Navigating the Complex World of Banking Documents

In personal and business finance, two often misunderstood documents that stand out are receipt and slip, but Is check receipt same as a deposit slip.

These seemingly simple pieces of paper hold significant importance in managing financial transactions, yet many people struggle to distinguish between them.

This comprehensive guide will unravel the mysteries surrounding these documents, providing you with an in-depth understanding that goes far beyond surface-level knowledge.

The Financial Literacy Crisis

Did you know that approximately 66% of Americans struggle with basic financial document comprehension?

This staggering statistic highlights the critical need for clear, accessible information about banking documents.

By the end of this article, you’ll be equipped with the knowledge to confidently navigate check receipts and deposit slips like a financial expert.

Check Receipts Explained

What Exactly Are Check Receipts?

A check receipt is much more than a simple piece of paper. It’s a crucial document that serves as an official record of a financial transaction.

Let’s break down its comprehensive components:

Detailed Components of a Check Receipt:

- Transaction Metadata

- Precise date and time of transaction

- Exact location or branch of the transaction

- Transaction identification number

- Financial Details

- Complete check amount

- Specific check number

- Routing and account numbers (partially masked for security)

- Type of transaction (deposit, cash, transfer)

- Verification Elements

- Bank logo and official stamp

- Unique transaction code

- Authorized signature or digital verification

The Legal and Financial Significance of Check Receipts

Check receipts are not just casual documentation. They serve critical purposes:

- Legal Proof: Admissible evidence in financial disputes

- Tax Documentation: Essential for accurate income and expense tracking

- Financial Audit Trail: Provides a chronological record of transactions

- Fraud Protection: Helps identify and resolve unauthorized transactions

Comprehensive Understanding of Deposit Slips

What Are Deposit Slips and Why Do They Matter?

A deposit slip is a strategic financial instrument that communicates explicit instructions to your bank about how to process your deposit. It’s far more than a simple form – it’s a critical communication tool in your banking ecosystem.

