Understanding VAT compliance and designated free zones in the UAE is crucial for businesses operating in these areas. The UAE government has outlined specific zones where special VAT rules apply, distinguishing them from regular free zones.

In this guide, we’ll explore the designated free zones in the UAE, their benefits, and what makes them unique.

What Is a Designated Free Zone in UAE?

A designated zone is a special type of free zone where VAT (Value Added Tax) is treated differently from the rest of the UAE territory. Although supplies of goods and services in the UAE are subject to VAT, designated free zones are treated as being outside the UAE for VAT purposes.

This means:

-

- VAT Exemptions: Supplies made within or to and from these zones are VAT-free (with certain exceptions).

-

- Exclusive Regulations: Specific criteria and cabinet decisions dictate the treatment of VAT in these zones.

For detailed VAT payment guidelines, check out our guide on how to make VAT payment in UAE.

How to Identify a Designated Zone in UAE?

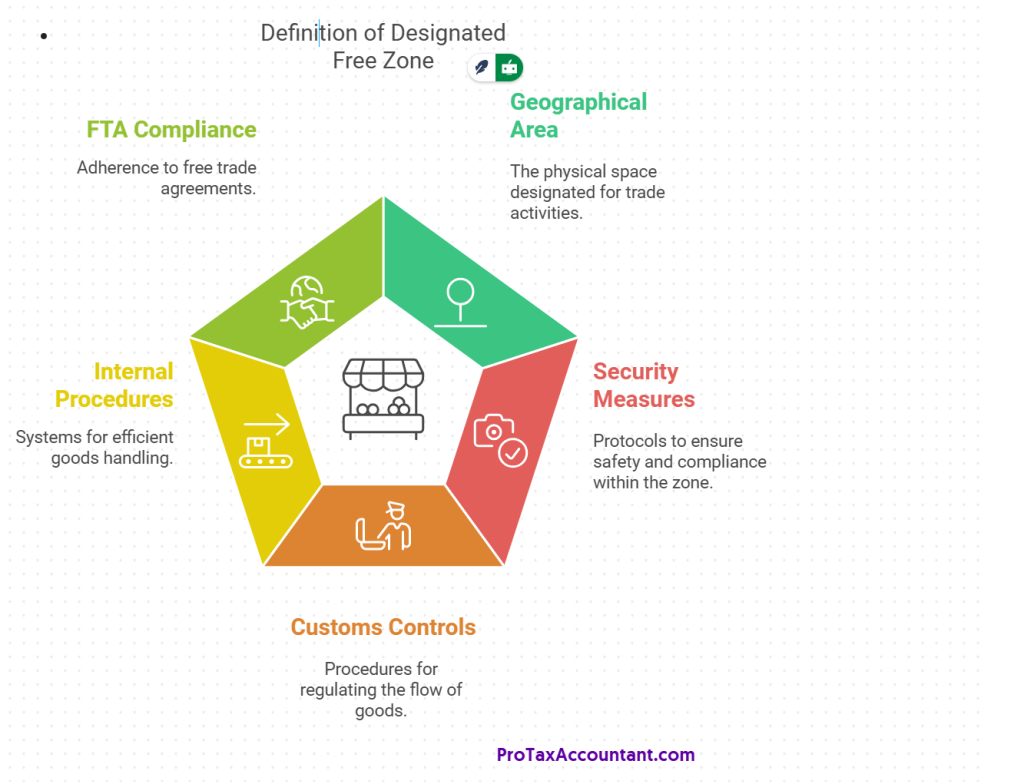

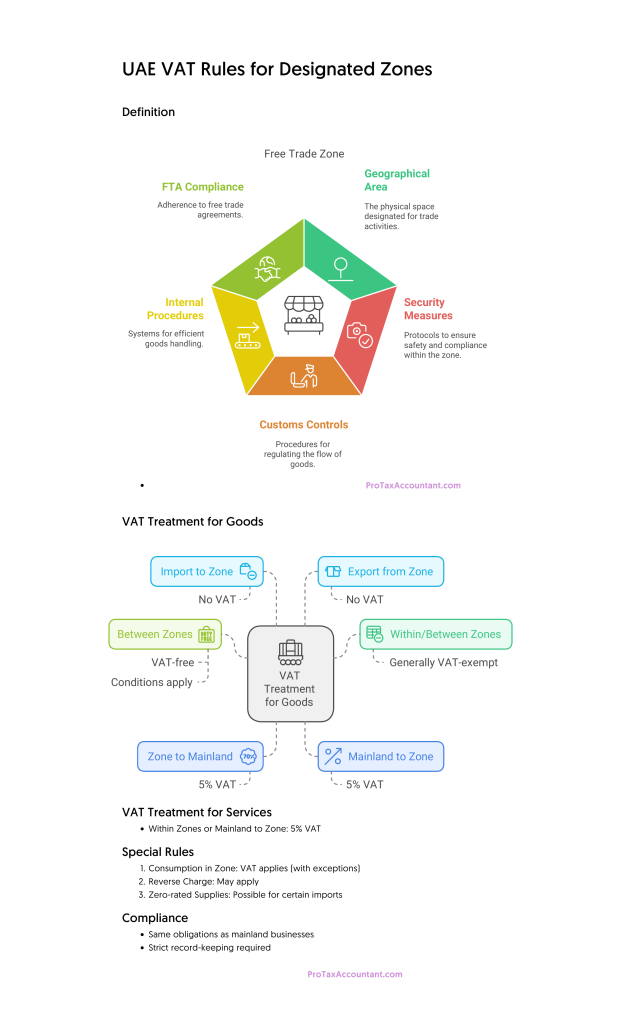

Not all free zones qualify as designated zones. Designated zones in the UAE are areas considered outside the UAE territory for VAT purposes. To qualify as a designated zone, an area must:

-

- Be a fenced geographical area

-

- Have security measures and customs controls for monitoring entry/exit of people and goods

-

- Have internal procedures for storing, retrieving, and processing goods

-

- Comply with FTA regulations

VAT Treatment for Designated Free Zones in UAE:

VAT Treatment for Goods

-

- Supply within or between designated zones:

-

- Generally exempt from VAT

-

- Exception: Goods consumed within the designated zone are subject to VAT

-

- Supply within or between designated zones:

-

- Supply from designated zone to UAE mainland:

-

- Subject to 5% VAT

-

- Supply from designated zone to UAE mainland:

-

- Supply from UAE mainland to designated zone:

-

- Subject to 5% VAT

-

- Supply from UAE mainland to designated zone:

-

- Import from outside UAE to designated zone:

-

- Considered outside UAE VAT territory, no VAT applied

-

- Import from outside UAE to designated zone:

-

- Export from designated zone to outside UAE:

-

- Considered outside UAE VAT territory, no VAT applied

-

- Export from designated zone to outside UAE:

-

- Transfer between designated zones:

-

- VAT-free if:

a) Goods are not altered or used during transfer

b) Transfer follows GCC common customs law

c) Owner provides monetary guarantee to the Authority

- VAT-free if:

-

- Transfer between designated zones:

VAT Treatment for Services

-

- Services supplied within designated zones or from the mainland to designated zones:

-

- Subject to 5% VAT

-

- Services supplied within designated zones or from the mainland to designated zones:

