to ensure compliance with UAE tax laws.

Tips for Managing Corporate Tax Registration Costs

1. Hire a Qualified Tax Consultant

Hiring a qualified tax consultant can help you streamline the corporate tax registration process and avoid costly mistakes. A consultant will ensure that your business complies with the regulations and help you navigate the complexities of tax filing.

2. Plan for Annual Filing Costs

To avoid surprises, factor in the annual costs associated with tax filing when budgeting for your business. Ensure you have funds set aside for accounting services, audit reports, and any advisory services you may need.

3. Keep Your Records Organized

Keeping accurate financial records throughout the year will make tax registration and filing much easier. By staying organized, you can avoid last-minute rushes and ensure that your tax returns are filed correctly and on time.

4. Take Advantage of Tax Exemptions

If your business is a small startup with profits below AED 375,000, you may qualify for tax exemptions. Be sure to check your eligibility and ensure that you are taking full advantage of any available exemptions to reduce costs.

5. File On Time

To avoid penalties, always file your corporate tax returns on time. If you’re unsure about deadlines, consult with a tax expert to stay ahead of the curve.

Conclusion

Corporate tax registration in the UAE is a significant part of doing business in the country. By understanding the costs involved and ensuring compliance with tax regulations, businesses can avoid penalties and build a solid foundation for success.

Whether you’re a small business or a multinational corporation, registering for corporate tax is essential for operating legally in the UAE.

The cost of corporate tax registration is relatively affordable, especially when compared to the penalties for non-compliance.

By budgeting for registration and annual filing costs and seeking professional guidance when needed, businesses can make this process seamless and cost-effective.