Understanding capital expenditures (CAPEX) and their key performance indicators (KPIs) can seem daunting for small business owners.

However, breaking these concepts down into simple terms can help you grasp their significance and how they can benefit your business.

In this blog, we’ll explore 10 essential CAPEX KPIs, their meanings, and how they can help you make informed financial decisions.

What is CAPEX?

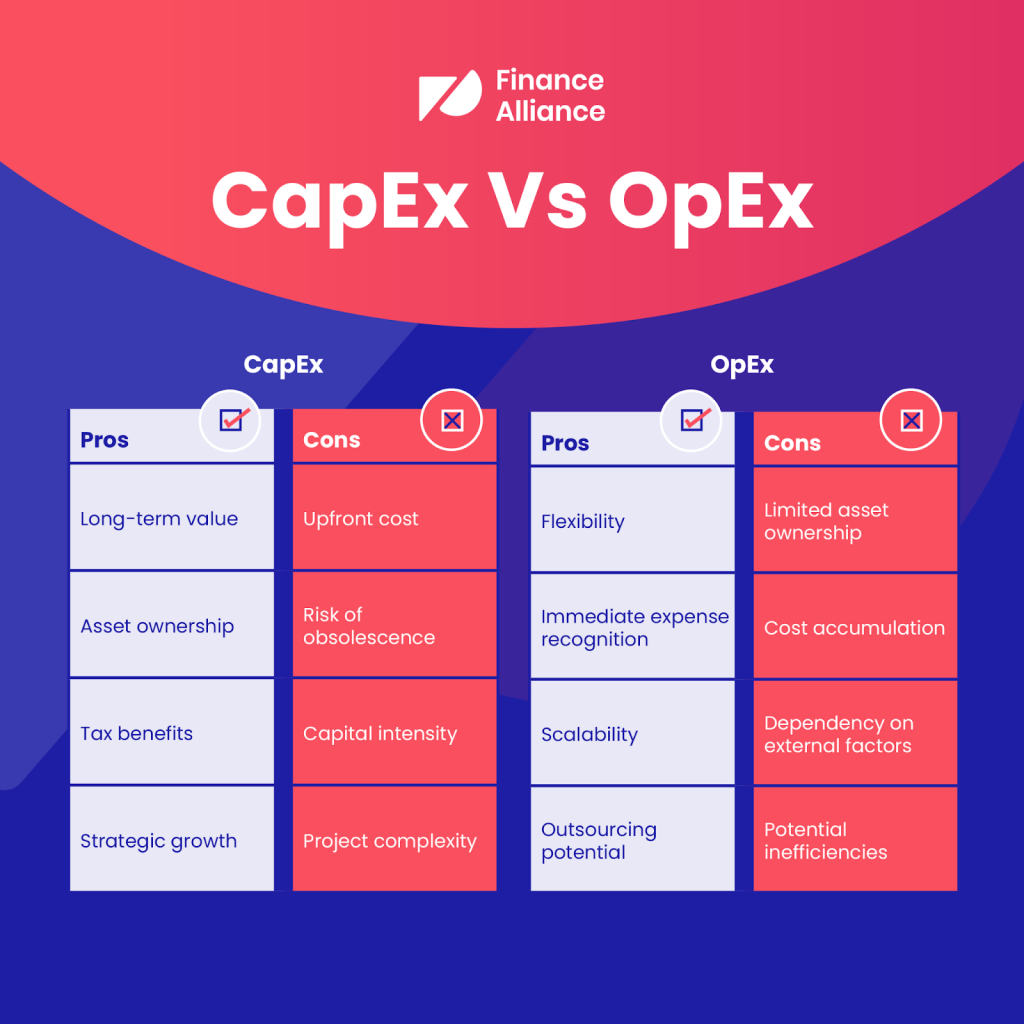

Capital expenditures (CAPEX) refer to the funds used by a business to acquire, upgrade, and maintain physical assets such as property, buildings, technology, or equipment.

Unlike operational expenses (OPEX), which are ongoing costs for running a business, CAPEX is typically a one-time investment that will benefit the company over several years.

Why CAPEX Matters

Understanding CAPEX is crucial for small businesses because it directly impacts your financial health and growth potential.

By investing wisely in fixed assets, you can enhance productivity, improve efficiency, and ultimately increase profits.

“Investing in the right assets is like planting seeds for future growth.” – Financial Expert

Now, let’s dive into the 10 essential CAPEX KPIs that every small business owner should know.

