Are your financial reports showing unexpected variances? Understanding the reasons behind those variances and taking prompt action can significantly boost your business’s efficiency and profitability.

In this blog, we’ll explore variance analysis in detail, breaking down its importance, common variances businesses face, and actionable strategies for addressing them.

📊 What is Variance Analysis?

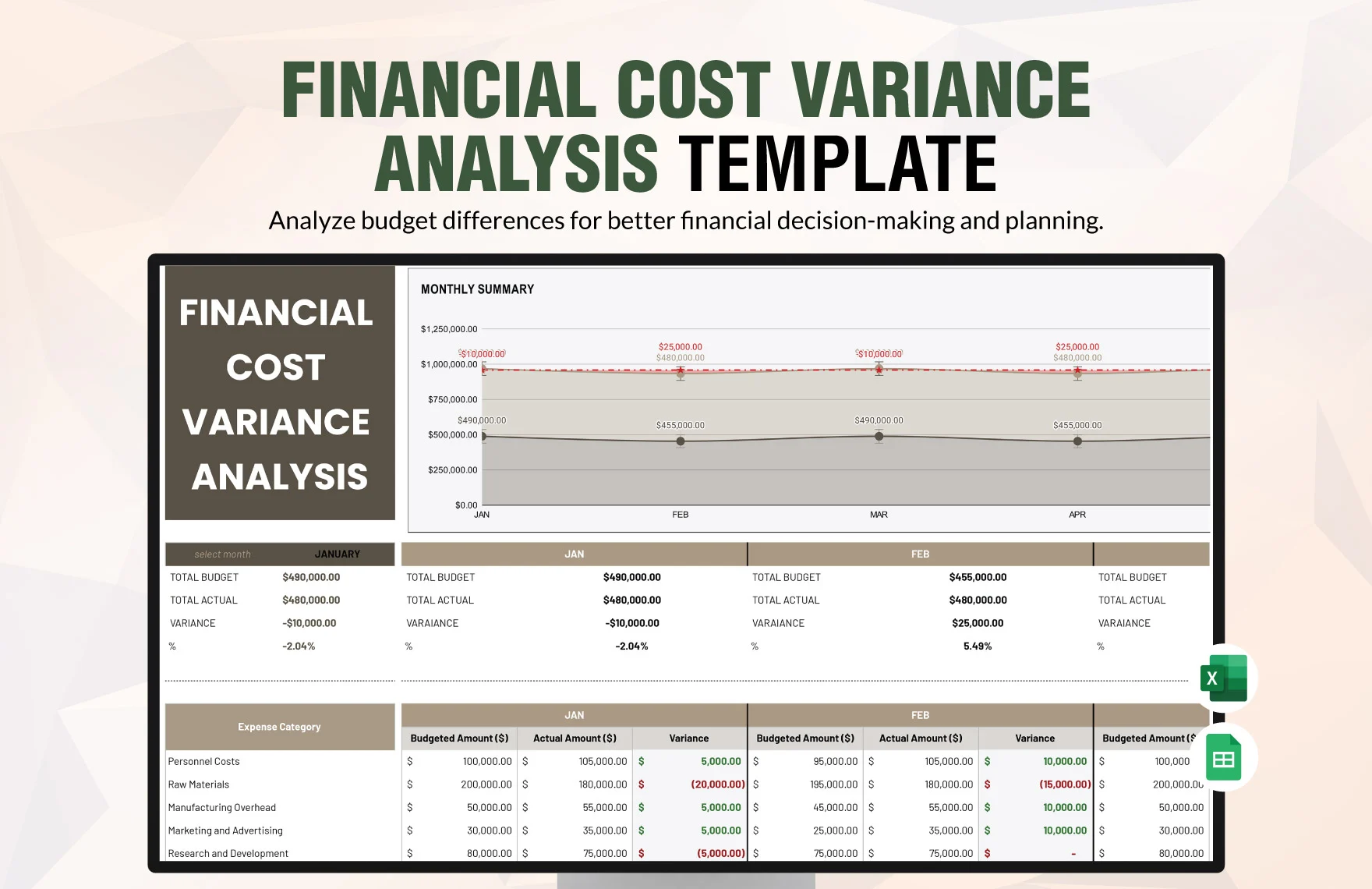

Variance analysis is a technique used by businesses to compare actual performance against budgeted targets.

It highlights areas where the company overperformed or fell short.

By analyzing these variances, you can pinpoint inefficiencies and opportunities for improvement across key business areas.