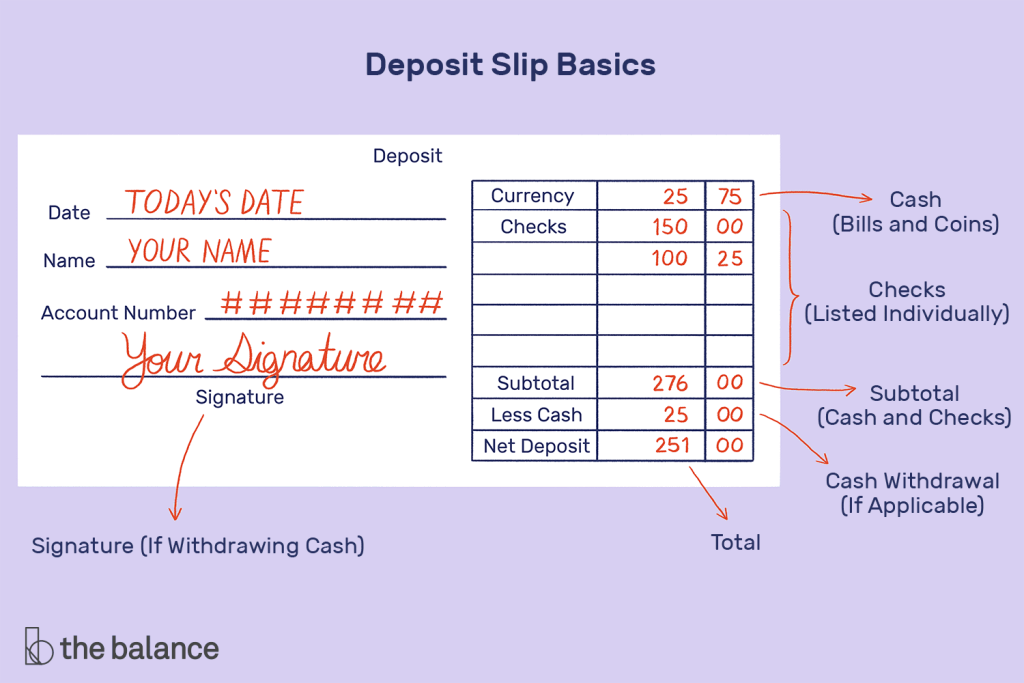

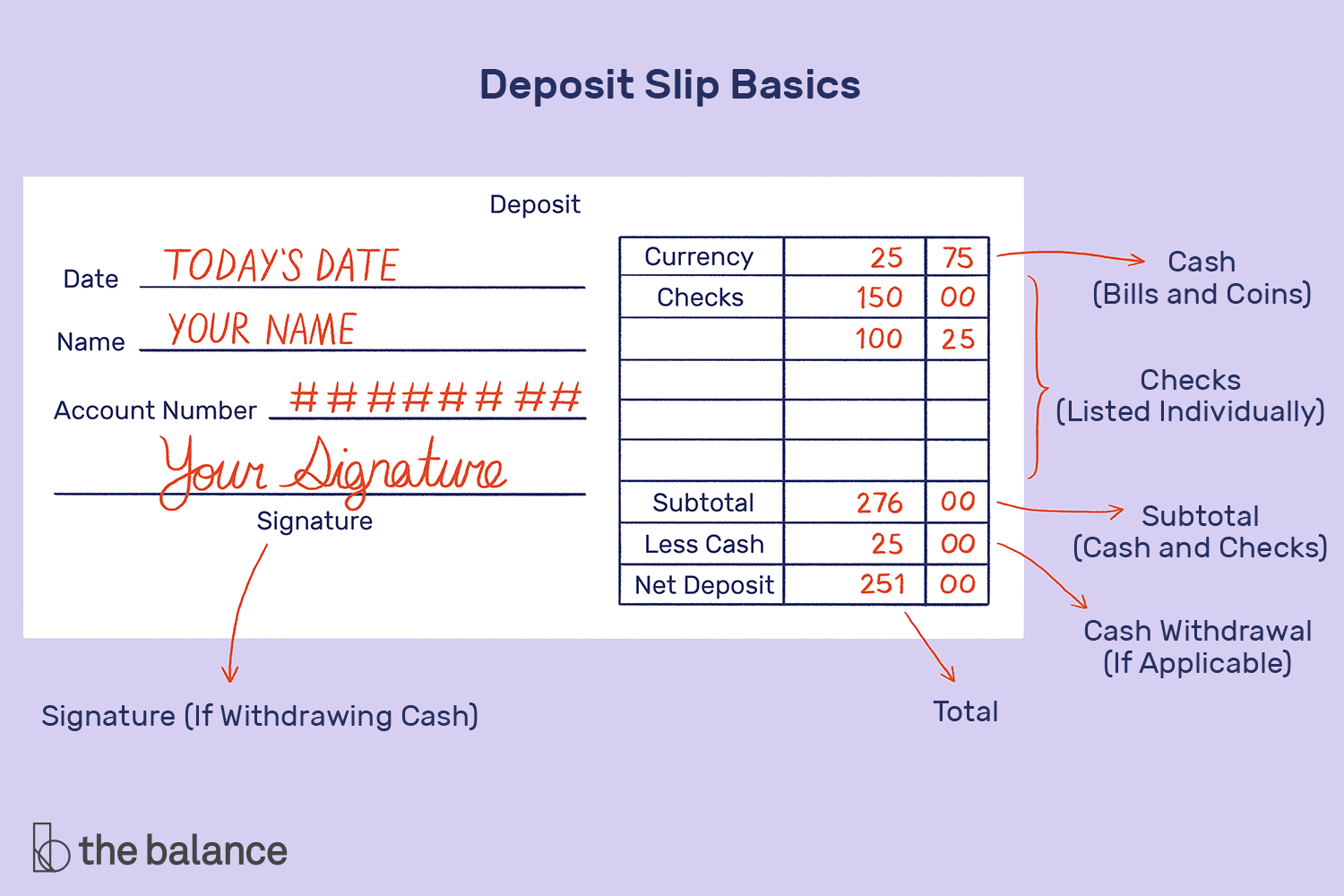

Anatomy of a Comprehensive Deposit Slip:

