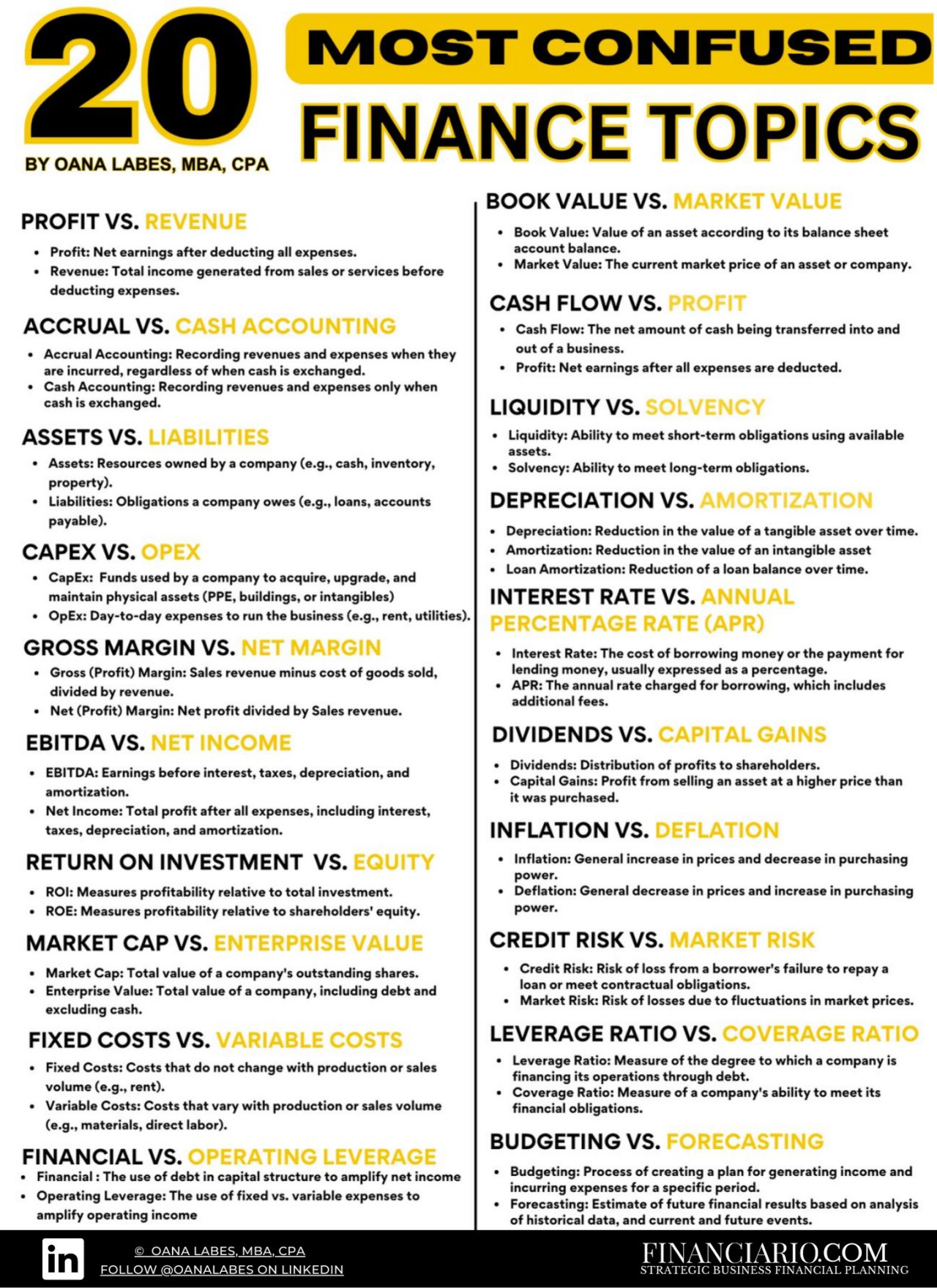

Understanding financial concepts can be a daunting task for small business owners, especially when terms seem to blend into one another.

But these concepts will help you understand financial statements better, and you will be able to make informed decisions.

This guide aims to simplify some of the most confusing topics in finance, breaking them down into easily digestible bits.

By the end, you’ll have a clearer understanding of these concepts and how they can impact your business.

Cash Flow vs. Profit

What’s the Difference?