Why is Variance Analysis Important?

Identifies Performance Trends:

By comparing actual results with expected results over time, variance analysis helps businesses identify areas of strength and weakness.

Improves Budgeting Accuracy:

Analyzing discrepancies between actual and expected results can enhance future budgeting processes.

Monitors Business Performance:

It allows businesses to keep tabs on financial performance and address any issues proactively.

Controls Costs:

Variance analysis helps identify areas of overspending or underspending.

Informs Decision-Making:

It provides critical insights that guide strategic decisions.

“Variance analysis is crucial for monitoring financial performance and making informed decisions.” – Wafeq

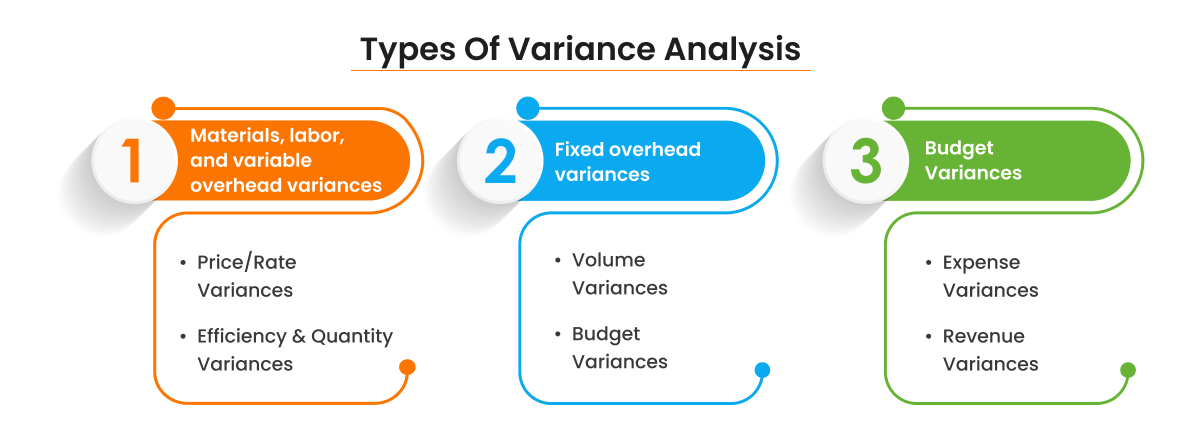

💡 Common Variances Businesses Face

Below are common variances businesses often encounter, along with insights into their causes and actionable strategies for addressing them:

