Value Added Tax (VAT) is a key aspect of doing business in the UAE, and VAT registration is a mandatory step for businesses that meet specific thresholds.

If you’re running a business in the UAE or planning to start one, understanding the VAT registration process is crucial for compliance and for taking advantage of tax benefits.

In this guide, we’ll walk you through the requirements, process, documentation, and even voluntary registration options.

What is VAT Registration?

VAT registration is the process by which a business registers itself with the UAE’s Federal Tax Authority (FTA) to comply with VAT laws.

Registered businesses collect VAT from customers on taxable goods and services, and they can recover VAT paid on their expenses, also known as input tax.

VAT Registration Thresholds

Mandatory Registration

Businesses must register for VAT if:

- Their taxable supplies and imports exceed AED 375,000 in the past 12 months.

- They expect to exceed this threshold within the next 30 days.

This requirement ensures that businesses contribute to the UAE’s tax system based on their scale of operations.

Voluntary Registration

Smaller businesses and startups can opt for voluntary VAT registration if:

- Their taxable supplies, imports, or taxable expenses exceed AED 187,500.

Voluntary registration is an excellent option for businesses that are below the mandatory threshold but want to recover input VAT and establish credibility.

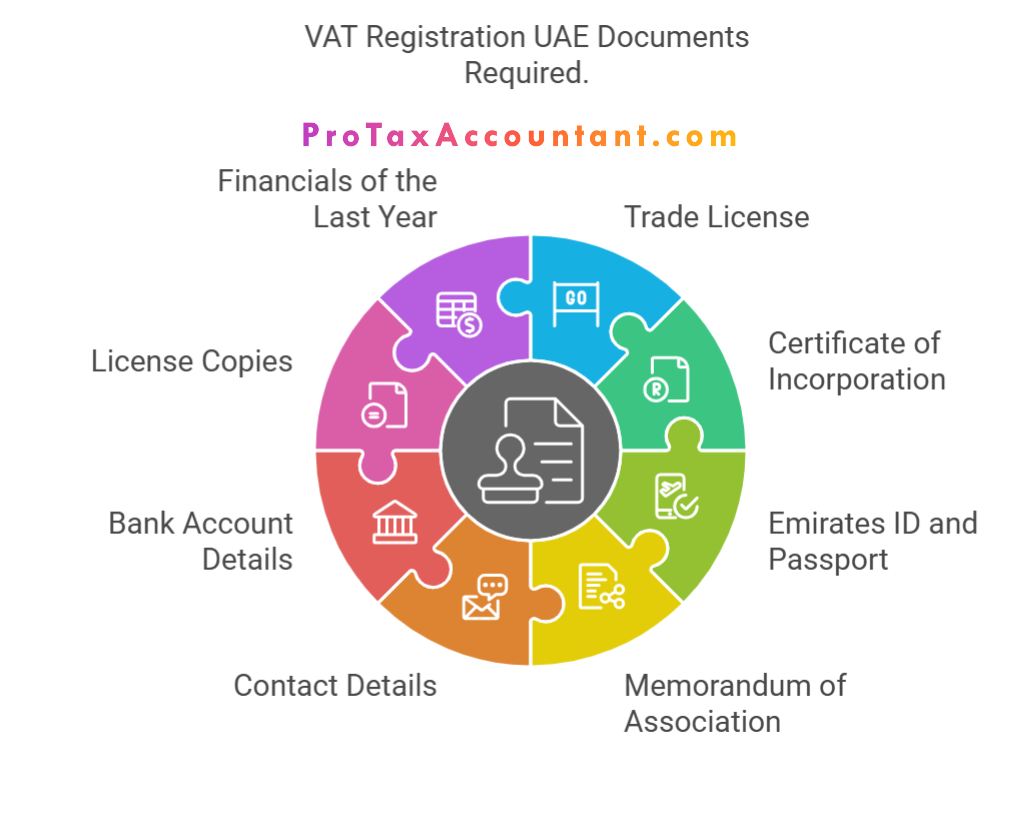

Essential Documents for VAT Registration

To complete VAT registration, you’ll need to prepare the following documents:

| Document | Requirement |

|---|---|

| Trade License | Valid and unexpired |

| Passport Copies | For all owners, shareholders, and managers |

| Emirates ID Copies | For all owners, shareholders, and managers |

| Company Address | P.O. Box and complete business address |

| Memorandum of Association (MOA) | Not required for sole establishments |

| Bank Details | Active company bank account information |

| Turnover Declaration | Signed and stamped on company letterhead |

| Sample Invoices | Sales or purchase invoices (signed and stamped) |

| Customs Department Letter | If applicable |

Having your documents prepared beforehand ensures a smooth application process.

VAT Registration Process

Eligibility Check

Determine whether your business qualifies for mandatory or voluntary VAT registration.

Document Preparation

Collect all required documents, ensuring they are accurate and up-to-date.

FTA Account Creation

Create an e-service account on the Federal Tax Authority (FTA) portal.

Form Completion

Log in to your FTA account and fill out the VAT registration form with all required business details.

Application Submission

Review the form thoroughly and submit it online.

Supporting Documentation

If the FTA requests additional documents, provide them promptly.

Application Review and Approval

The FTA reviews your application, and once approved, issues a Tax Registration Number (TRN). This process typically takes 2-3 weeks.

For step-by-step guidance, check out how-to guide on VAT registration.

Tax Group Registration

If an individual owns more than 50% shares in multiple companies, they may qualify for Tax Group Registration, provided that:

- All members are legal persons and UAE residents.

- None of the members belong to another Tax Group.

- The representative company has a TRN or applies for VAT registration when submitting a group application.

This setup simplifies tax reporting for businesses with interconnected entities.

Benefits of VAT Registration

Registering for VAT offers several advantages:

- Legal Compliance: Avoid penalties for non-registration and adhere to UAE tax laws.

- Input VAT Recovery: Claim back the VAT paid on business expenses.

- Business Credibility: Enhance your company’s reputation with customers and partners.

For tips on maximizing tax benefits, explore our VAT consultancy services.

Importance of Professional Assistance

Navigating VAT registration can be complex, especially for new businesses. Partnering with experts like ProTax Accountant ensures accuracy and compliance, saving you time and avoiding potential errors.

Final Thoughts

VAT registration is not just a legal obligation but also an opportunity to streamline your business finances. Whether you’re meeting the mandatory threshold or considering voluntary registration, understanding the process is essential.

Need help with VAT registration? Contact ProTax Accountant today for professional guidance tailored to your business needs.

Also Read:

Stay compliant and unlock your business’s potential in the UAE!