- Profit is the money your business makes after all expenses are deducted from revenue. It can look good on paper but doesn’t always reflect the actual cash you have on hand.

- Cash Flow, on the other hand, refers to the actual movement of money in and out of your business. It’s crucial because even if your profit looks healthy, poor cash flow can lead to financial trouble.

“You can be profitable and still go bankrupt if you don’t manage your cash flow.”

Why It Matters

Understanding the difference between cash flow and profit is vital for maintaining your business’s health.

For example, if you sell a product but don’t receive payment immediately, you might show a profit but lack cash to pay your bills.

Tips for Managing Cash Flow

Invoice Promptly: Send invoices as soon as services are rendered or products are delivered.

Monitor Expenses: Keep an eye on where your money goes each month.

Build a Cash Reserve: Aim to have enough cash saved to cover at least three months of expenses.

Assets vs. Liabilities

Defining the Terms

- Assets are what your business owns that provide future economic benefits (e.g., cash, inventory, equipment).

- Liabilities are what your business owes to others (e.g., loans, accounts payable).

“Assets put money in your pocket; liabilities take money out.” – Robert Kiyosaki

Why This Matters

A healthy balance between assets and liabilities is crucial for financial stability. If liabilities exceed assets, it could indicate financial trouble.

Quick Examples

| Assets | Liabilities |

|---|---|

| Cash | Bank loans |

| Equipment | Accounts payable |

| Inventory | Credit card debt |

Capital Expenditure (CapEx) vs. Operating Expenditure (OpEx)

Understanding CapEx and OpEx

- CapEx refers to long-term investments in physical assets like buildings or machinery that will benefit your business over time.

- OpEx involves short-term expenses necessary for day-to-day operations, such as rent and utilities.

“Think of CapEx as buying a house; OpEx is like paying for groceries.”

Importance of Knowing the Difference

Understanding these types of expenditures helps you budget effectively and plan for future growth.

Gross Margin vs. Net Margin

Breaking It Down

- Gross Margin measures how efficiently you produce goods by calculating revenue minus direct costs (like materials).

- Net Margin takes into account all expenses (including operating expenses, taxes, etc.) to show overall profitability.

“Gross margin tells you how well you’re producing; net margin shows how well you’re running your business.”

Why It Matters

Both margins provide insight into different aspects of your business’s financial health.

EBITDA vs. Net Income

What’s What?

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) gives a clear picture of operational profitability.

- Net Income is what remains after all expenses have been deducted from total revenue.

“EBITDA is like looking at the engine of a car; net income is how far it drives.”

Importance in Business Valuation

Investors often look at EBITDA for a clearer view of operational efficiency without the noise of financing and accounting decisions.

Return on Investment (ROI) vs. Return on Equity (ROE)

Key Differences

- ROI measures the efficiency of an investment relative to its cost.

- ROE focuses on how effectively a company uses equity to generate profits.

“ROI tells you how good an investment is; ROE tells you how well you’re using shareholders’ money.”

Why This Matters

Both metrics help assess performance but from different perspectives—investors often care about both.

Profit vs. Revenue

Clarifying Terms

- Revenue is the total income generated from sales before any expenses are deducted.

- Profit is what remains after all costs are subtracted from revenue.

“Revenue is like the top line; profit is what’s left after all the bills are paid.”

Importance in Business Strategy

Understanding this difference helps in setting realistic sales goals and managing expectations.

Market Capitalization vs. Enterprise Value

Definitions Simplified

- Market Capitalization refers to the total value of a company’s outstanding shares.

- Enterprise Value includes market cap plus debt and subtracts cash—providing a fuller picture of a company’s worth.

“Market cap tells you what investors think it’s worth; enterprise value tells you what it would cost to buy it.”

Why It Matters for Investors

Investors often look at enterprise value when assessing acquisition costs or investment potential.

Fixed Costs vs. Variable Costs

Understanding Costs

- Fixed Costs remain constant regardless of production levels (e.g., rent).

- Variable Costs fluctuate with production volume (e.g., raw materials).

“Fixed costs are like your monthly mortgage; variable costs are like groceries that change every week.”

Importance in Budgeting

Knowing these costs helps in budgeting and forecasting future expenses accurately.

Financial Leverage vs. Operating Leverage

Key Concepts

- Financial Leverage involves using borrowed funds to increase returns.

- Operating Leverage measures how revenue growth translates into profit growth based on fixed costs.