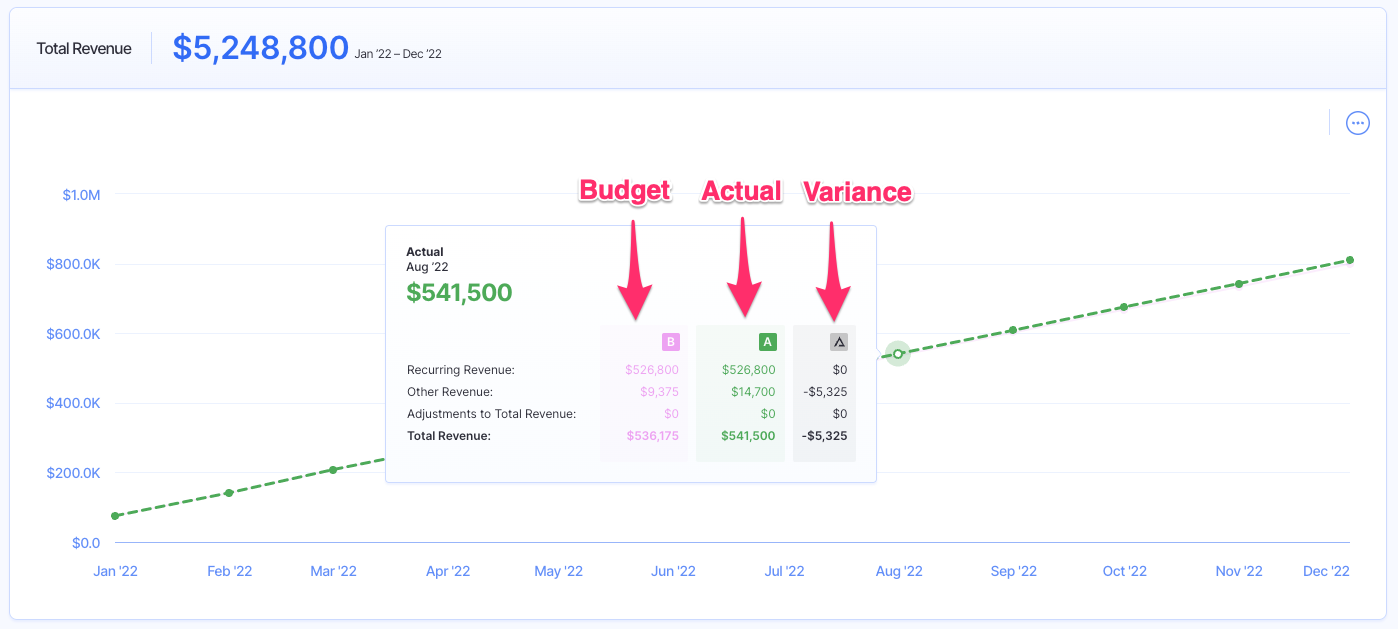

Revenue Variance

What It Is:

This variance occurs when actual revenue differs from the forecasted revenue.

Example:

If your actual revenue came in 10% below forecast due to reduced customer demand, you might have expected AED 100,000 but only received AED 90,000.

Action:

-

- Adjust forecasts based on current market conditions.

-

- Launch targeted promotions to attract more customers.

-

- Explore new customer segments to diversify your revenue streams.

COGS Variance

What It Is:

Cost of Goods Sold (COGS) variance arises when the cost of producing goods differs from what was budgeted.

Example:

If COGS increased 5% beyond the budget because of unforeseen supplier price hikes, you might have planned for AED 50,000 but ended up spending AED 52,500.

Action:

-

- Negotiate better terms with suppliers.

-

- Lock in favorable contracts to avoid future price increases.

-

- Explore alternative suppliers to reduce costs.

Gross Margin Variance

What It Is:

This variance indicates a change in gross profit margin compared to what was expected.

Example:

If your gross margin dropped by 3% largely due to discounts given during promotions, you may have initially aimed for a gross margin of 40%, but it fell to 37%.

Action:

-

- Refine discounting strategies by optimizing the timing and targeting of promotions.

-

- Balance revenue generation with maintaining healthy margins.

Operating Expenses Variance

What It Is:

Operating expenses variance occurs when actual operating expenses exceed budgeted amounts.

Example:

If operating expenses exceeded budget by 7%, primarily due to overspending on marketing campaigns, you might have budgeted AED 30,000 but spent AED 32,100.

Action:

-

- Evaluate marketing ROI to determine effectiveness.

-

- Adjust the spending mix based on performance metrics.

-

- Establish stricter budget controls moving forward.

CapEx Variance

What It Is:

Capital Expenditures (CapEx) variance happens when actual capital spending differs from planned spending.

Example:

If capital expenditures were 12% below forecast due to delays in executing planned projects, you might have expected to spend AED 100,000 but only spent AED 88,000.

Action:

-

- Expedite key projects that are behind schedule.

-

- Reassess timelines and update CapEx forecasts for more accurate budget allocation.

Headcount Variance

What It Is:

Headcount variance reflects differences between actual staffing levels and planned staffing levels.

Example:

If your actual headcount was 15% below plan, affecting operational capacity and team performance, you might have planned for 20 employees but only had 17.

Action:

-

- Reassess hiring priorities based on current needs.

-

- Fill critical roles to enhance operational efficiency.

-

- Review workload distribution among existing staff to optimize productivity.

Salary & Wages Variance

This variance occurs when overtime or staffing issues cause salary costs to exceed the budget.

For example, if overtime costs rise unexpectedly due to increased production demands, you may end up spending more than planned on salaries.

R&D Spending Variance

Research and development expenditures can come in under budget due to delayed project initiations.

If you budgeted AED 50,000 but spent only AED 45,000 because projects were postponed, this variance needs investigation.

Marketing Spend Variance

Campaign overspending can result in an 8% budget overrun. If your marketing team planned a campaign costing AED 20,000 but ended up spending AED 21,600 due to last-minute changes or added features, this variance requires attention.

Sales Volume Variance

A drop in sales volume due to supply chain issues can cause missed revenue targets.

For instance, if you projected sales of AED 100,000 but only achieved AED 80,000 because of delays in product delivery, this variance indicates a need for better supply chain management.

Product Mix Variance

A shift to lower-margin products leads to a higher proportion of low-profit sales.