- Personal Information Section

- Full name

- Account number

- Contact information

- Date of deposit

- Detailed Deposit Breakdown

- Cash amount

- Individual check amounts

- Check numbers

- Total deposit amount

- Banking Infrastructure Details

- Bank routing number

- Branch identification

- Deposit type (checking, savings, money market)

The Strategic Importance of Accurate Deposit Slips

Precision is paramount when completing a deposit slip. Even minor errors can lead to:

- Delayed fund processing

- Incorrect account crediting

- Potential banking fees

- Unnecessary administrative complications

Definitive Comparison: Check Receipts vs. Deposit Slips

Forensic Breakdown of Key Differences

| Characteristic | Check Receipt | Deposit Slip |

|---|

| Primary Purpose | Transaction proof | Deposit instructions |

| Timing of Issuance | After transaction | Before/during deposit |

| Legal Standing | Verification document | Transactional directive |

| Information Focus | Transaction details | Deposit specifics |

Advanced Misconceptions and Myth-Busting

Top 5 Dangerous Myths Debunked

Myth: Check receipts and deposit slips are the same thing

Reality: They serve entirely different, complementary functions

Myth: Digital banking eliminates the need for these documents

Reality: Physical and digital records remain crucial for comprehensive financial management

Myth: Anyone can fill out these documents without careful consideration

Reality: Precision is critical to prevent financial errors

Myth: Only banks care about these documents

Reality: Businesses, tax authorities, and legal entities rely on them

Myth: These documents are becoming obsolete

Reality: They remain fundamental to financial record-keeping

Expert-Level Strategies

7 Professional Tips for Document Management

- Digitization

- Scan and backup all important financial documents

- Use secure, encrypted cloud storage

- Maintain both digital and physical copies

- Organizational System

- Create a dedicated filing system

- Use chronological and categorical sorting

- Implement a consistent labeling method

- Security Protocols

- Redact sensitive information before disposal

- Use cross-cut shredders for physical documents

- Enable two-factor authentication for digital financial platforms

- Regular Reconciliation

- Monthly review of all financial documents

- Cross-reference bank statements with personal records

- Identify and resolve discrepancies immediately

- Technology Integration

- Leverage banking apps with document scanning features

- Use financial management software

- Set up automatic transaction tracking

- Continuous Learning

- Stay updated on banking regulations

- Attend financial literacy workshops

- Follow reputable financial education resources

- Proactive Communication

- Maintain open dialogue with banking representatives

- Ask questions about document processes

- Seek clarification on complex financial matters

Real-World Application:

Sarah’s Financial Journey: From Confusion to Mastery

Sarah, a freelance graphic designer, transformed her financial management by understanding these documents:

Before Understanding

- Missed deposit confirmations

- Inconsistent record-keeping

- Frequent banking errors

After Implementing Strategies

- Systematic document management

- Reduced banking mistakes

- Improved financial confidence

- Streamlined tax preparation

Technological Evolution and Future Outlook

The Digital Transformation of Financial

Documentation

As financial technology advances, we’re witnessing a fascinating evolution:

- AI-powered document verification

- Blockchain-based transaction records

- Enhanced security protocols

- Seamless multi-platform integration

Conclusion:

Empowerment Through Knowledge

Understanding check receipts and deposit slips is more than a technical skill—it’s a gateway to financial empowerment.

By mastering these documents, you’re not just managing papers; you’re taking control of your financial narrative.

You can also read my article on how to understand the most confused financial topics.