“Financial leverage amplifies risk; operating leverage amplifies reward.”

Why This Matters for Business Growth

Both forms of leverage can significantly impact profitability but come with their own risks.

Book Value vs. Market Value

Definitions Made Easy

- Book Value represents the value of an asset according to its balance sheet account.

- Market Value reflects what someone is willing to pay for that asset in the market.

“Book value is what it’s worth on paper; market value is what it’s worth in reality.”

Importance for Investors and Owners

Understanding both values helps in making informed decisions about buying or selling assets.

Accrual Accounting vs. Cash Accounting

Key Differences

- Accrual Accounting records revenues and expenses when they occur, regardless of when cash changes hands.

- Cash Accounting records transactions only when cash is exchanged.

“Accrual accounting gives a fuller picture; cash accounting shows immediate cash flow.”

Why This Matters for Small Businesses

Choosing between these methods affects financial reporting and tax obligations.

Liquidity vs. Solvency

Defining Both Terms

- Liquidity refers to how easily assets can be converted into cash to meet short-term obligations.

- Solvency, however, indicates whether a company can meet its long-term debts and obligations.

“Liquidity is about short-term health; solvency is about long-term survival.”

Importance in Financial Management

Both metrics are crucial for assessing financial health and making strategic decisions.

Depreciation vs. Amortization

Understanding Both Concepts

- Depreciation applies to physical assets like machinery or buildings over time.

- Amortization, on the other hand, applies to intangible assets like patents or loans.

“Depreciation wears down physical stuff; amortization spreads out the cost of intangible stuff.”

Why It Matters for Financial Statements

Both processes affect how businesses report their asset values over time.

Interest Rate vs. Annual Percentage Rate (APR)

Clarifying Terms

- The Interest Rate refers to the cost of borrowing money expressed as a percentage.

- The APR, however, includes additional costs beyond just interest—like fees—providing a more comprehensive view of borrowing costs.

“Interest rate tells you what you’ll pay; APR tells you what it’ll really cost.”

Importance When Borrowing

Understanding these terms helps make informed decisions about loans and credit options.

Dividends vs. Capital Gains

Key Differences Explained

- Dividends are payments made by a corporation to its shareholders out of profits.

- Capital Gains, however, arise from selling an asset at a higher price than its purchase price.

“Dividends give you cash now; capital gains give you profit later.” – Unknown

Why This Matters for Investors

Both forms represent ways investors can earn returns but come with different tax implications.

Inflation vs. Deflation

Definitions Made Simple

- Inflation occurs when prices rise due to increased demand or supply shortages.

- In contrast, Deflation happens when prices fall due to decreased demand or excess supply.

“Inflation means your dollar buys less; deflation means it buys more.”

Importance for Economic Health

Understanding these concepts helps businesses plan pricing strategies effectively.

Credit Risk vs. Market Risk

Breaking Down Risks

- Credit Risk refers to the possibility that borrowers will default on their obligations.

- Conversely, Market Risk involves potential losses due to market fluctuations affecting asset prices.

“Credit risk is about who owes you money; market risk is about how much that money might be worth later.”

Why It Matters for Your Business

Both risks affect investment decisions and financial planning strategies significantly.

Leverage Ratio vs. Coverage Ratio

Key Concepts Clarified

- The Leverage Ratio assesses how much debt a company has relative to its equity.

- The Coverage Ratio, however, measures a company’s ability to service its debt obligations from its earnings.

“Leverage ratio shows how much risk you’re taking; coverage ratio shows if you’re managing that risk well.”

Importance in Financial Analysis

These ratios help investors gauge financial stability and risk levels before investing in a company.

Budgeting vs. Forecasting

Finally, let’s clarify these two critical concepts:

- Budgeting: This involves creating a detailed plan outlining expected income and expenses over a specific period.

- Forecasting: This predicts future financial results based on historical data and trends without detailing every line item like budgeting does.

“Budgeting sets limits; forecasting predicts possibilities.”

Why Both Matter

Having both budgets and forecasts allows businesses to plan financially while remaining flexible enough to adapt as conditions change.

Navigating through these financial concepts doesn’t have to be overwhelming! Understanding them will empower you as a small business owner to make informed decisions that positively impact your bottom line.

For expert assistance tailored specifically for small businesses navigating these complexities, Pro Tax Accountant provides the best services, ensuring compliance while maximizing savings!