If your product mix changes unexpectedly—say from high-margin electronics to lower-margin accessories—this could negatively impact overall profitability.

Inventory Variance

Excess inventory tied up with more cash than anticipated raises holding costs.

If you expected to hold AED 20,000 worth of inventory but ended up with AED 25,000 due to overproduction or slow sales, this variance affects liquidity.

Cash Flow Variance

Cash flow from operations being lower than expected can result from slower collections and higher operating expenses.

If you anticipated cash inflows of AED 60,000 but only received AED 51,000 due to delayed customer payments or unexpected costs, this variance highlights cash management issues.

Variance analysis: Pros & Cons

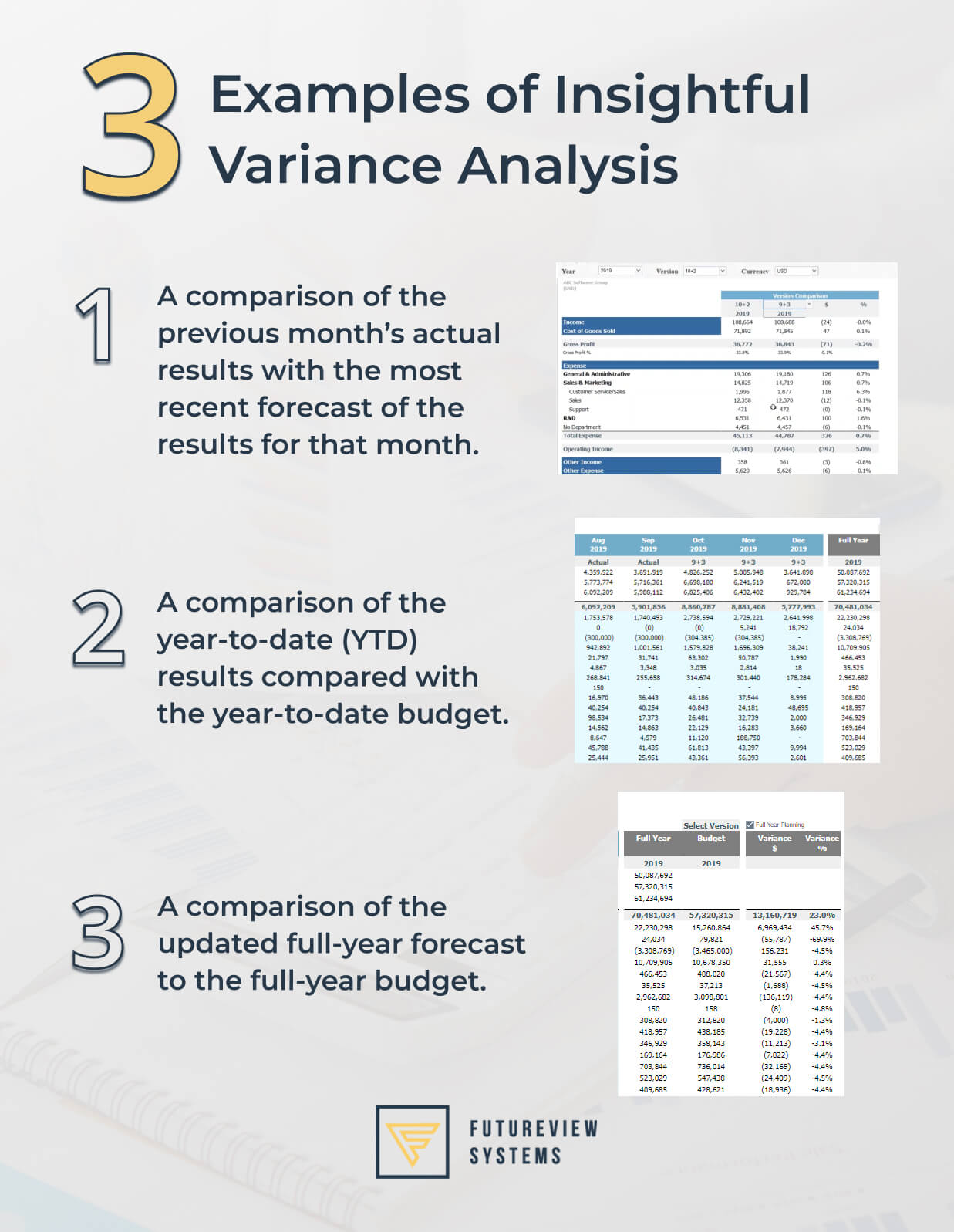

Variance analysis is an essential financial management tool that helps businesses compare their actual performance against budgeted expectations.