Acquisition

Description

This KPI measures the total amount spent on acquiring fixed assets.

Formula

Acquisition = Purchase Cost + Direct Costs

Importance

Tracking acquisition costs helps you understand how much you’re investing in long-term assets and whether those investments align with your business goals.

Keeping an eye on these costs can prevent overspending and ensure that your acquisitions provide value over time.

Commitments

Description

This KPI tracks the total amount committed for future fixed asset purchases.

Formula

Commitments = Future Purchase Contracts

Importance

Knowing your commitments allows you to plan your cash flow better. It ensures that you have enough liquidity to meet future obligations without jeopardizing your current operations.

Asset Turnover

Description

Asset turnover measures how efficiently a company generates revenue from its fixed assets.

Formula

Asset Turnover = Revenue / Fixed Assets

Importance

A higher asset turnover ratio indicates that your business is using its assets efficiently to generate sales.

Monitoring this KPI can help identify underperforming assets that may need to be optimized or replaced.Return on Assets (ROA)

Description

ROA indicates how profitable a company is relative to its total assets.

Formula

ROA = Net Income / Fixed Assets

Importance

This KPI shows how effectively your business is using its assets to generate profit. A higher ROA means more efficient use of your assets, which is crucial for long-term sustainability.

“Understanding ROA helps businesses assess their operational efficiency.” – Business Analyst

Return on Investment (ROI)

Description

ROI measures the profitability of an investment relative to its cost.

Formula

ROI = Net Income / Total Investment

Importance

Calculating ROI helps you evaluate the effectiveness of your capital expenditures. By comparing different investments, you can prioritize those that yield the highest returns.

Payback Period

Description

This KPI indicates the time required to recoup the investment in fixed assets.

Formula

Payback Period = Total Investment / Annual Cash Flow

Importance

Knowing how long it will take to recover your investment helps in planning future expenditures and understanding cash flow dynamics.

A shorter payback period is generally more favorable, as it indicates quicker returns on investments.

Internal Rate of Return (IRR)

Description

IRR is the expected rate of return on a fixed asset investment over time.

Formula

IRR = (Future Value / Present Value) ^ [(1 / Number of Periods) – 1]

Importance

IRR helps assess the profitability of potential investments. A higher IRR suggests a more attractive investment opportunity, allowing you to make informed decisions about where to allocate resources.

Net Present Value (NPV)

Description

NPV calculates the present value of future cash flows from fixed assets minus the initial investment cost.

Formula

NPV = Net Cash Flows / [(1 + discount rate) ^ Number of periods]

Importance

NPV provides insight into whether an investment will add value to your business over time.

A positive NPV indicates that the projected earnings exceed the anticipated costs, making it a worthwhile investment.

Depreciation

Description

Depreciation measures the reduction in value of fixed assets over time due to wear and tear or obsolescence.

Formula

Depreciation = Acquisition Cost / Useful Life

Importance

Understanding depreciation helps you account for asset value accurately in your financial statements and tax filings. It also aids in planning for future asset replacements or upgrades.

“Accounting for depreciation ensures that businesses reflect true asset values.” – CPA Insights

Utilization

Description

Utilization measures how effectively fixed assets are being used in production or service delivery.

Formula

Utilization = (Actual Production / Maximum Production) x 100%

Importance

Monitoring utilization rates helps identify underused assets that may need optimization or replacement.

High utilization rates indicate efficient use of resources, contributing to overall productivity.

Cost-Saving Strategies for Small Businesses

Understanding these KPIs not only helps in tracking performance but also opens up avenues for cost savings:

Prioritize Essential Investments:

Focus on acquiring only those assets that align with your strategic goals.

Explore Cost-Effective Alternatives:

Consider options like leasing instead of purchasing expensive equipment.

Regularly Review Asset Performance:

Conduct periodic assessments of asset utilization and performance metrics.

Invest in Technology:

Utilize software solutions that help track CAPEX and related KPIs efficiently.

Engage Professional Services:

Consulting with financial experts can provide insights into optimizing capital expenditures and improving ROI.

“Regular reviews and adjustments are key to effective CAPEX management.” – Financial Consultant

Conclusion

Navigating the world of capital expenditures and their associated KPIs may seem overwhelming at first, but understanding these concepts is vital for any small business owner looking to optimize their investments and enhance profitability.

By keeping track of these KPIs, you can make informed decisions that align with your business objectives while ensuring long-term sustainability.

For expert assistance tailored specifically to small businesses, Pro Tax Accountant provides the best services, ensuring compliance while maximizing savings!