Special Rules

-

- Consumption within designated zone:

-

- Goods consumed within the zone are subject to VAT

-

- Exceptions:

a) Goods for resale

b) Goods incorporated into other goods not consumed in the zone

c) Goods used in production of other goods not consumed in the zone

- Exceptions:

-

- Consumption within designated zone:

-

- Reverse charge mechanism:

-

- May apply when supplier is in a designated zone or outside UAE

-

- Reverse charge mechanism:

-

- Zero-rated supplies:

-

- Some goods imported from designated zones to UAE or other countries may be zero-rated

-

- Zero-rated supplies:

Compliance Requirements

-

- Businesses in designated zones have the same VAT obligations as mainland businesses:

-

- May need to register for VAT, file returns, and pay VAT

-

- Eligible for VAT grouping with other UAE businesses

-

- Businesses in designated zones have the same VAT obligations as mainland businesses:

-

- Strict record-keeping is required to prove eligibility for VAT exemptions or zero-rating

Understanding these rules is crucial for businesses operating in or trading with UAE designated zones to ensure proper VAT compliance and take advantage of potential benefits.

List of Designated Free Zones in the UAE

The UAE Cabinet Decision No. 59 outlines the following designated zones:

Abu Dhabi

Dubai

For more details on Dubai’s top free zones, check our article on the best free zones in the UAE for business setup.

Sharjah

Ajman

Umm Al Quwain

Ras Al Khaimah

Fujairah

Why Choose a Designated Zone for Your Business?

Setting up a business in a designated zone offers several advantages, especially for industries dealing with goods trade.

-

- Tax Savings: VAT exemptions reduce operational costs significantly.

-

- Ease of Trade: Simplified customs processes enhance logistics efficiency.

-

- Regulatory Benefits: Businesses can operate under a more flexible framework compared to standard zones.

Interested in starting a business in Dubai? Check out our ultimate business setup guide in Dubai.

Compliance and Records for Businesses

Businesses operating in designated zones must maintain strict compliance with VAT laws. Detailed records of transactions, goods movement, and VAT filings are essential. Non-compliance can lead to penalties.

For bookkeeping support, consider affordable virtual bookkeeping services.

Final Thoughts

Designated free zones in the UAE provide unique opportunities for businesses to benefit from tax advantages while operating in a globally connected environment.

Whether you’re looking to start a new venture or expand your existing operations, understanding the rules of these zones is key to success.

For professional guidance on VAT compliance or corporate tax requirements, reach out to experts like ProTax Accountant.

More for You.

Boost your knowledge and make informed decisions for your business today!