This process allows organizations to identify discrepancies, understand their causes, and implement corrective actions.

Below, we explore the advantages and disadvantages of variance analysis, supplemented with practical examples and authoritative resources for deeper insights.

Advantages of Variance Analysis

Pinpointing Root Causes

Variance analysis provides clarity on why financial goals are not being met.

For instance, if a manufacturing company budgeted for 5,000 units of material at $10 per unit but actually used 6,000 units at $12 per unit, the unfavorable variance indicates inefficiencies or increased demand that need investigation.

Understanding these root causes allows businesses to make informed adjustments to their operations (SolveXia).

Enhanced Financial Insights

By analyzing variances, businesses can make strategic decisions about product lines, vendor relationships, and customer targeting.

For example, if a retail company expected to generate $100,000 in sales but only achieved $90,000, variance analysis can reveal whether the shortfall was due to lower sales volume or pricing issues.

This insight enables companies to refine their marketing strategies or adjust pricing to improve cash flow (HighRadius).

Building Team Cohesion

Engaging team members in variance analysis fosters collaboration towards common objectives.

When employees understand how their contributions affect financial outcomes, it encourages a culture of accountability and teamwork.

For instance, if a construction company finds that labor costs exceeded budget due to overtime, discussing this openly can lead to collective brainstorming on efficiency improvements (BlackLine).

Continuous Improvement

Variance analysis promotes a cycle of continuous improvement by encouraging businesses to learn from past performance.

For example, if a tech company budgets $50,000 for a project but completes it for only $45,000 while delivering more features than planned, this positive variance can be analyzed for best practices that can be replicated in future projects (Corporate Finance Institute).

Disadvantages of Variance Analysis

Time-Consuming Process

Conducting variance analysis can be labor-intensive and slow. For instance, if a company requires real-time data but takes weeks to compile reports on variances in marketing expenses, it may miss critical opportunities for timely adjustments (Brixx).

Data Dependency

Accurate variance analysis relies on comprehensive data collection and tracking. If a business lacks sufficient data regarding labor hours or material costs, it may draw incorrect conclusions about its performance.

For example, if a company does not track overtime accurately, it might misinterpret labor variances as purely efficiency issues rather than cost overruns (SolveXia).

Potential for Misinterpretation

Different analysts may interpret the same data differently. For instance, if one analyst focuses on negative variances without considering positive trends in other areas (like increased production efficiency), it could lead to misguided strategic decisions (HighRadius).

Rigid Focus on Historical Data

Variance analysis often relies on past performance metrics that may not reflect current market conditions.

For example, if a business bases its budget solely on last year’s figures without accounting for new competitors or market shifts, it risks making decisions based on outdated information (Corporate Finance Institute).

Is Variance Analysis Right for Your Business?

Variance analysis is beneficial across various industries—from manufacturing to retail—by providing insights that drive operational improvements and strategic adjustments. For instance:

Manufacturing:

A company discovers through variance analysis that its material costs are consistently higher than budgeted due to supplier price increases.

This insight prompts renegotiation with suppliers or exploration of alternative materials.

Construction:

A contractor realizes that labor costs have exceeded budgets due to unexpected project complexities.

By analyzing these variances, the contractor can adjust future bids and resource allocations accordingly (Brixx).

In conclusion, while variance analysis offers significant advantages in understanding financial performance and guiding strategic decisions, businesses must also be aware of its limitations and invest in accurate data collection and interpretation methods to maximize its effectiveness.

By leveraging this powerful tool thoughtfully, organizations can enhance their financial health and operational efficiency over time.

Conclusion

Understanding and analyzing variances is crucial for effective financial management in any business.

By identifying discrepancies between actual performance and budgeted targets—whether related to revenue, expenses, or other key metrics—you can gain valuable insights into your operations.

This knowledge allows you to make informed decisions that improve efficiency and profitability while avoiding potential pitfalls.

How Pro Tax Accountant Can Help

Navigating the complexities of financial reporting and variance analysis can be challenging for small businesses.

At Pro Tax Accountant, we specialize in providing online bookkeeping, accounting, and tax services designed specifically for small businesses.

Our team can help you analyze variances effectively while ensuring compliance with local regulations.

Let us handle the numbers so you can focus on growing your business!

For more information on managing your finances effectively or if you have questions about accounting practices in your industry, feel free to reach out!